Blogs

Legacy Notice | Collecting Legacy Content Under DPDPA

India’s DPDP Act makes legacy data a compliance hurdle. Learn to manage transition notices, build defensible audit trails, and understand why a Consent Manager is a vital risk-containment tool for your existing database.

Digital Lending: Navigating the Interplay Between RBI Guidelines and DPDP Rules

India’s digital lending ecosystem is entering a decisive compliance phase. With the DPDP Rules notified and RBI mandates tightening, lenders and LSPs must rethink consent, data roles, legacy data, and governance frameworks ahead of the 2027 enforcement deadline.

Account Aggregator: Why the Future of Financial Intelligence is Consented, Intelligent, and Insightful

DigioLink Account Aggregator transforms consented financial data into real-time, actionable insights, enabling a complete 360° view of user finances.

Operationalizing DPDPA Compliance with ROPA

With the release of the DPDP Rules on November 13th, 2025, one truth has become abundantly clear: effective privacy management begins with knowing exactly what personal data you process and why.

Navigating SEBI Onboarding: Building a Compliant, No-Code Journey with DigiStudio

Understand the key steps and compliance checks involved in SEBI onboarding, and how DigiStudio helps create faster, smoother investor experiences.

CKYC Compliance Made Simple: A Guide to the Full Search, Download, and Upload Process

A concise guide to CKYC compliance, explaining how to search, download, and upload KYC records via CKYCR, simplifying onboarding across banks, mutual funds, and financial services.

What Is Money Laundering, and Why Do Companies Worry About It?

Money laundering is the process criminals use to make “dirty” money (proceeds of illegal activity) appear legitimate. Without checks, illicit cash can flow through everyday financial products like loans, investments, and trading. funding terrorism, drug cartels, fraud, and corruption.

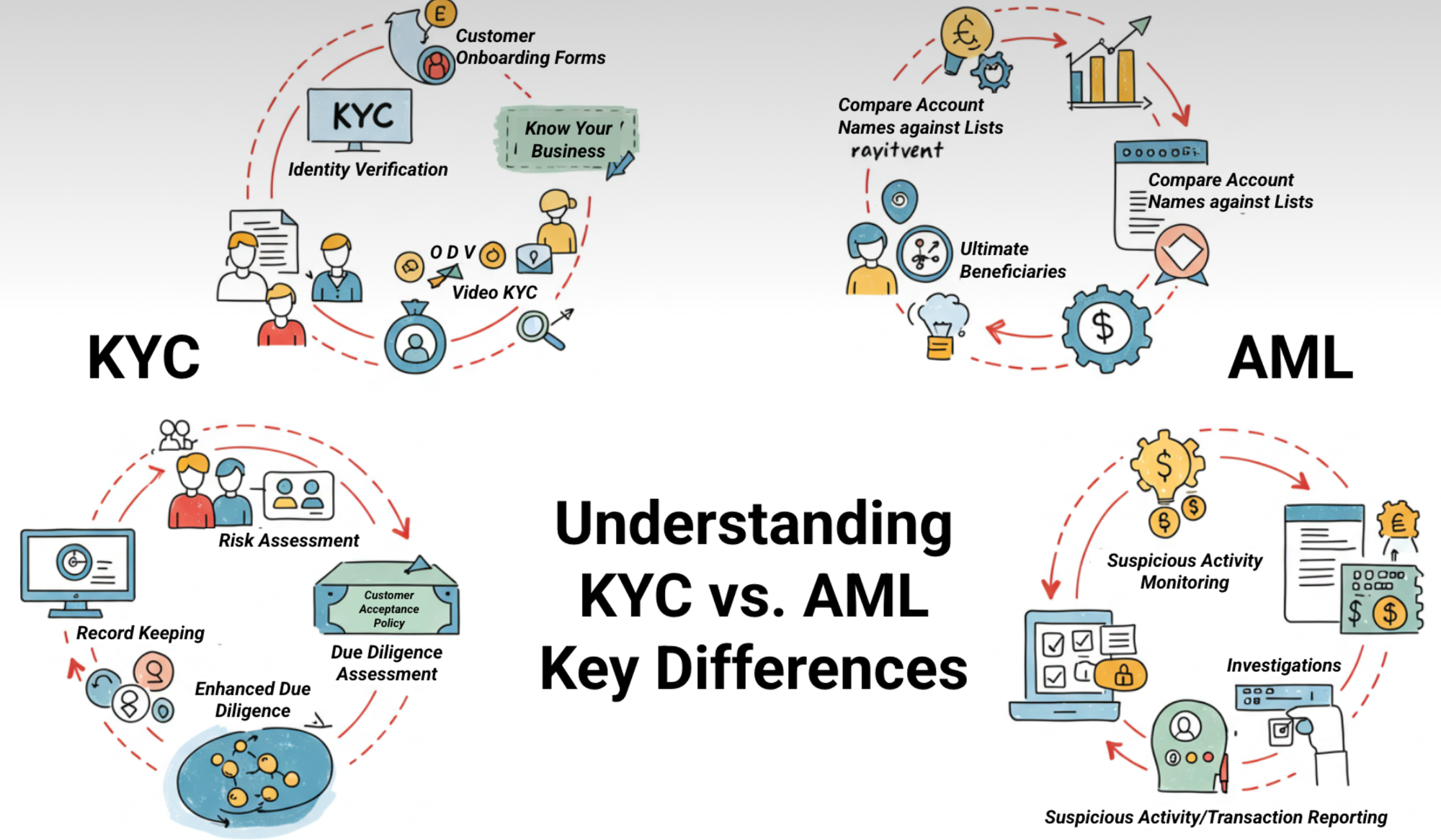

Understanding KYC vs. AML: Key Differences

KYC vs. AML, although they work hand-in-hand, each has its own scope, timing, and technical requirements. This article focuses on a concise breakdown to help businesses assess solutions against both requirements while remaining compliant.

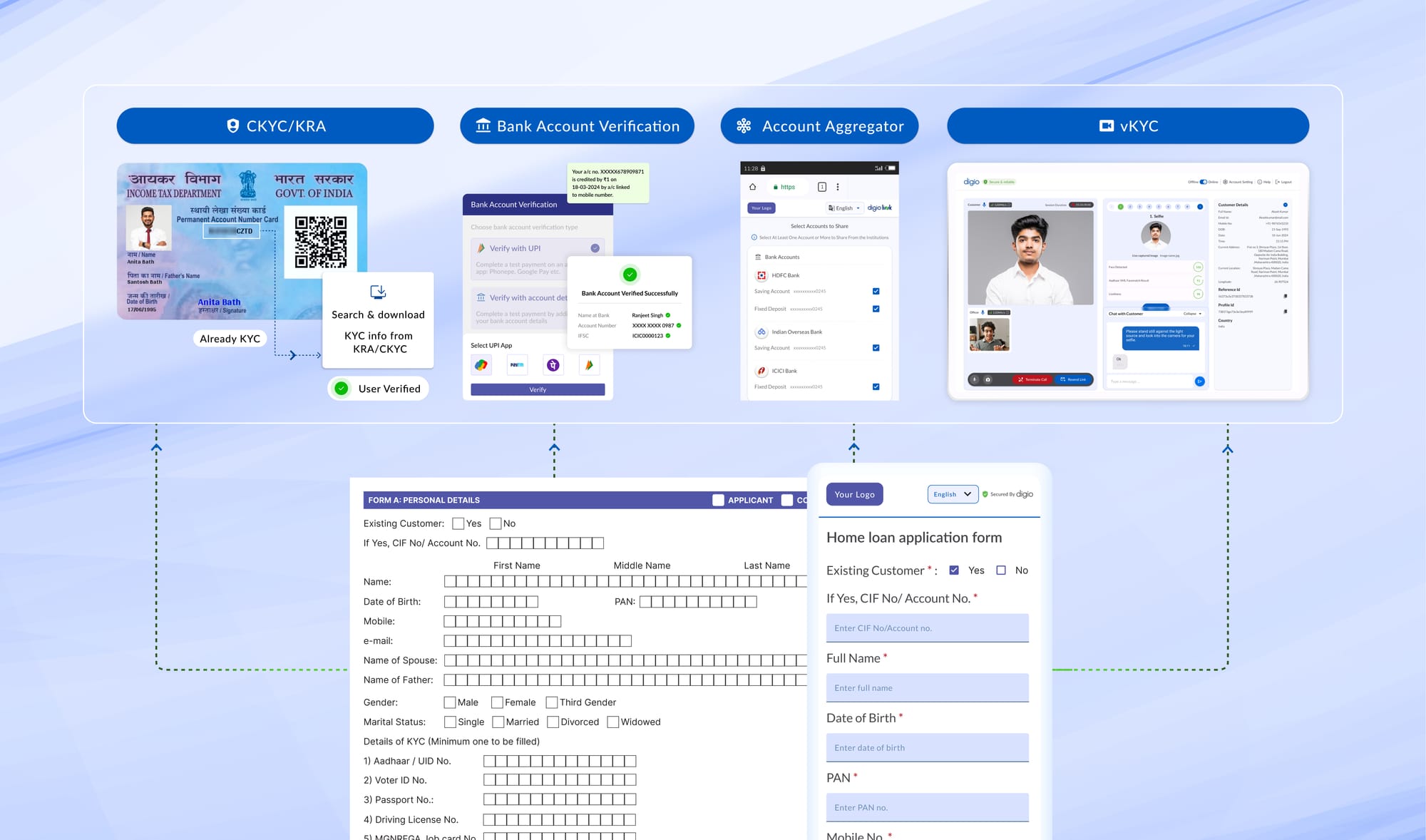

Accelerating Loan Approvals in India: Role of the latest technology

The biggest game-changer for Indian NBFC growth is faster onboarding and digital journeys supported by new technologies like the CKYC registry, automated bank account verification, bank-statement retrieval via Account Aggregator, video-based KYC, and UPI mandates.

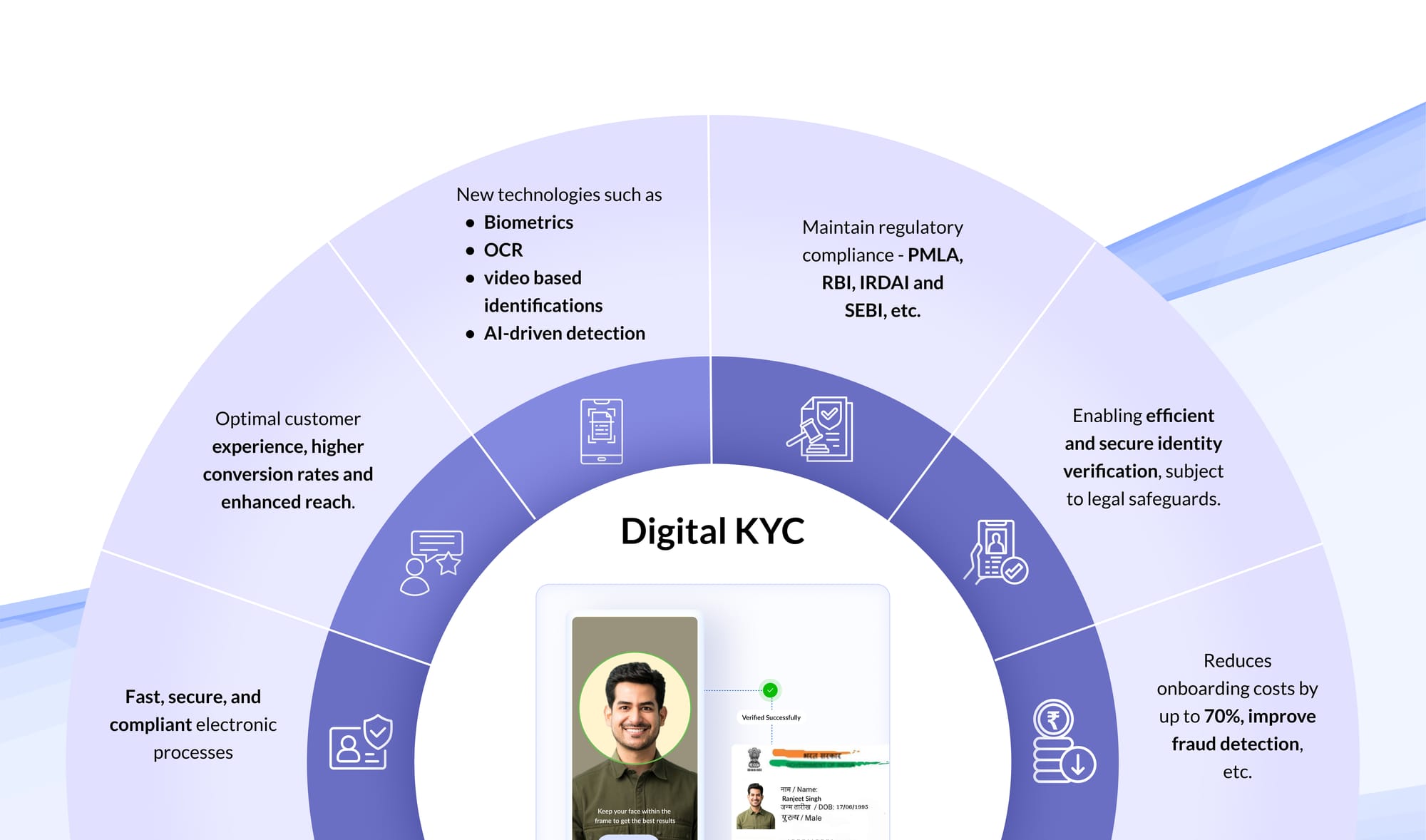

Digital KYC: The Cornerstone of Regulatory Compliance in the Digital Age

Digital KYC is an enabler for operational efficiency and regulatory compliance which allows businesses to transform their paper-based verification processes. This represents a paradigm shift in how customer identities are verified & financial crimes are mitigated in a completely electronic manner.

Beyond Consent Management: Addressing DPDPA Compliance Comprehensively

India's DPDPA marks a pivotal step in reinforcing data privacy standards and fostering trust between organisations and their users. Digio.in & Aurva have partnered to deliver value to businesses, as they navigate the complexities involved in this entire journey.

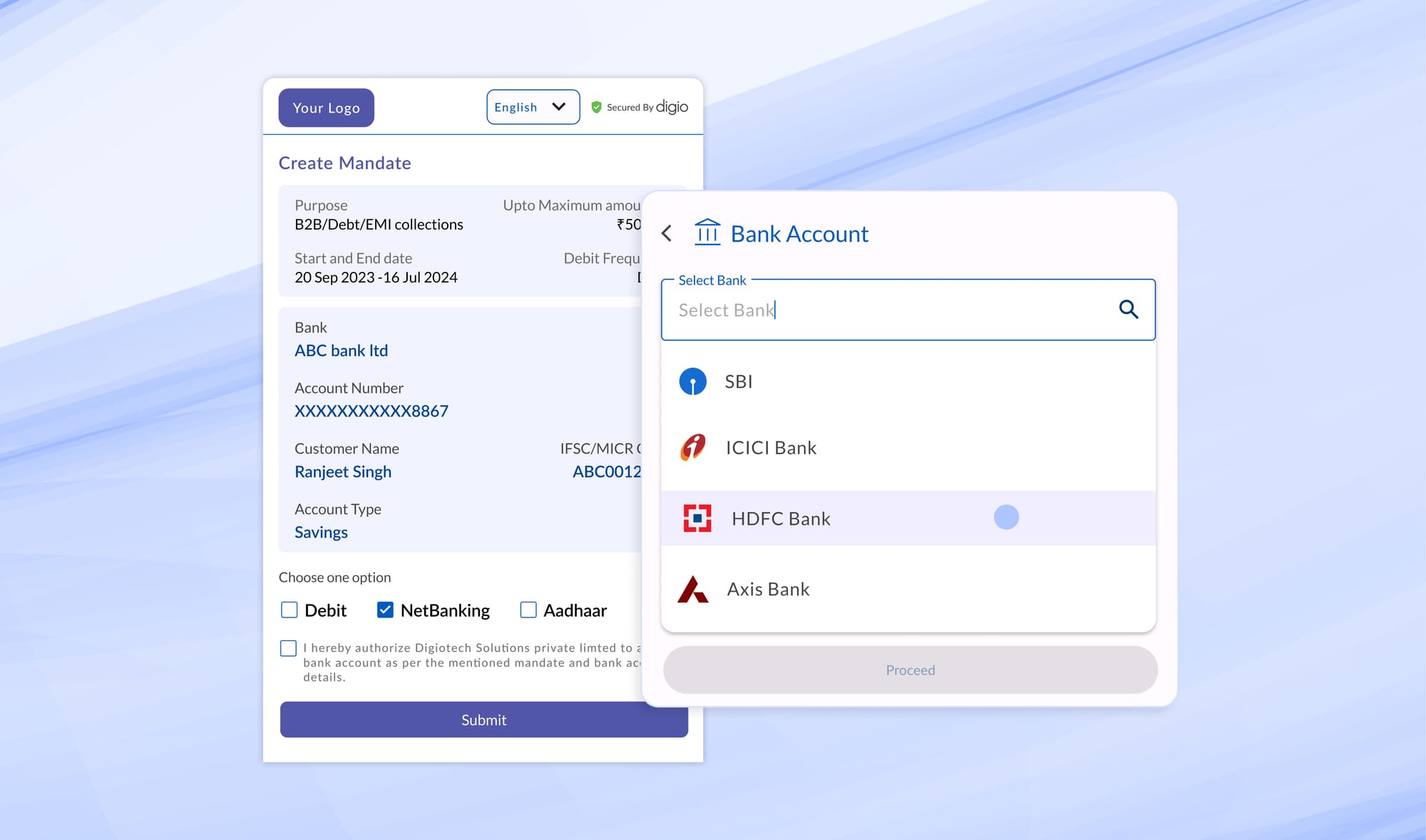

Scaling Recurring Payments

Piramal Capital & Housing Finance Limited (referred to as Piramal Finance), achieved best-in-class eMandate success rate of 93%, and reinforced its position as a customer-focused leader in India’s NBFC-HFC segment.

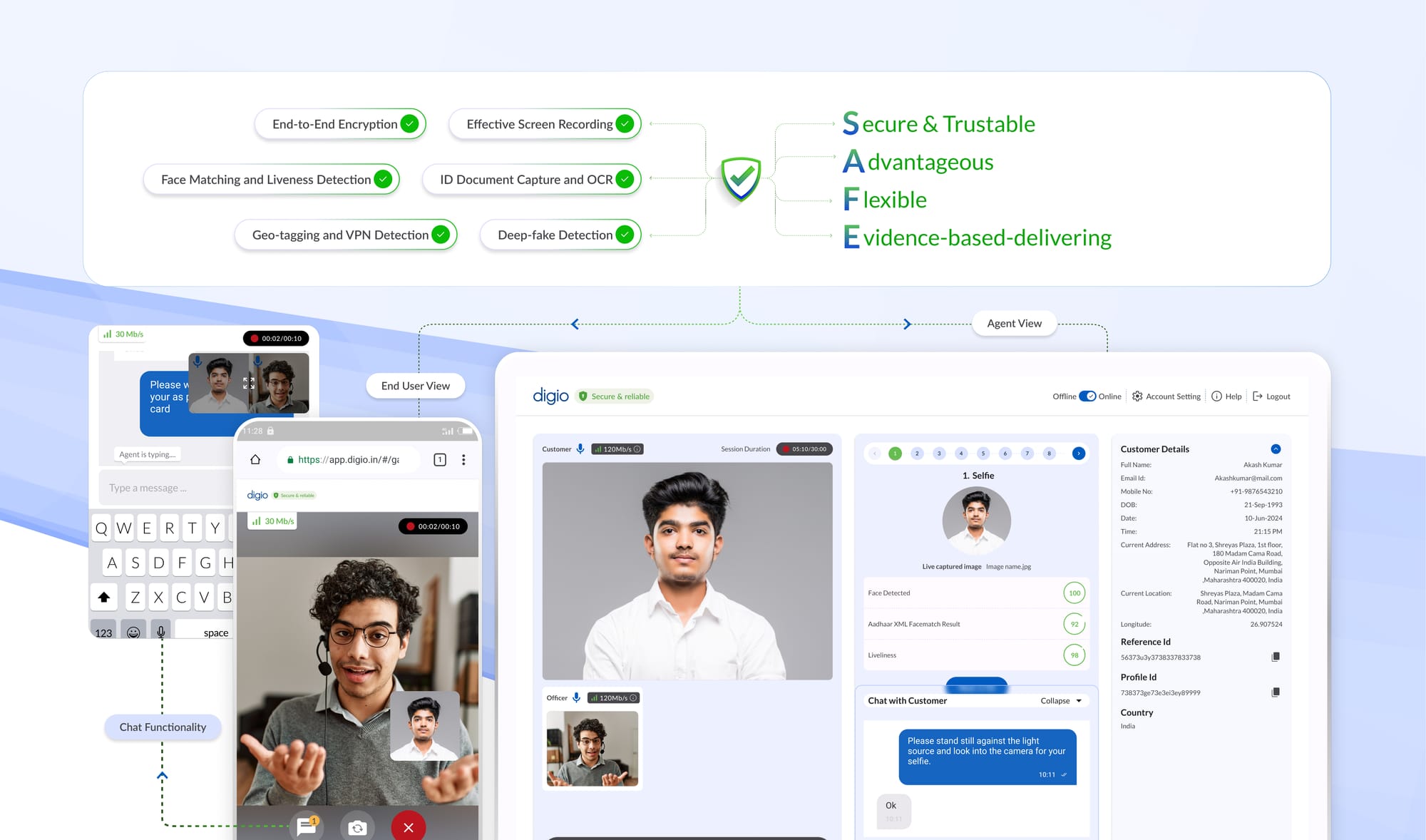

vKYC: Conquer the Paperless and Presenceless frontier with proofs

As India’s fast-evolving economy becomes increasingly digital, businesses are looking for seamless, straight through customer onboarding experiences. Customers, regulators and businesses have quickly realized the benefits of vKYC as a fast, efficient, and secure methodology.

Video KYC : In-Person Verification simplified

Digio as a leading provider of digital solutions, and has pioneered vKYC with strong focus on being SAFE - Secure & Trustable, Advantageous, Flexible, and Evidence-based solution - delivering a process that is efficient, compliant, and user-friendly.

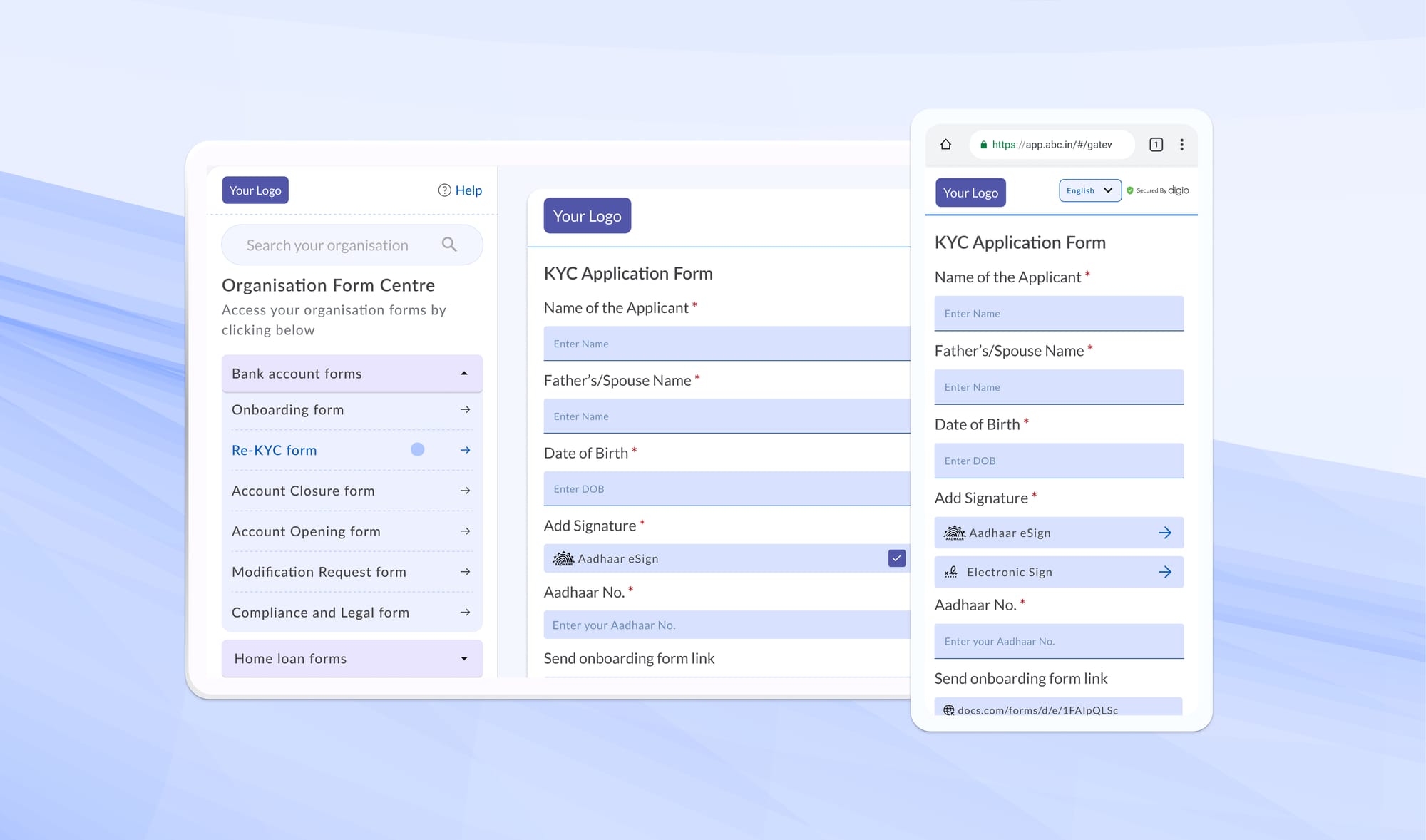

Digitization of Business Forms: The India Story

India’s digitization journey has been monumental, impacting nearly every aspect of governance, business, and public services. Business Forms continue to play a crucial role in banking, governance, and service delivery across the country.

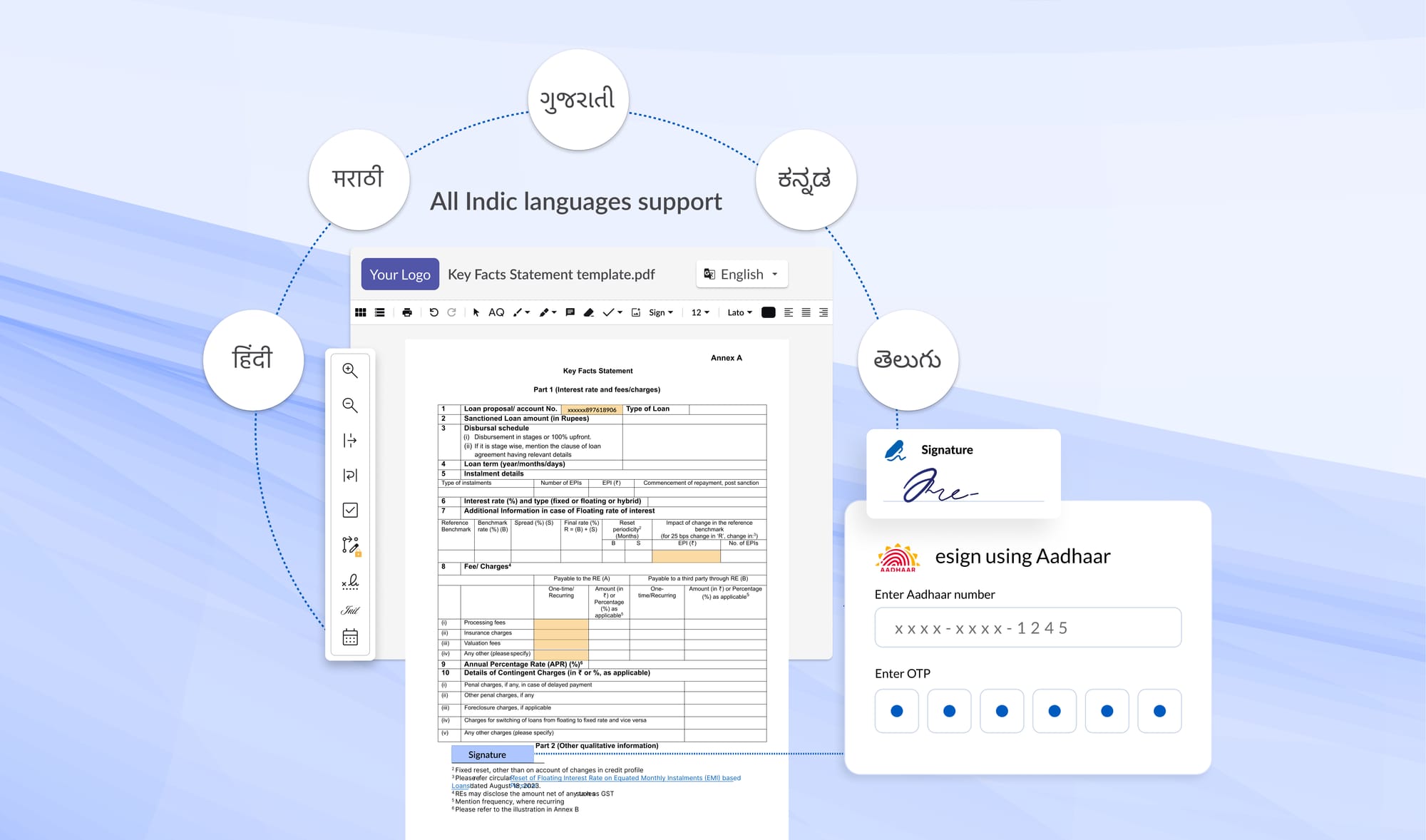

Understanding Key Fact Statements (KFS): A Guide for Borrowers and Lenders

RBI’s KFS guidelines mandate a standardized, local-language summary for all MSME and retail term loans, ensuring clear pricing, explicit borrower consent, and stronger transparency across India’s digital lending ecosystem.

Insurance KYC: Decoding IRDAI AML/CFT Guidelines

To ensure that insurers accurately verify the true identity of their customers, IRDAI has allowed insurers to use a wide range of Know Your Customer (KYC) methods.

NACH and Mandates: All You Need to Know

The transition from the ECS to the NACH system resulted in a variety of positives for recurring payments in India. Mutual Fund SIPs, Loan EMIs, Insurance Premium payments became much simpler and less time-consuming.

Digital and Electronic Signatures: All You Need to Know

The Indian Information Technology (IT) Act (passed in 2000) holds electronic signatures as legally valid as wet ink signatures. The impact of moving from physical to digital or electronic signatures has been immense, both from a business and from a consumer-standpoint

Legal Digital Documentation: All You Need to Know

We've covered how to digitalize KYC, mandates, and signatures. Today, we're looking at the most fundamental way a business can go paperless by digitalizing its documentation.

RBI’s Updated KYC Guidelines: All You Need to Know

Perhaps the most important aspect of the RBI’s changed guidelines is the explicit approval of video authentication in place of physical In-Person Verification (IPV). The Video Customer Identification Process (or V-CIP), is a consent-based alternative method of identity verification

Automating identity Verification With Artificial Intelligence

As regulators tighten KYC and AML norms, institutions are turning to AI to automate identity verification, detect fraud, and cut onboarding time. From facial biometrics to OCR and link analysis, AI is redefining secure, compliant customer onboarding.

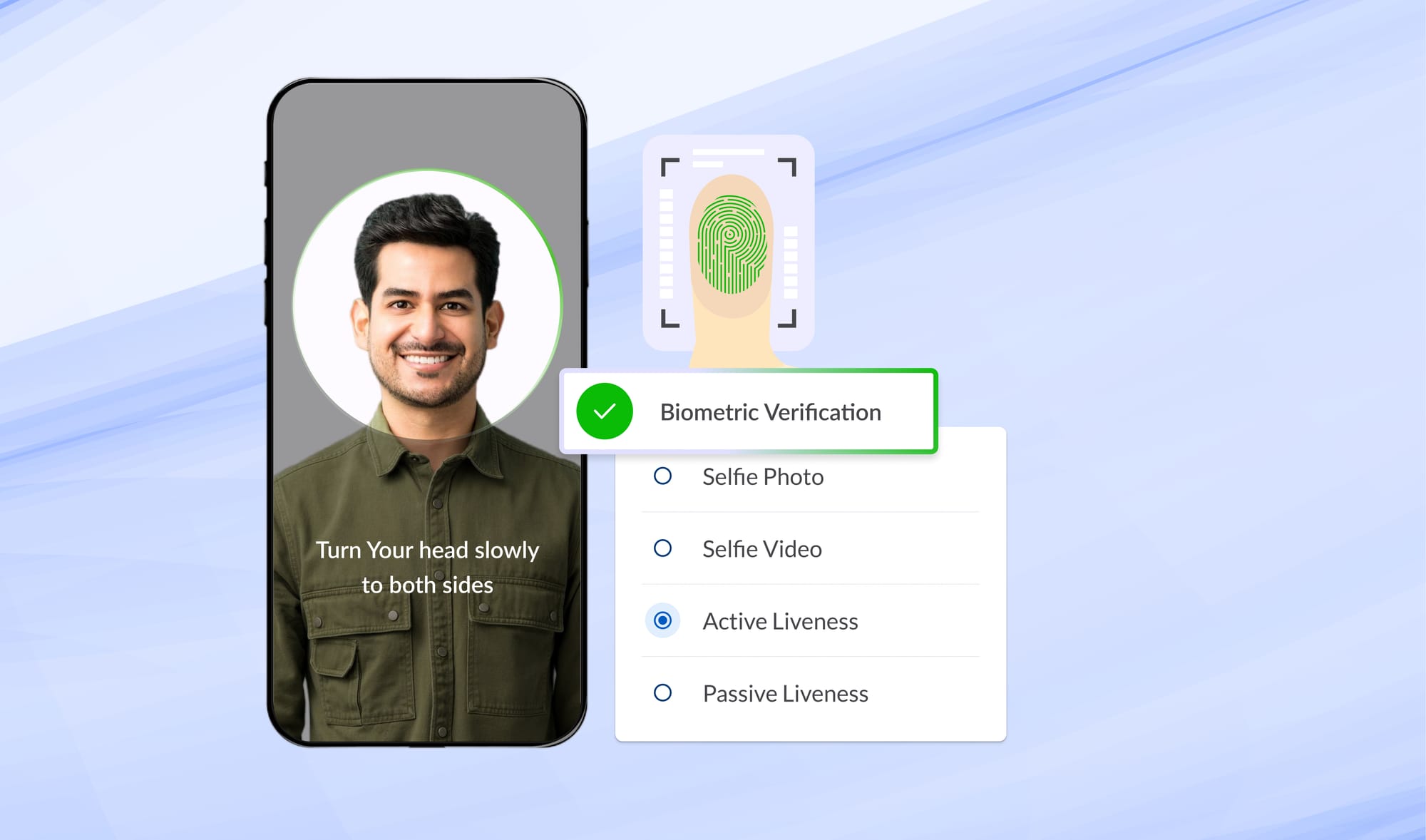

The Need for Biometric Verification and Liveness Checks in Digital Onboarding Journeys

With increased demand for remote customer onboarding, there is also a rise in the risk of fraud and identity theft. Technology has addressed it to a great extent and in some cases it is claimed to be better than human decision making

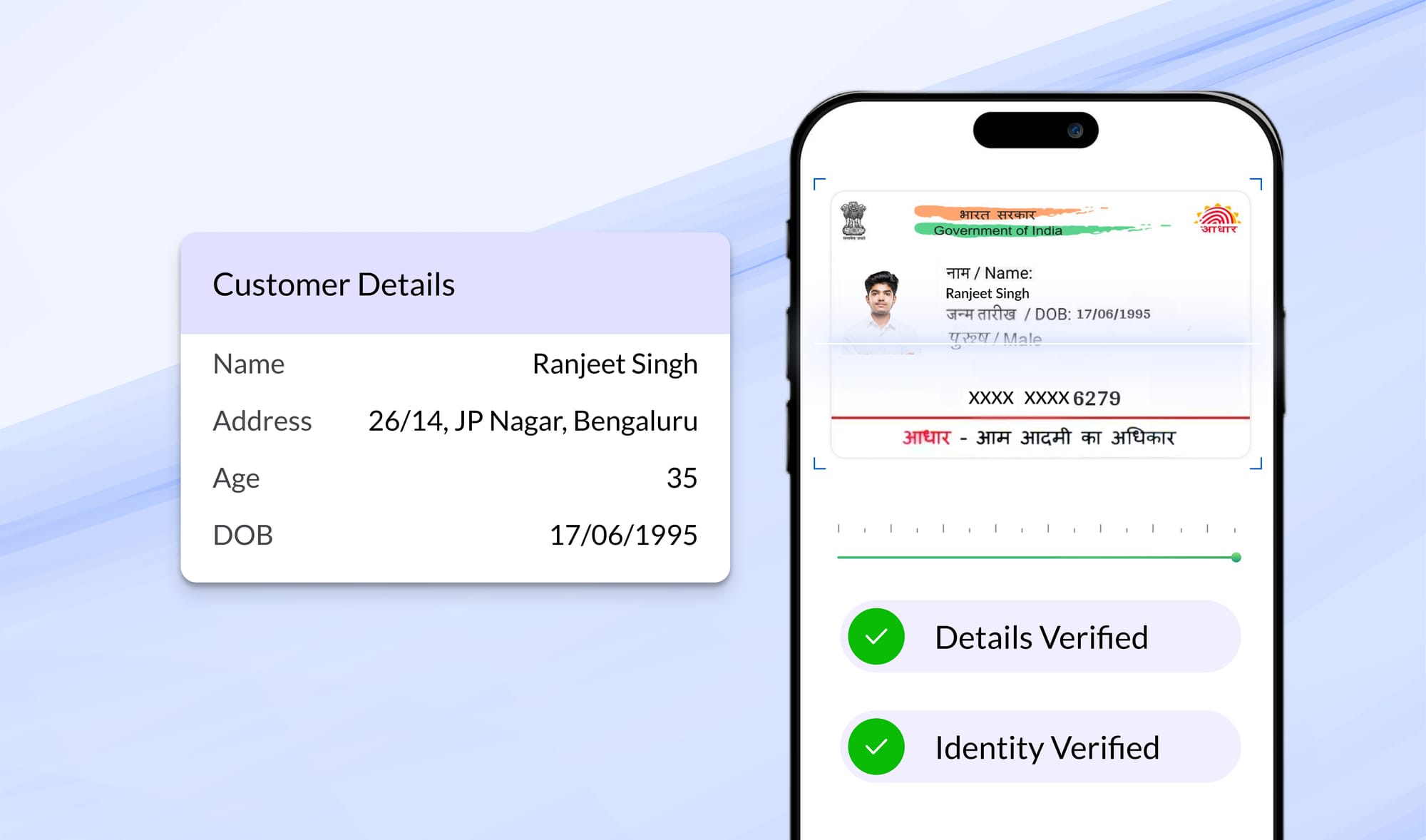

Aadhaar: The Rule of Thumb for Identity Verification in India

With Aadhaar gaining prominence as an identity in every aspect of our lives today, we shall in this blog discuss Aadhaar, its use, and its relevance for businesses in the identity verification process.

Try first. Subscribe later.

Boost your legal ops efficiency by 80%

Learn how Digio can enhance your business productivity

Get 1-on-1 business use case solutioning

Speak with our business consultants to get a solution walkthrough for your business requirement

Test the APIs

Let your development team test our API suite to understand configurability and product integration

Subscribe

Get the best in industry commercials for your business usecase