Verify Identity & Perform Enhanced Due Diligence with

DigiKYC

Streamline your KYC and KYB Operations at scale for customer onboarding while being 100% compliant with regulations

Identity and Business Verification

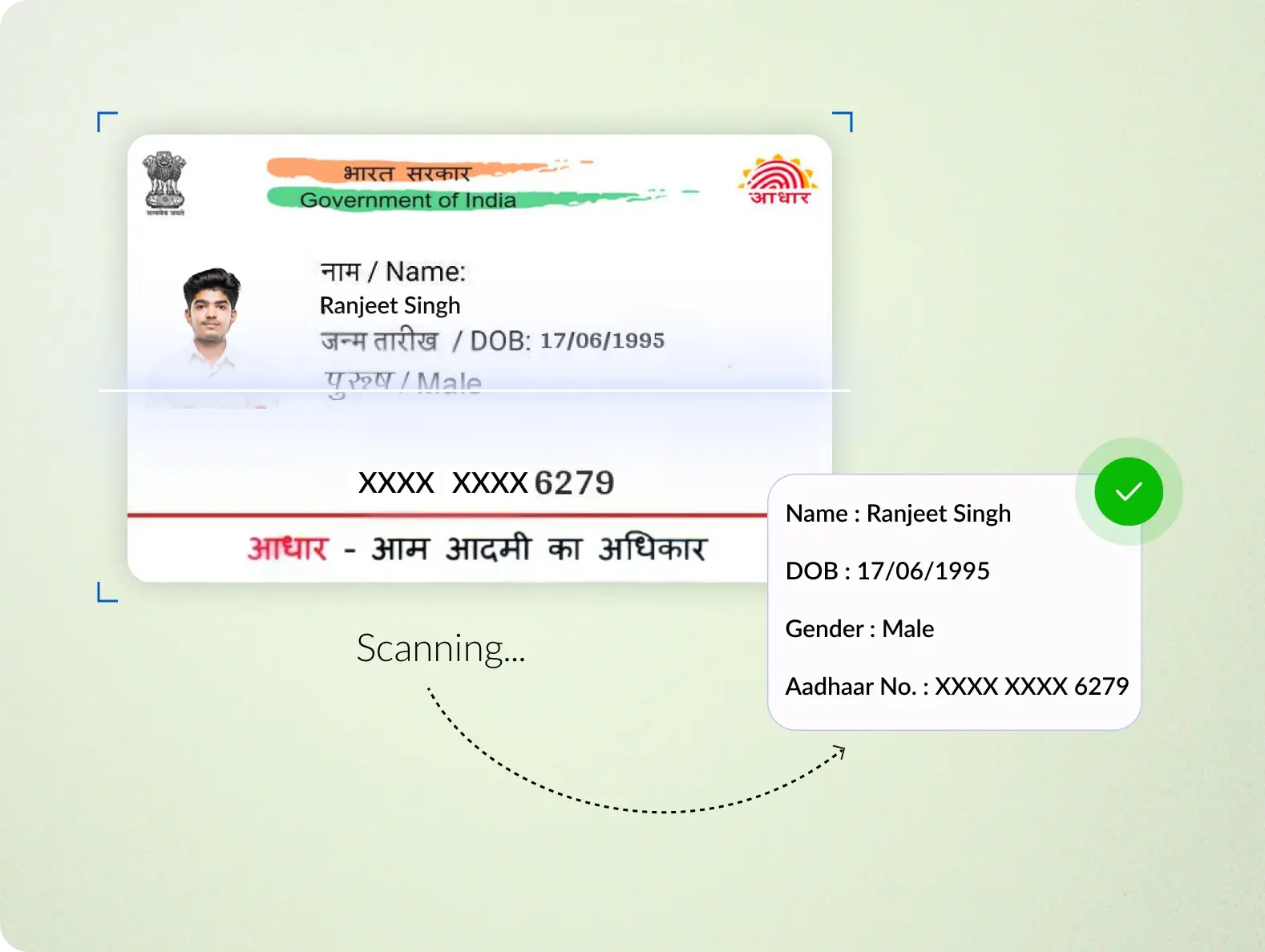

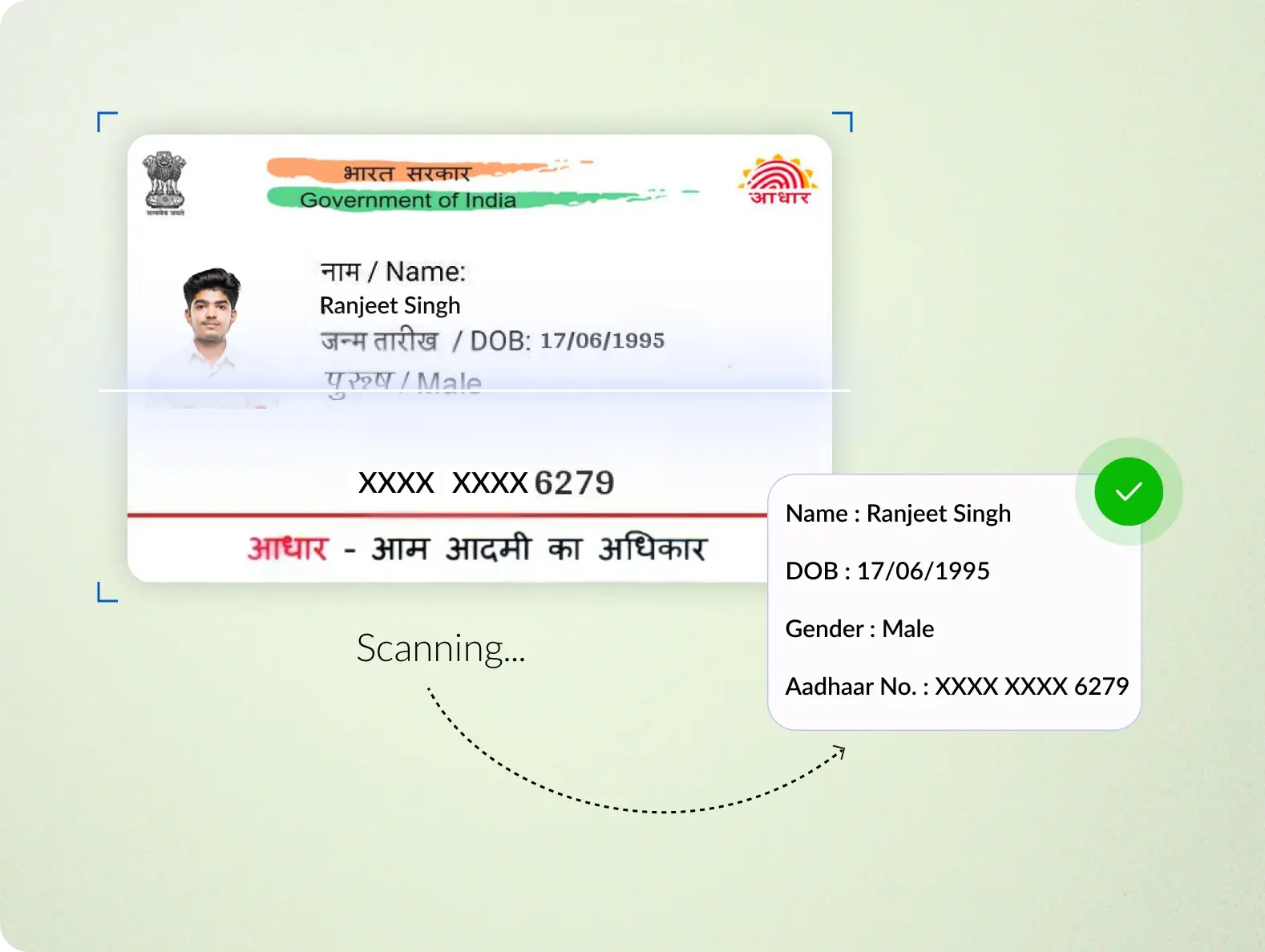

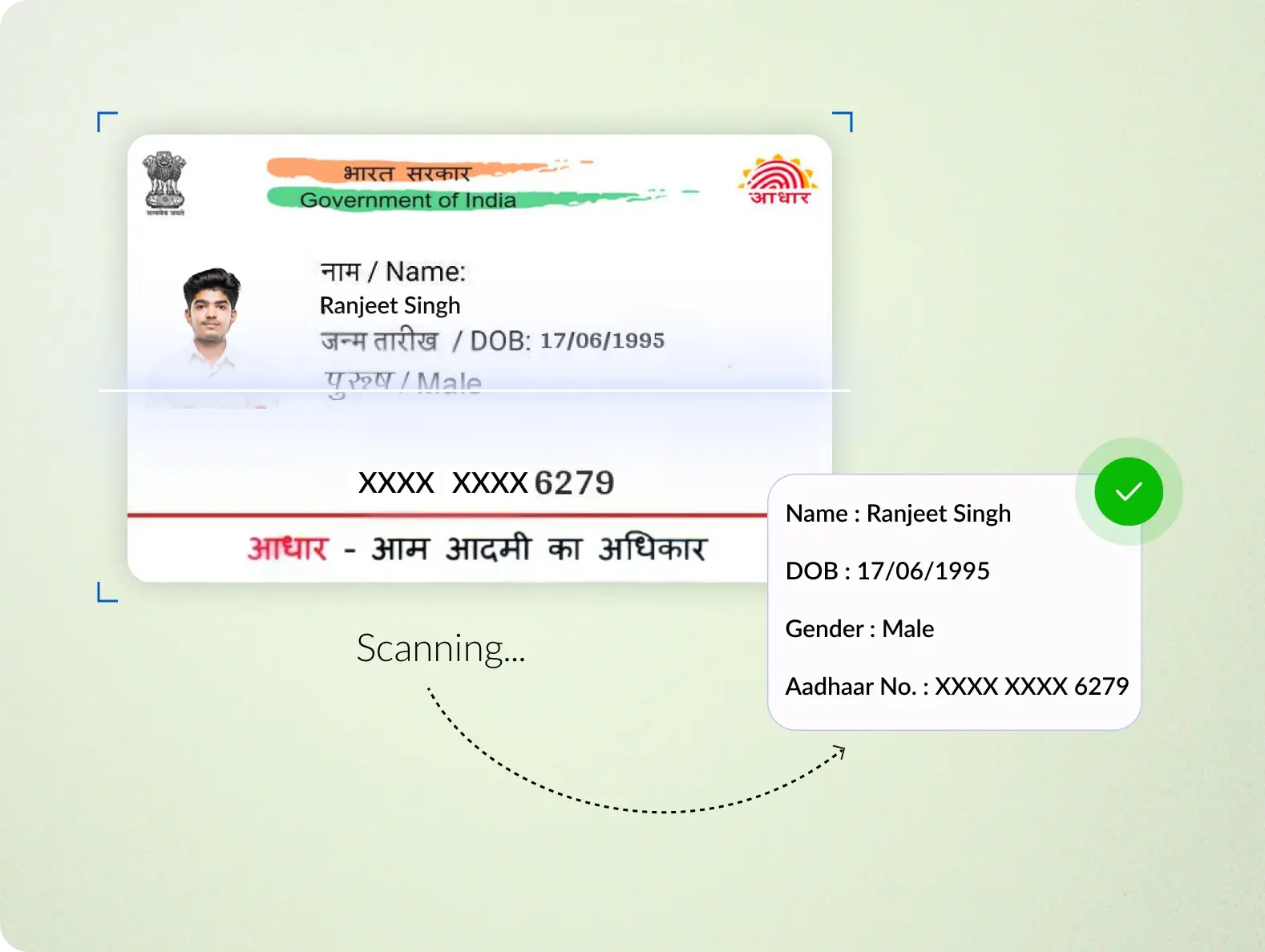

ID OCR Analysis

Complete data extraction and user image retrieval through advanced Image detection with Digio ID OCR

Data extraction directly from IDs to simplify customer data capture

Verification of extracted data with central databases

ID classification and validation for custom rule engines

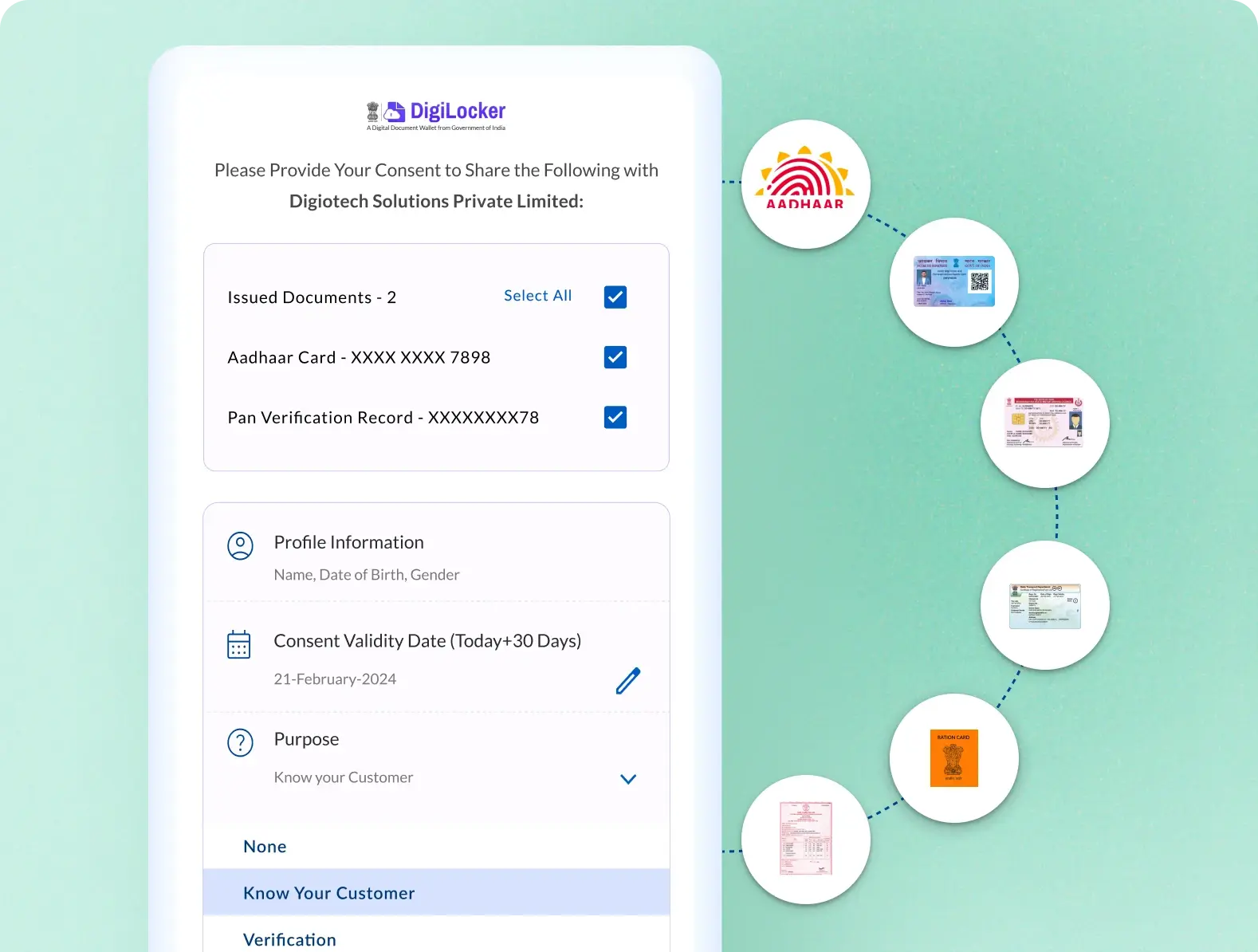

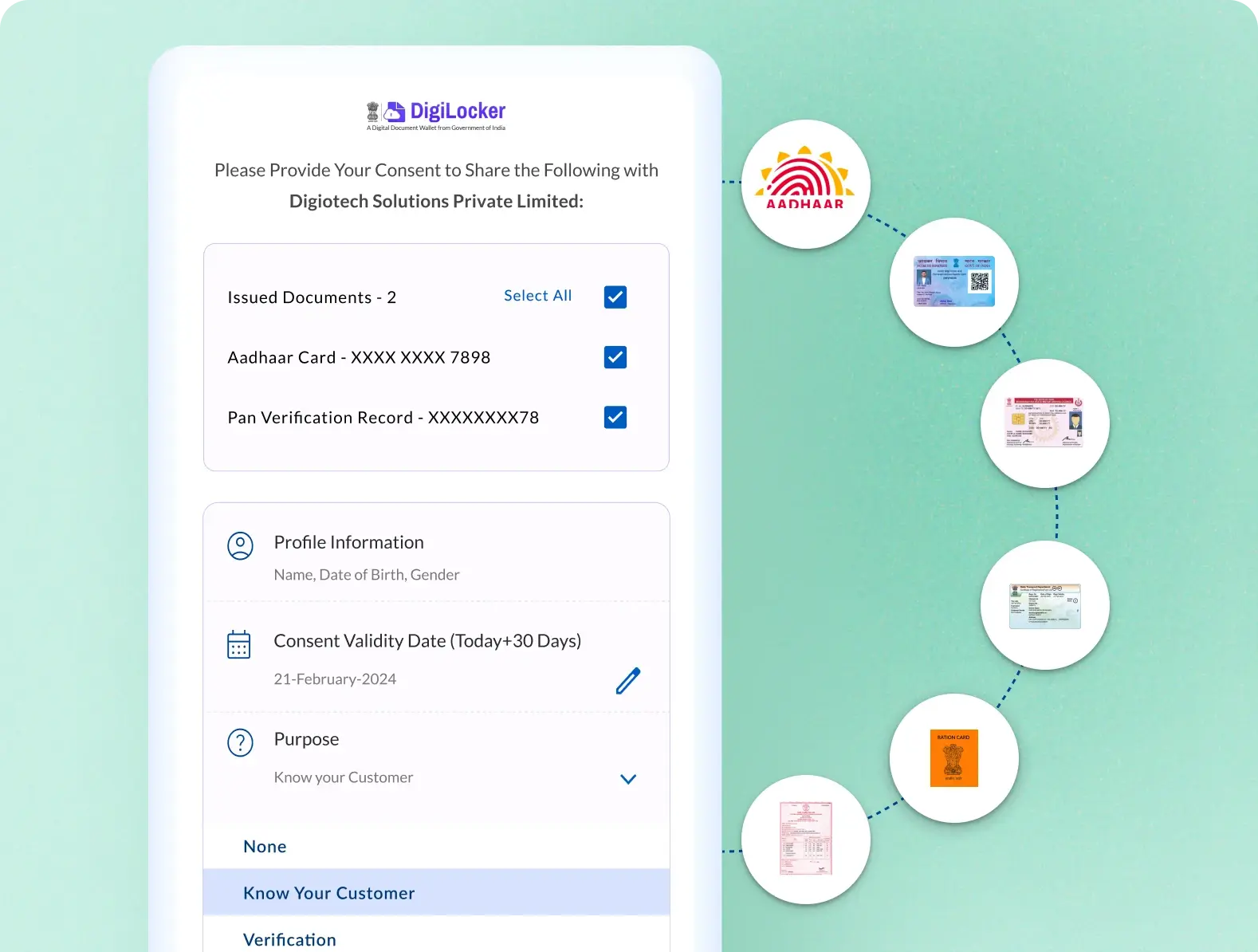

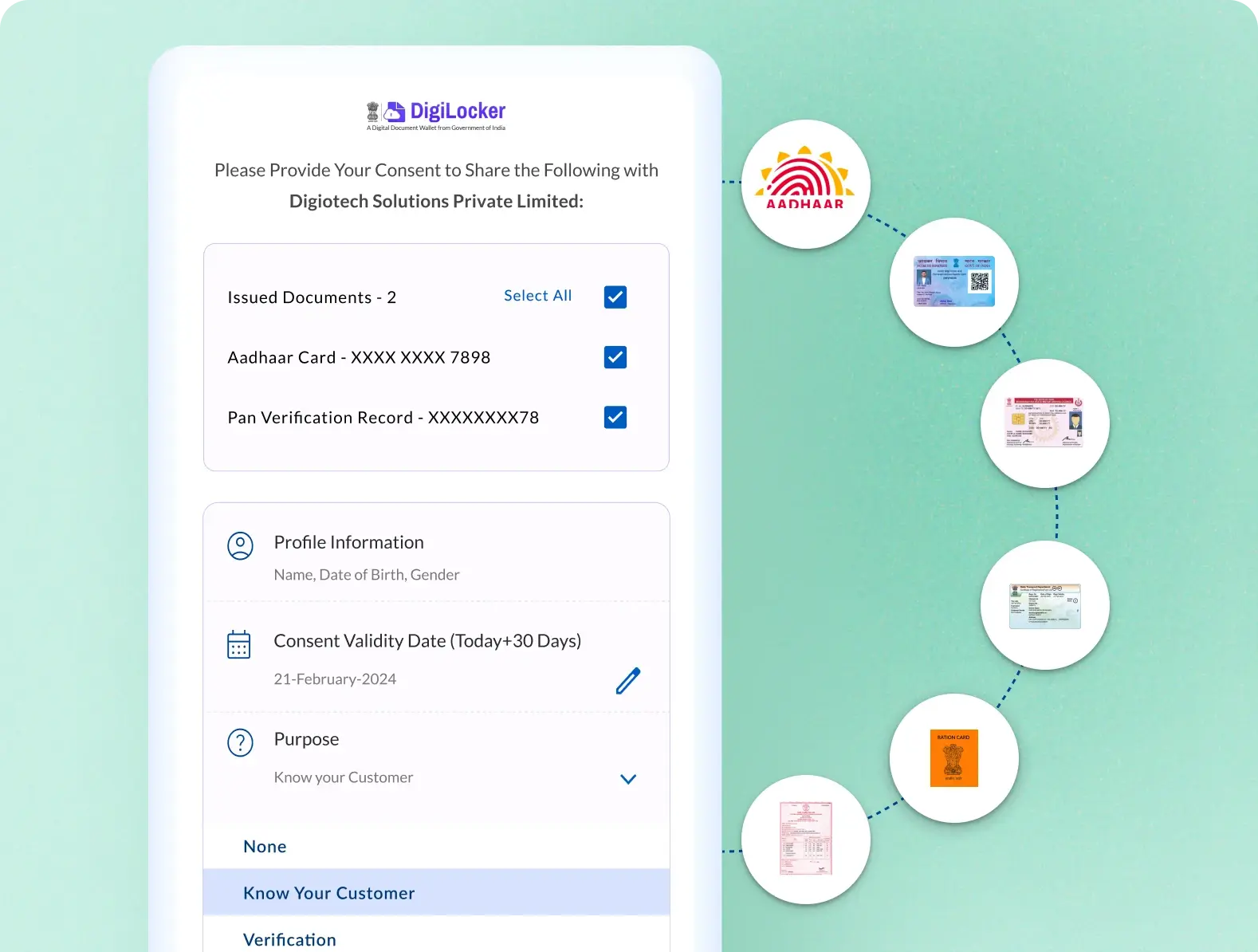

Digilocker Integration

Easy access to certified, Govt. issued documents for customer verification

Seamless user experience with a single authentication step

Access multiple ID documents like PAN, Aadhar, Voter ID, DL etc.

Fully compliant under PMLA and KYC guidelines by central regulators

ID OCR Analysis

Complete data extraction and user image retrieval through advanced Image detection with Digio ID OCR

Data extraction directly from IDs to simplify customer data capture

Verification of extracted data with central databases

ID classification and validation for custom rule engines

Digilocker Integration

Easy access to certified, Govt. issued documents for customer verification

Seamless user experience with a single authentication step

Access multiple ID documents like PAN, Aadhar, Voter ID, DL etc.

Fully compliant under PMLA and KYC guidelines by central regulators

Impersonation Checks

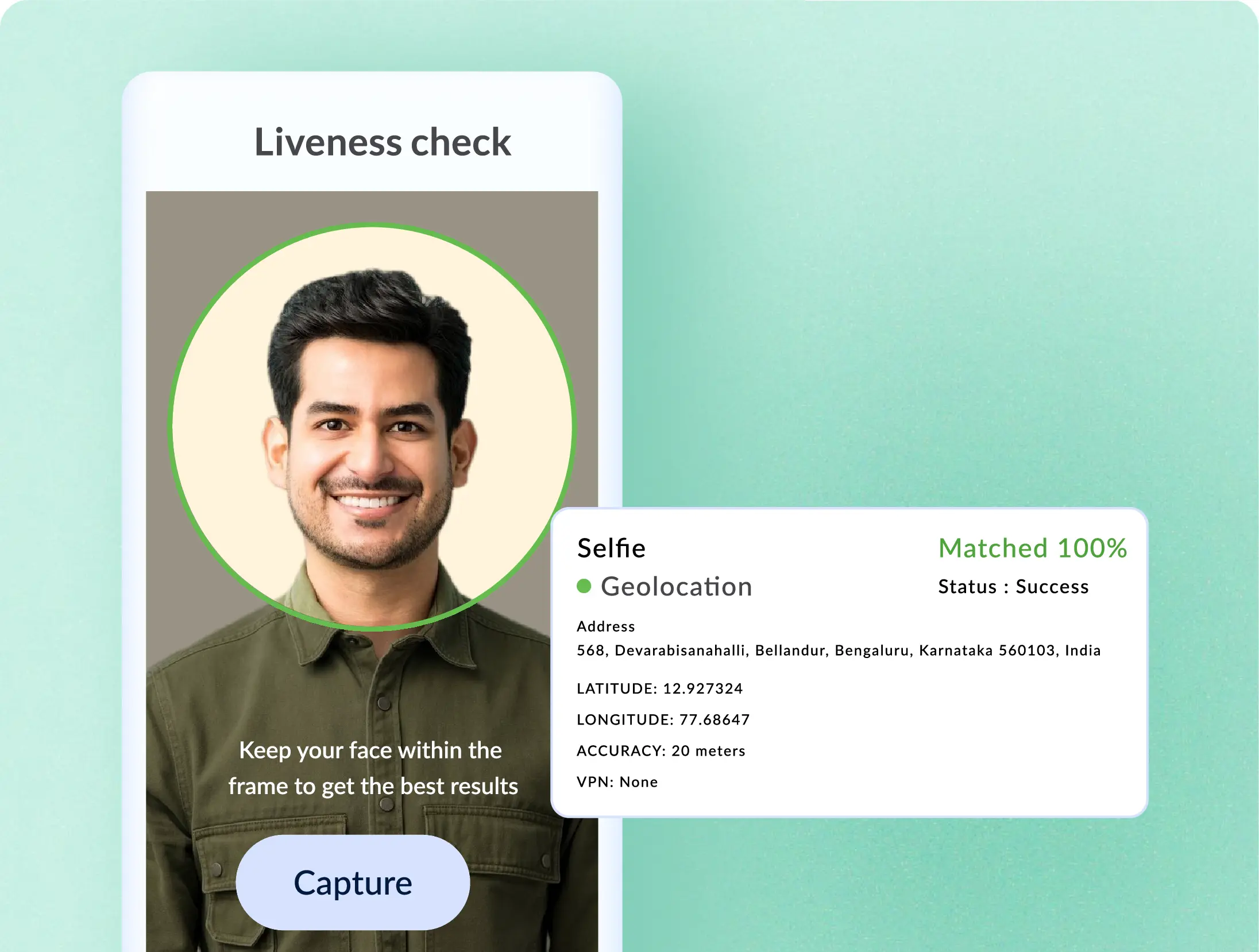

Liveness Detection with location and VPN Checks

Enforce liveness checks (both active and passive) to verify the presence of a person and prevent identity theft

20+ checks to determine Selfie Liveness and Integrity

Junk/invalid images rejected at source with 99.6% accuracy

Verifiable audit trail for business compliance checks

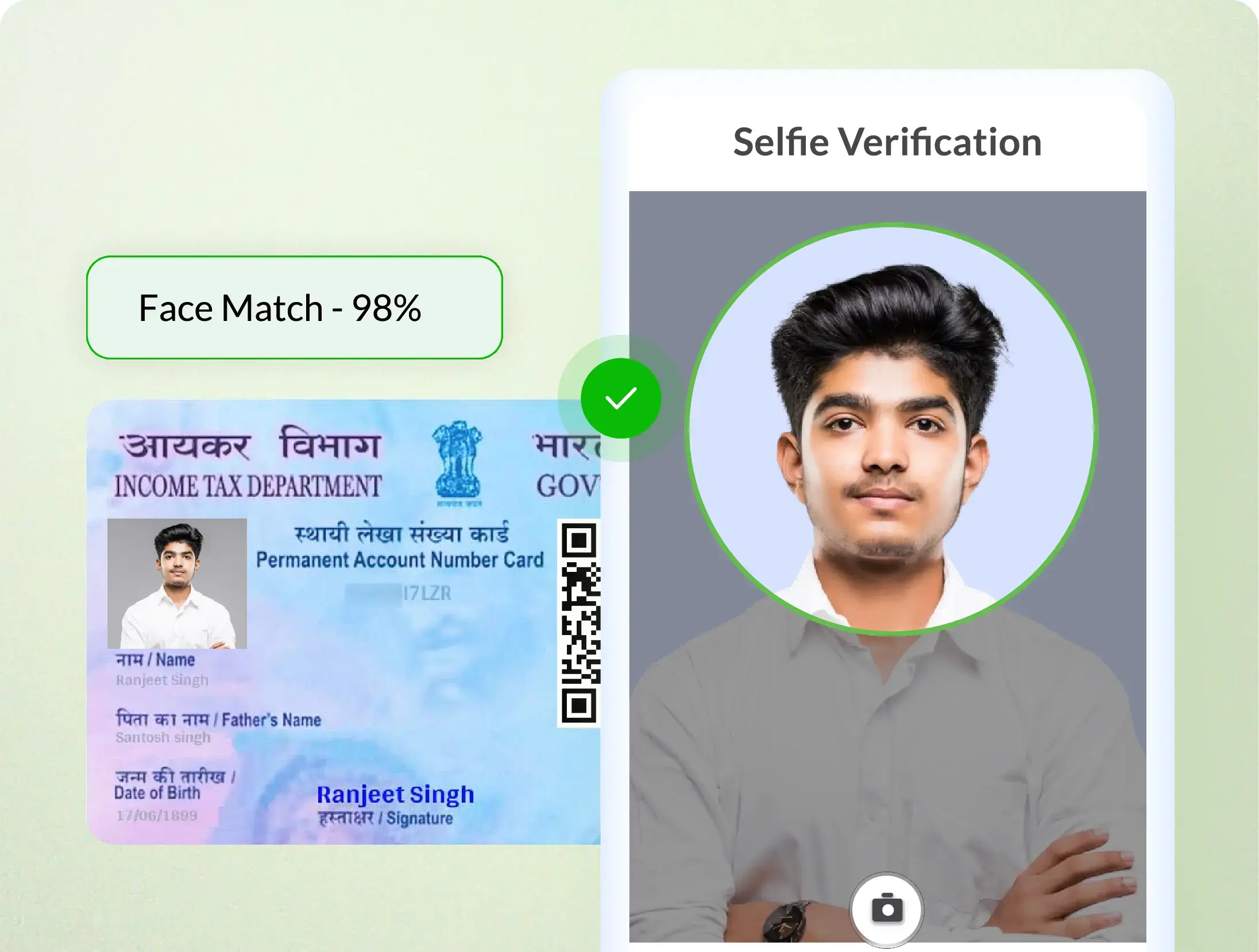

Selfie Verification with Face Match

Selfie verification using facial recognition to assess the authenticity of facial images.

Face dedupe across large scale image sets to prevent frauds

Real time Face match with photo ID and Geo-tagging

Time stamped verification reports for compliance audits

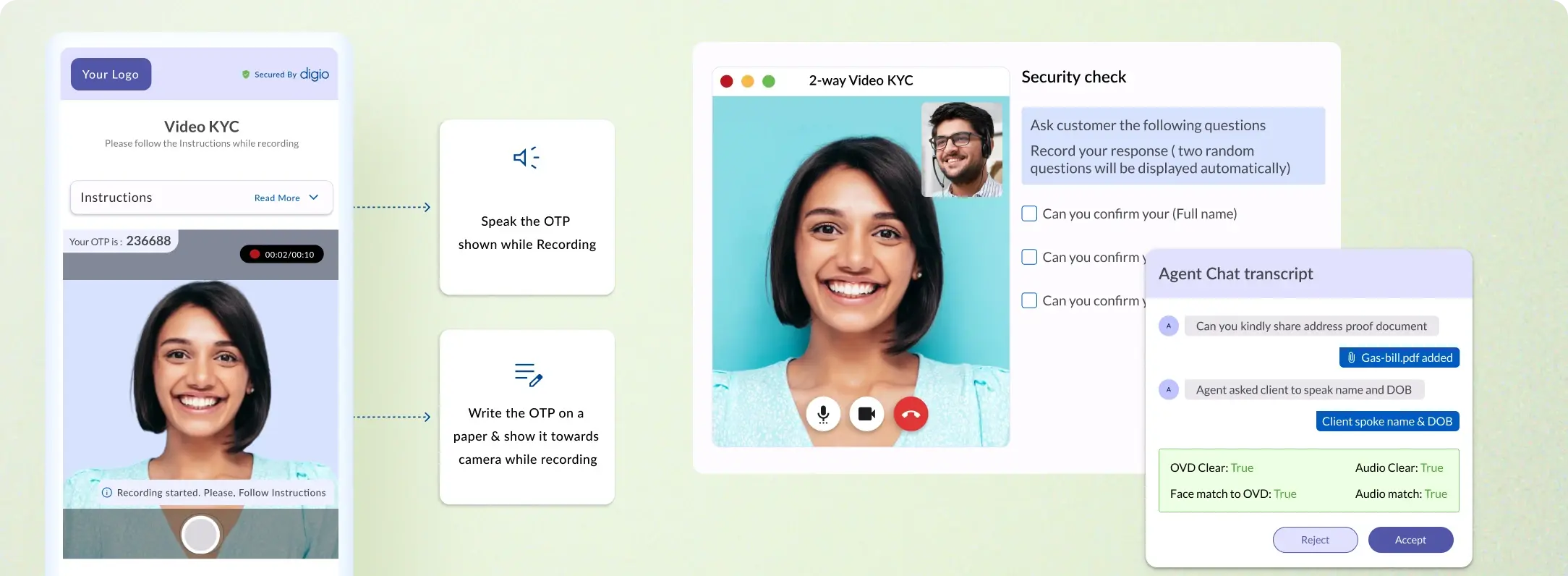

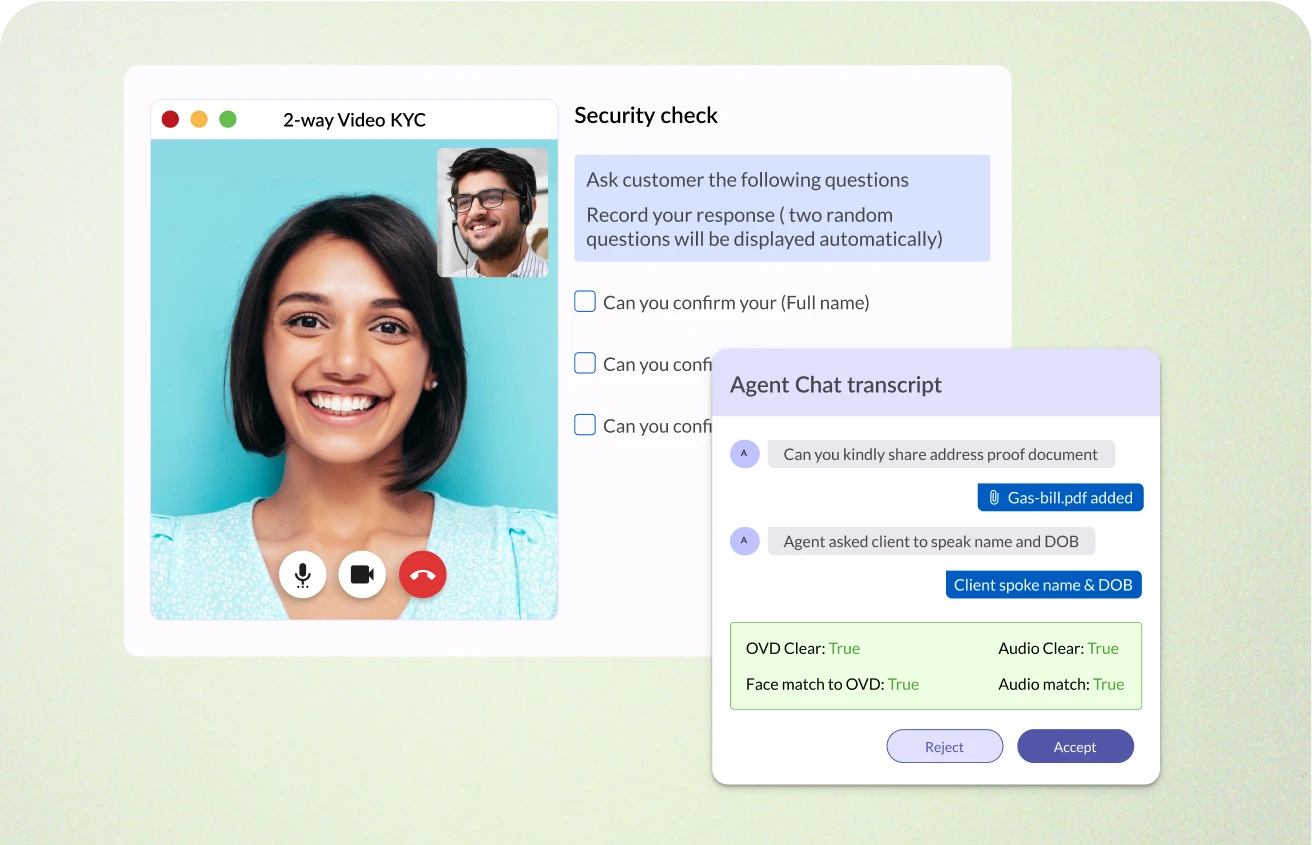

Video KYC - Self and Assisted Video KYC

Simplify workflows with powerful digital signature features

Conduct real-time identity verification using high-quality video interaction for customer onboarding, ensuring KYC compliance

Real time Facial recognition and Geo-location verification

Auto adjustment of video quality based on network strength

Multi agent support with agent productivity features such as call reminders, calendar integrations, in-call chat and file sharing

Enhanced Due Diligence

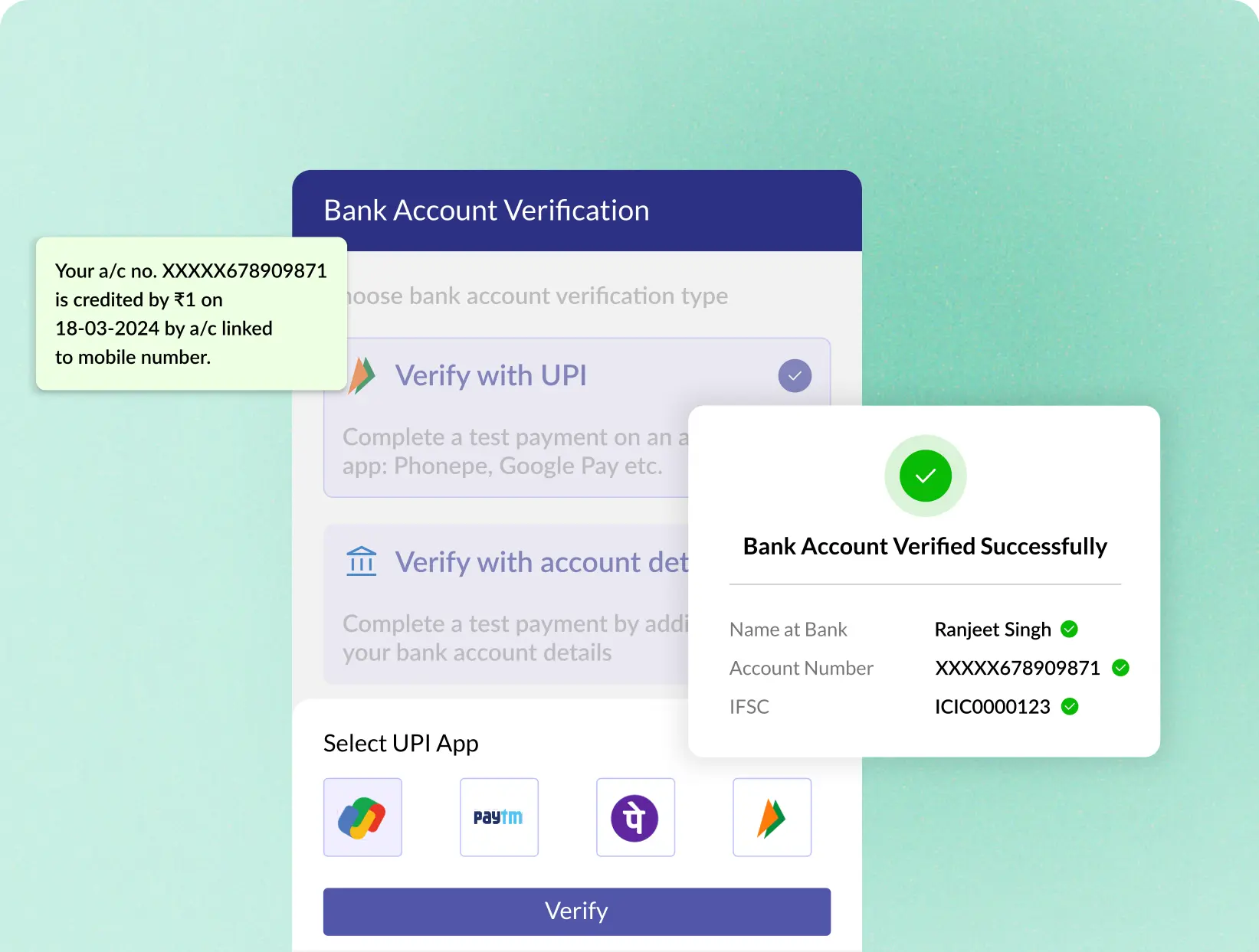

Bank Account Verification

Comprehensive Bank A/C Verification, including Penny drop Standard (Re. 1), Custom, Penniless, and Reverse via UPI

Built-in failover mechanism with multiple sponsor bank integrations

Integrity checks on customer name as per KYC and Bank records

Best-in-industry latency with verification turn around at 1.8 seconds

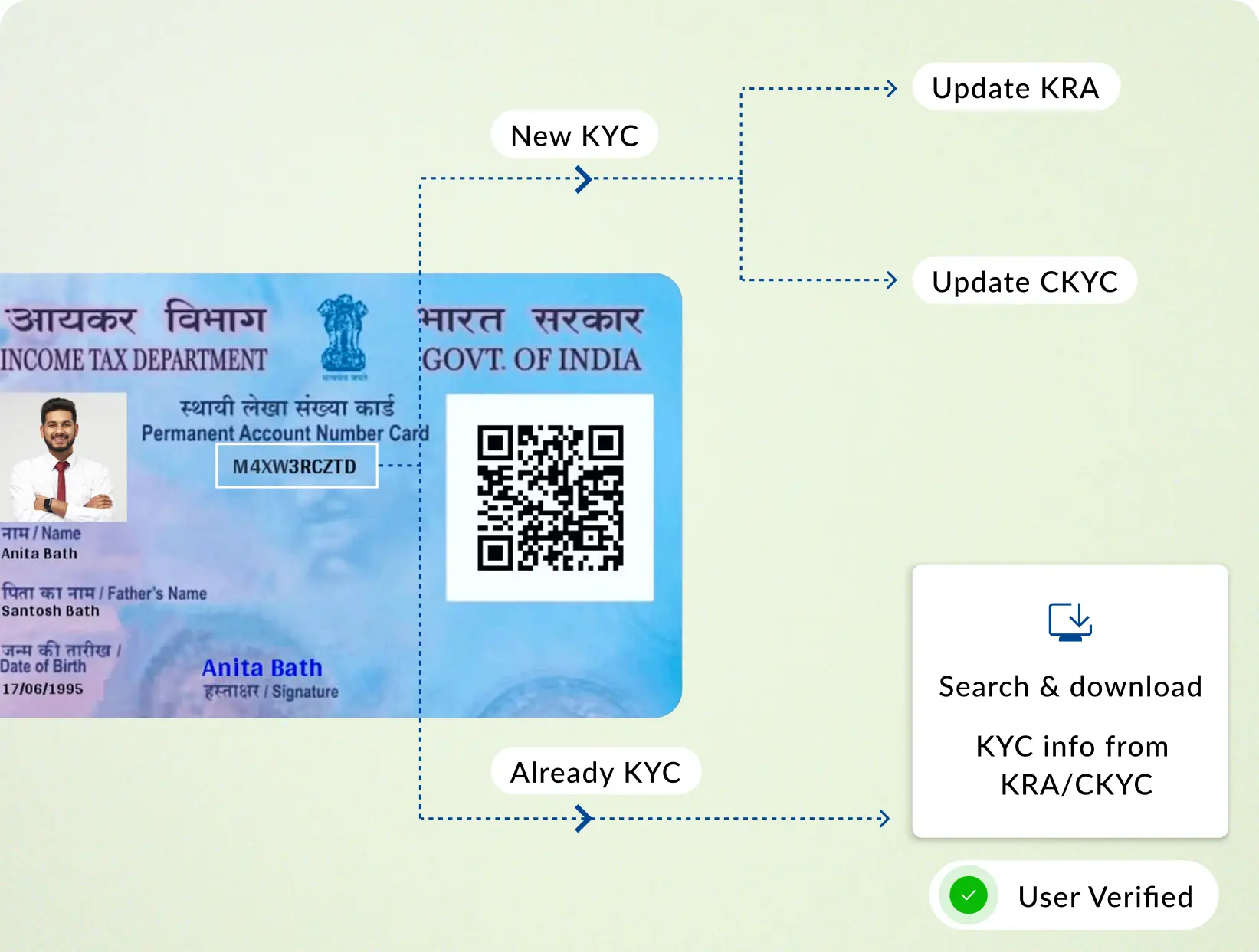

CKYC and KRA Checks

Enhance onboarding efficiency and achieve substantial cost savings by utilizing a single CKYC API

Update CKYC, KRA records for new customers with a single API

Save time with search and download of existing CKYC/KRA records

Reduce operational costs and provide a seamless onboarding experiences

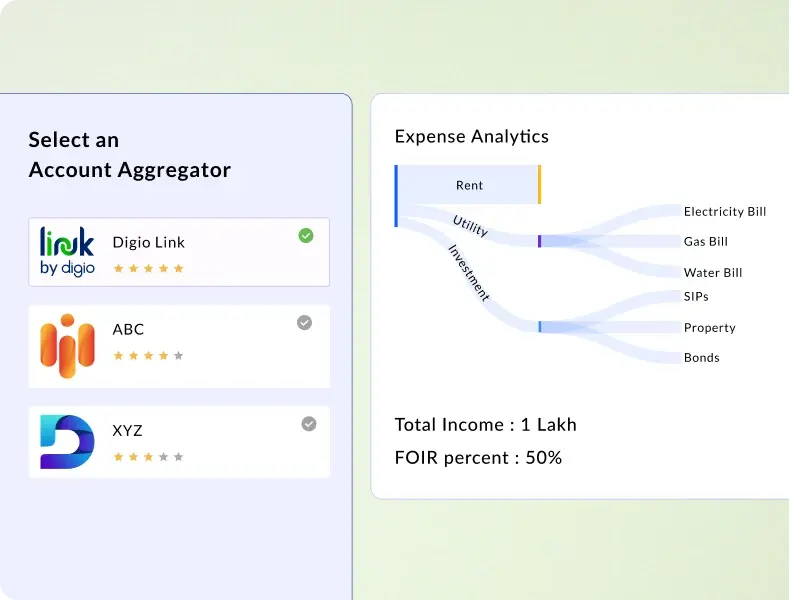

Account Aggregator

Retrieve financial information of customers with a consent based data sharing framework

Determine credit worthiness using alternate data from a customer’s bank statements, investments, insurance policies etc.

Perform enhanced due diligence on financial transactions of a customer

Implement conditional logics by building financial ratios over customer data

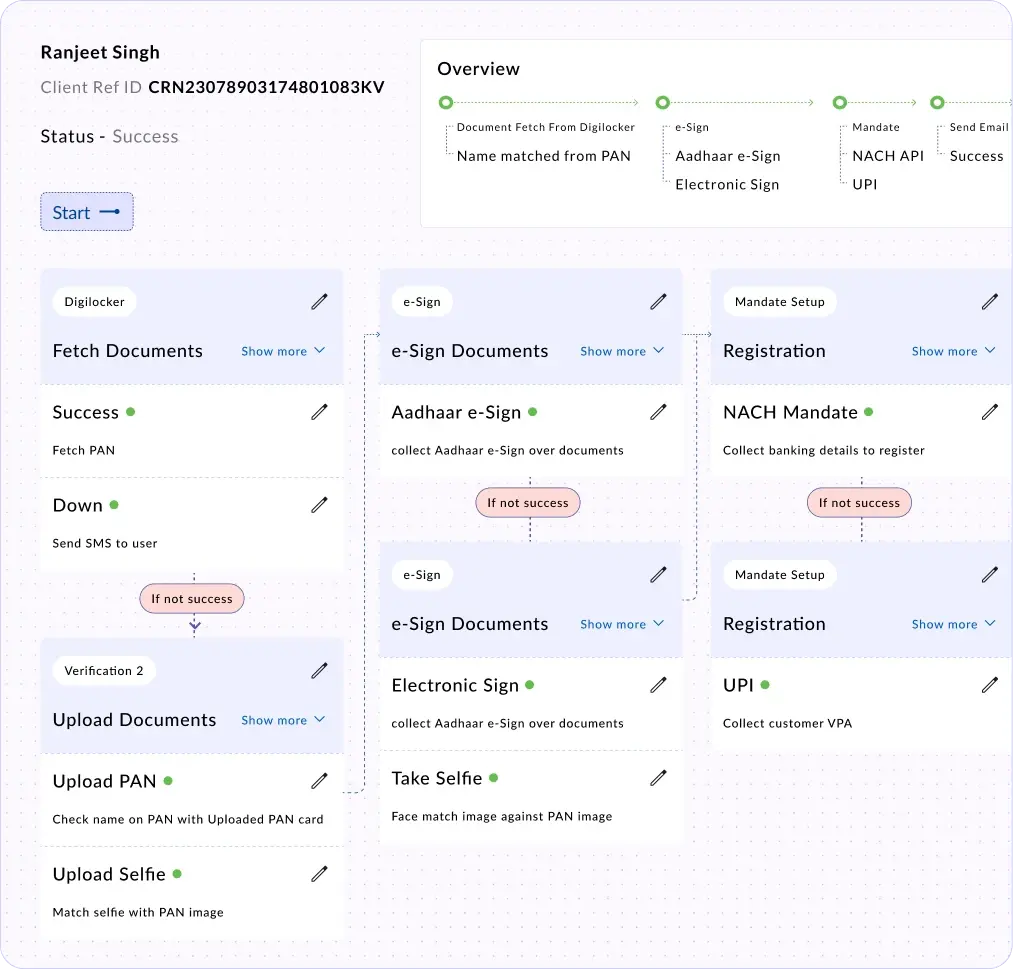

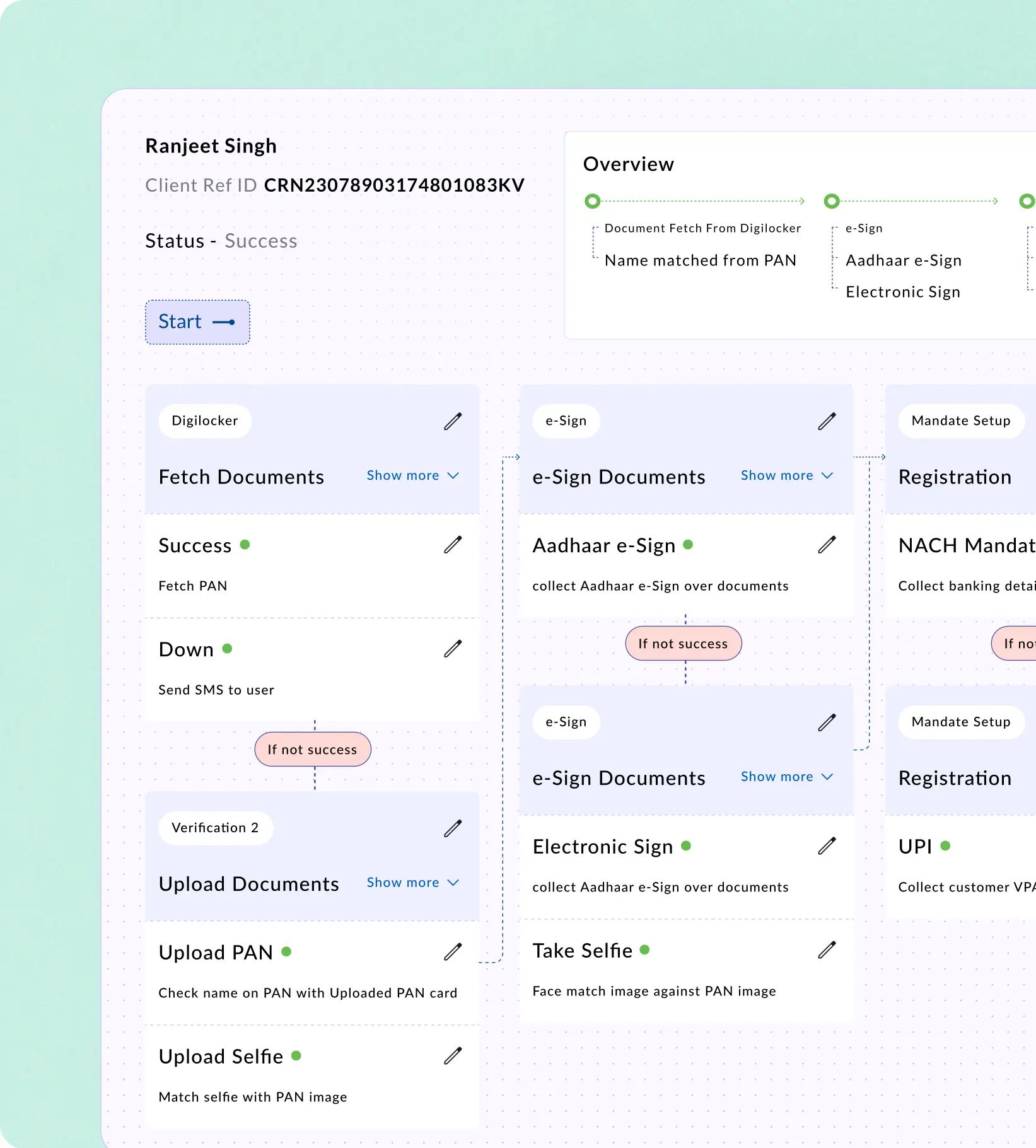

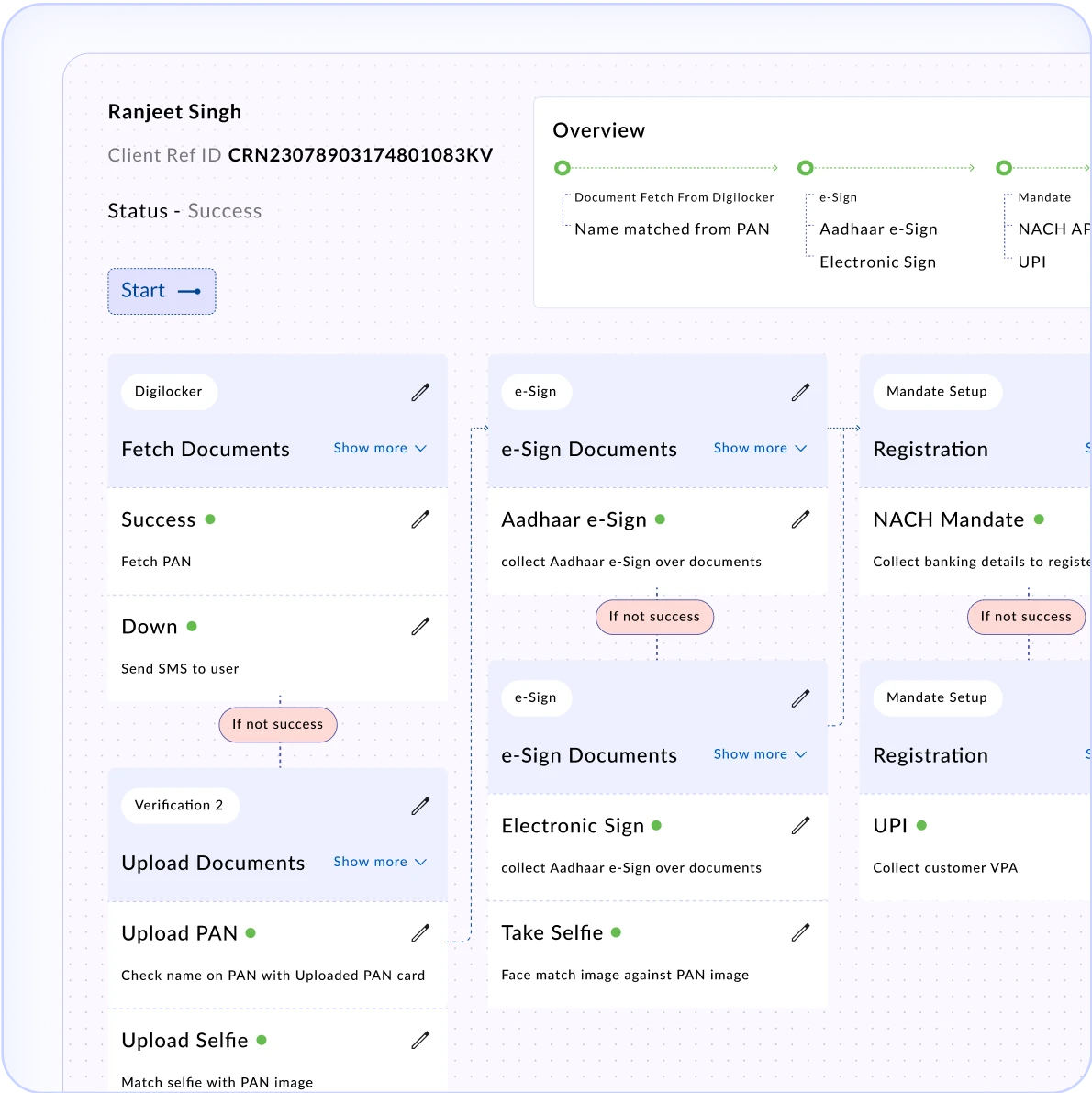

Studio USPs

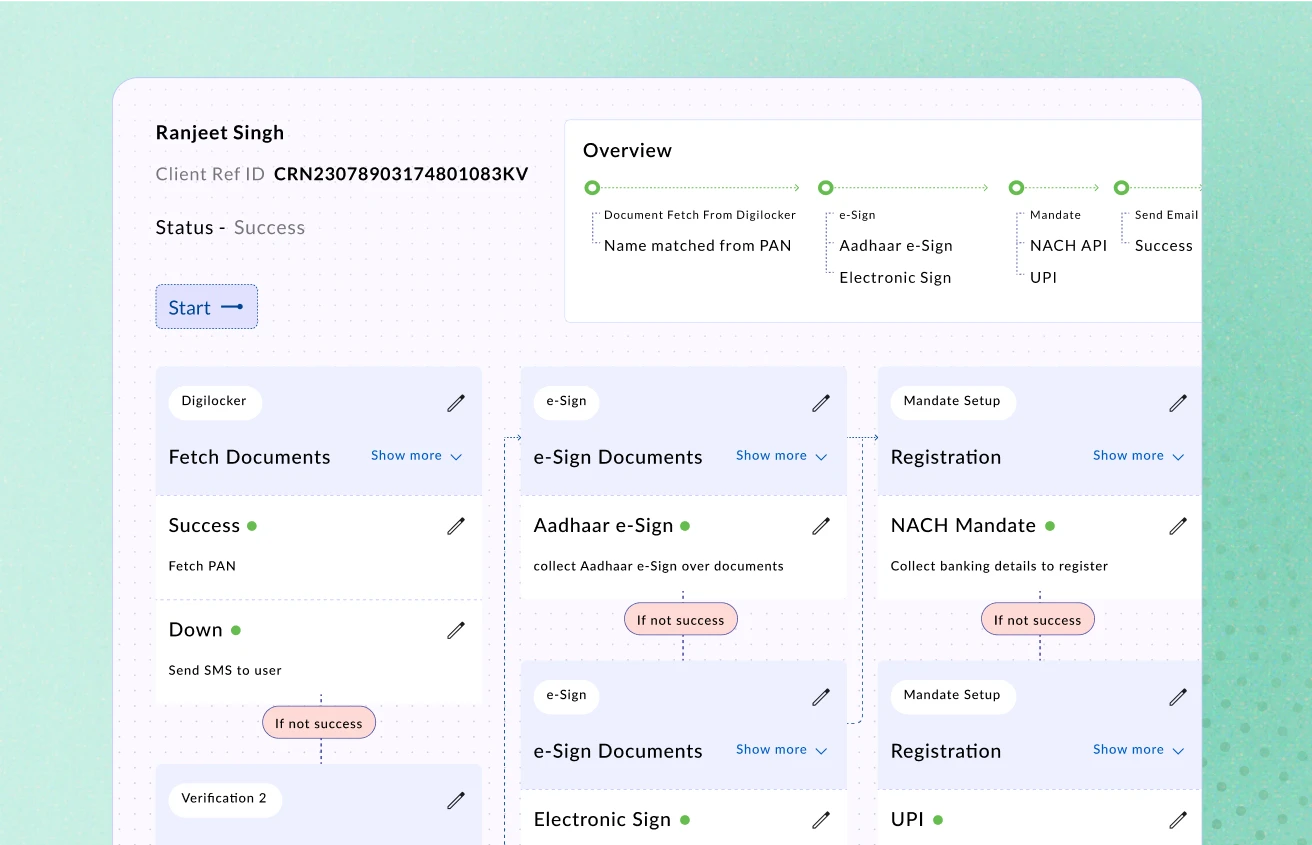

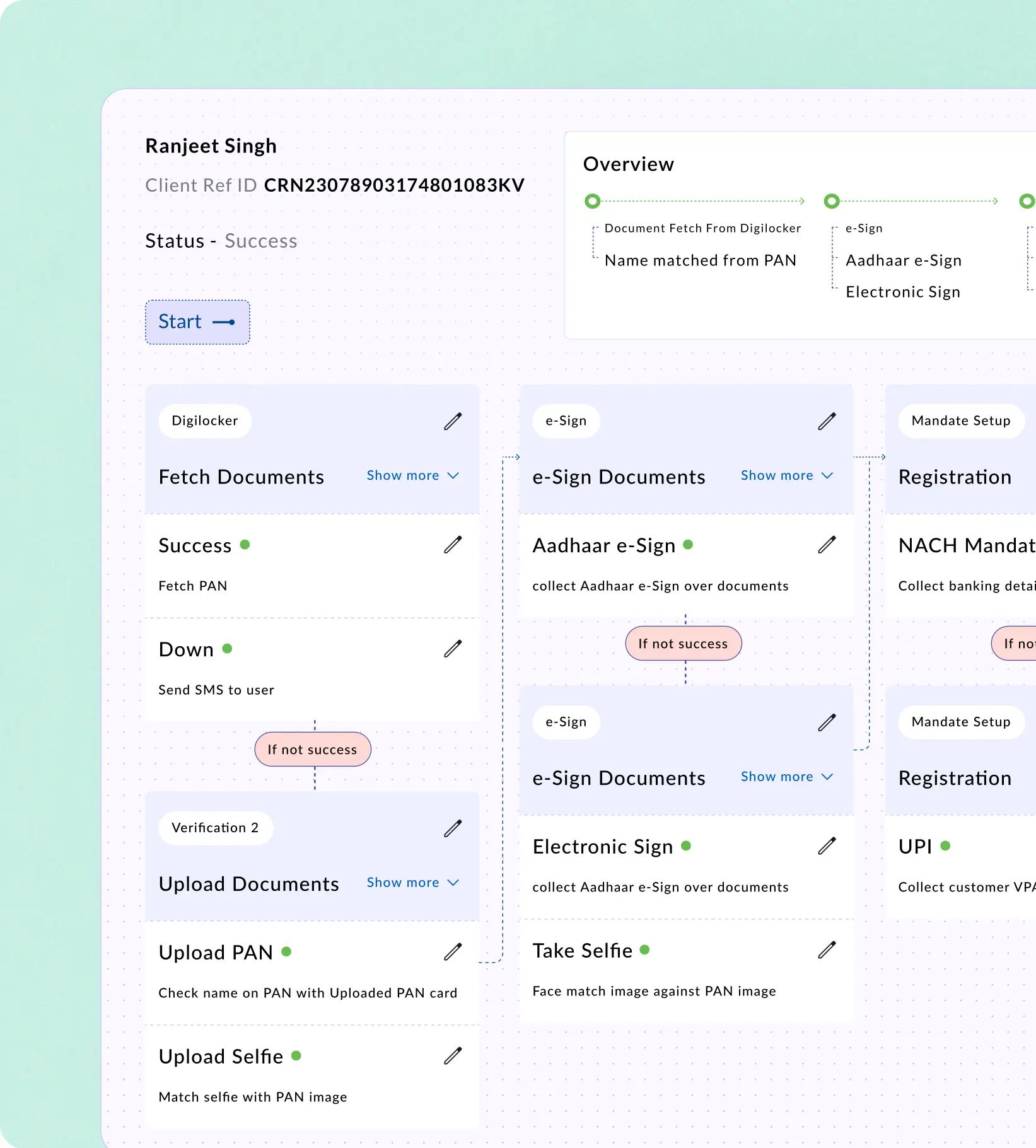

Orchestrate end-to-end Onboarding for Individuals and Businesses with DigiStudio

Business Workflow builder for end-to-end customer or client onboarding

Drag & Drop reconfigurability with auto-approval mechanism

Onboarding journey traceability and analytics

Configure complex business validations to ensure full compliance

Orchestrate end-to-end Onboarding for Individuals and Businesses with DigiStudio

Business Workflow builder for end-to-end customer or client onboarding

Drag & Drop reconfigurability with auto-approval mechanism

Onboarding journey traceability and analytics

Configure complex business validations to ensure full compliance

Leverage insights, enhance your KYC workflows

Achieve Measurable Business Value with comprehensive DIGIKYC Suite

60%

Operational cost Reduction

95%

Turnaround time (TAT) Reduction

75%

Improvement in Workforce productivity

3X%

Business Scale Achieved

Explore Digio’s Other Solutions

DigiStudio

Business Workflow builder for end-to-end onboarding

Drag & Drop reconfigurability with auto-approval mechanisms

Onboarding journey traceability and analytics

Configurable business validations to ensure full compliance

Drag & Drop reconfigurability with auto-approval mechanisms

Onboarding journey traceability and analytics

Configurable business validations to ensure full compliance

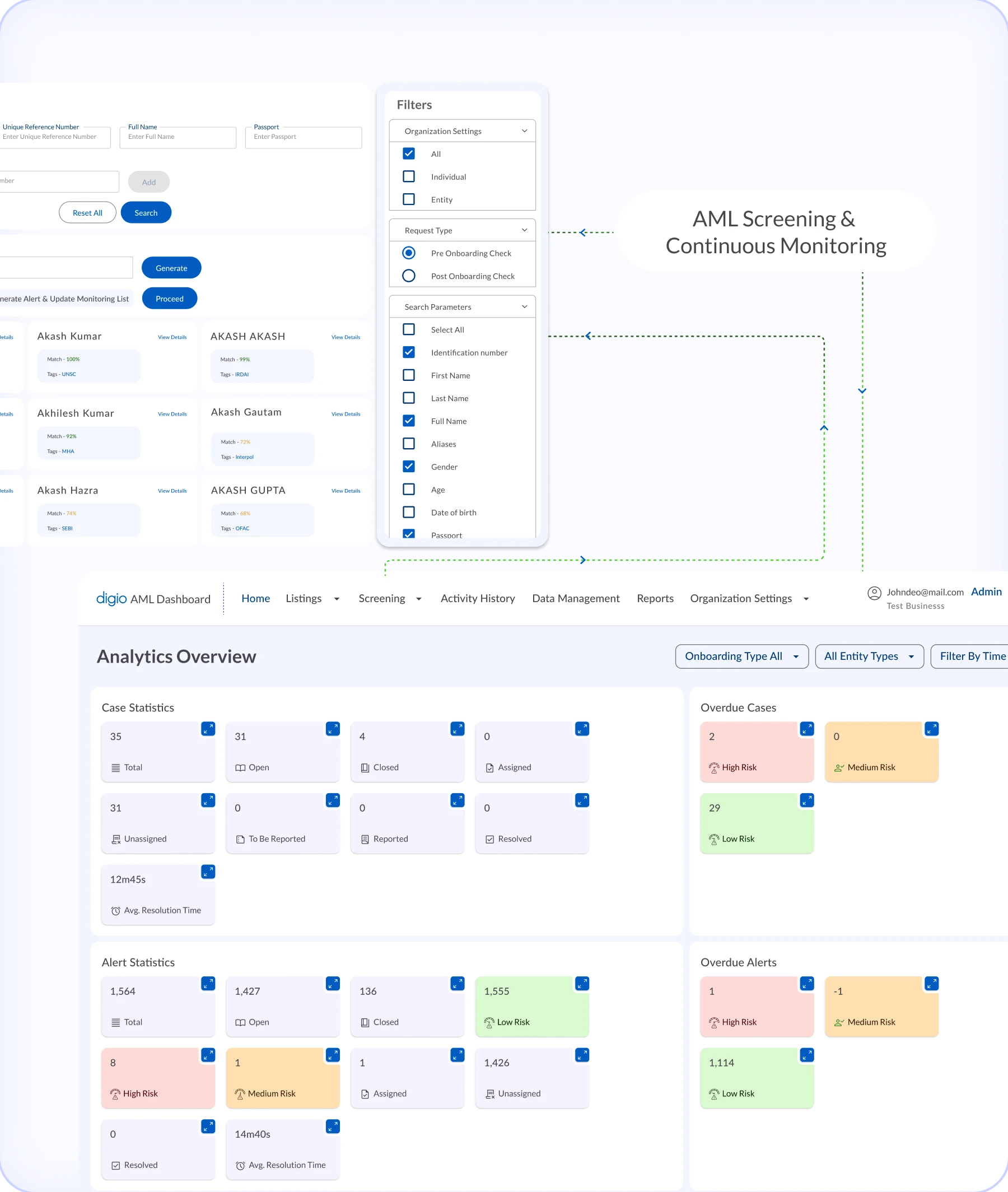

DigiShield

Intelligent screening and real-time monitoring ensure secure onboarding and compliance with regulatory standards, preventing inclusion on sanctions or embargo lists.

Robust Screening Engine

Enables Compliance Efficiency

Drilled-down Insights

Powerful Rule Orchestration

Private List Support

Test Bed

STR Filing

Robust Screening Engine

Enables Compliance Efficiency

Drilled-down Insights

Powerful Rule Orchestration

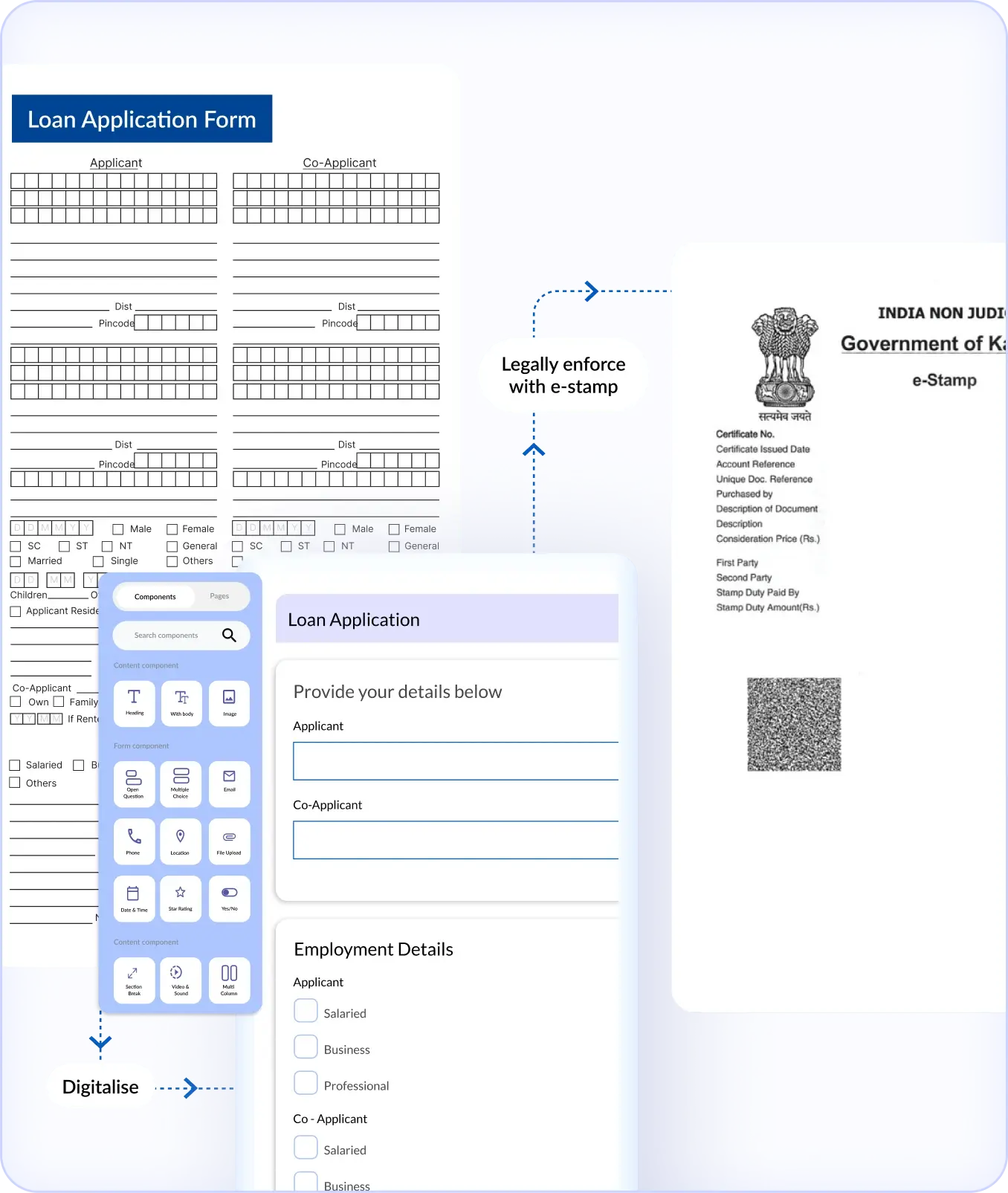

DigiDocs

All-Inclusive Platform for all your Document Creation and Management Needs

Document Template Creation

Secured Document Repository

Document Version Control

Form Builder with Drag & Drop UI, Field Validations, and Conditional Logic

Folder management of executed documents

Filters and tags for efficient document retrieval

E-stamp - Single platform with pan India multi denomination support

Document Template Creation

Secured Document Repository

Document Version Control

Form Builder with Drag & Drop UI, Field Validations, and Conditional Logic

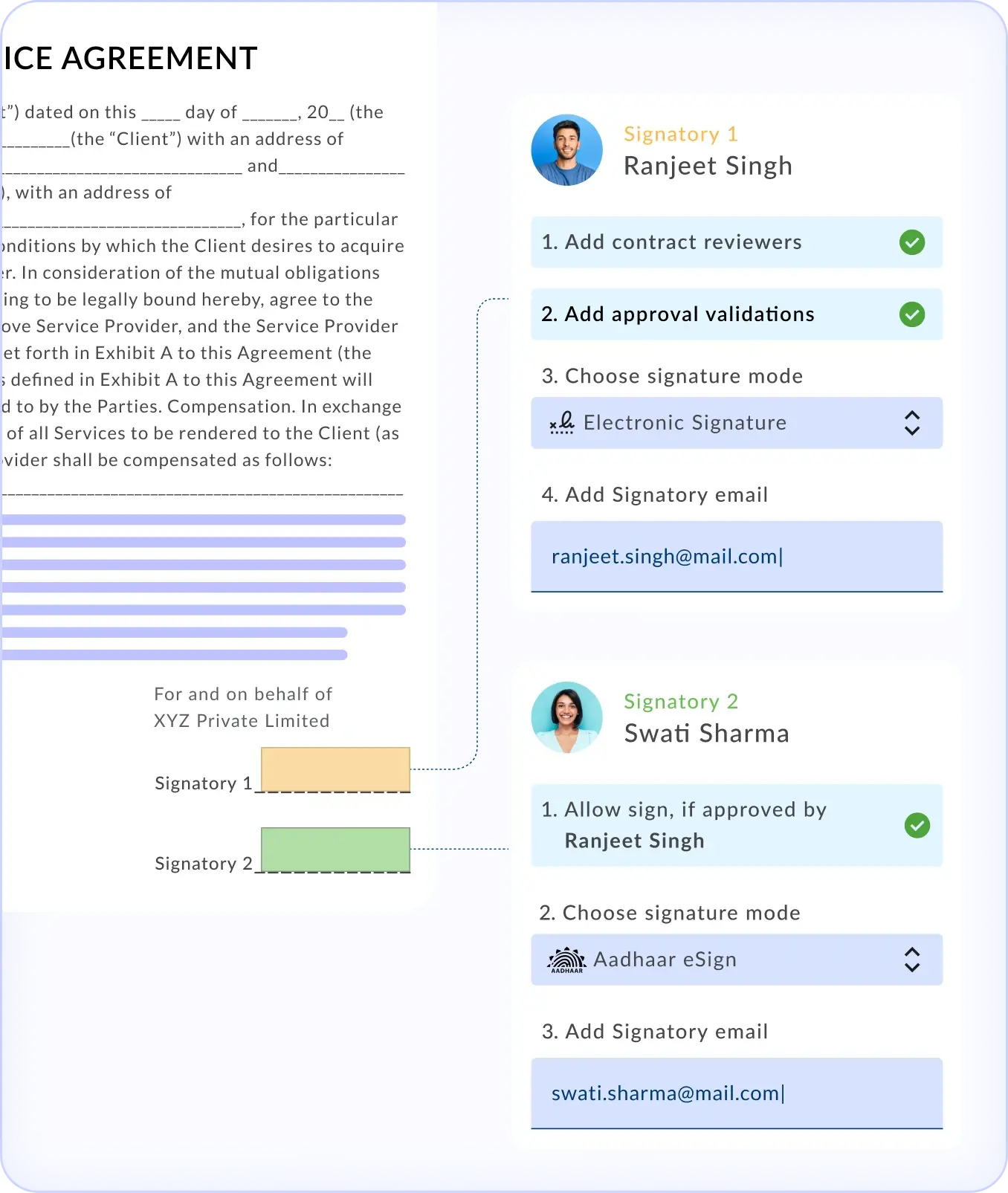

DigiSign

The Most Trusted Signing Solution in India, enabling you with highest configurability for digital signing

Aadhaar eSign

USB Based Digital Signer Certificate

Document Signer Certificate

Electronic Signatures

KYC Backed Signing

Aadhaar eSign

USB Based Digital Signer Certificate

Document Signer Certificate

Electronic Signatures

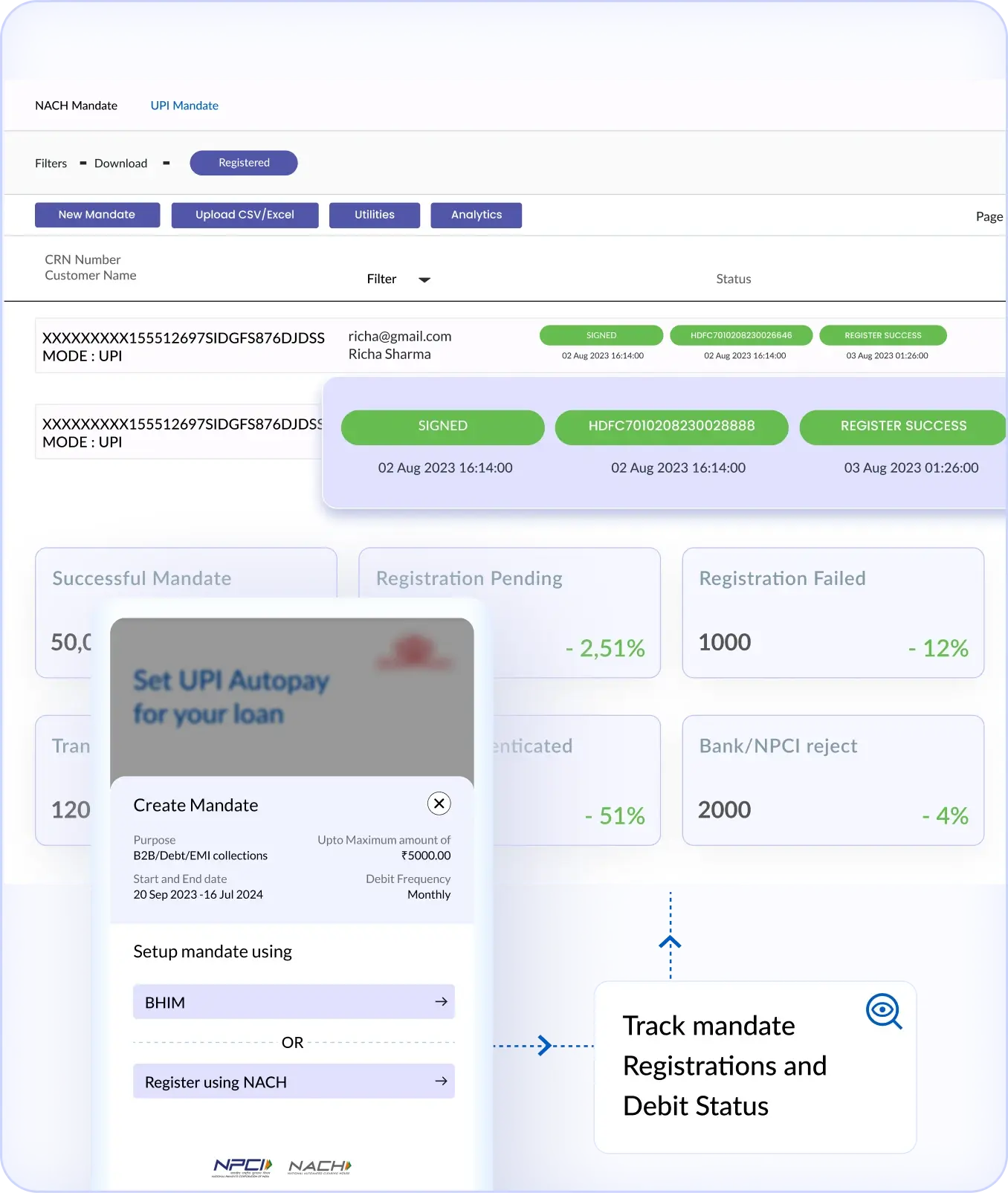

DigiCollect

Automate NACH-Compliant Recurring Collections with Multiple Sponsor Bank integrations

API Mandates via Debit Card and Net Banking

360 degree view of collectibles with single integration and dashboard for effective tracking

NACH Mandates

UPI Mandates

Physical Mandates

Mandate Book

Debit Presentations

Sponsor Bank Dashboard

Alternate Collection Mechanisms

API Mandates via Debit Card and Net Banking

360 degree view of collectibles with single integration and dashboard for effective tracking

NACH Mandates

UPI Mandates

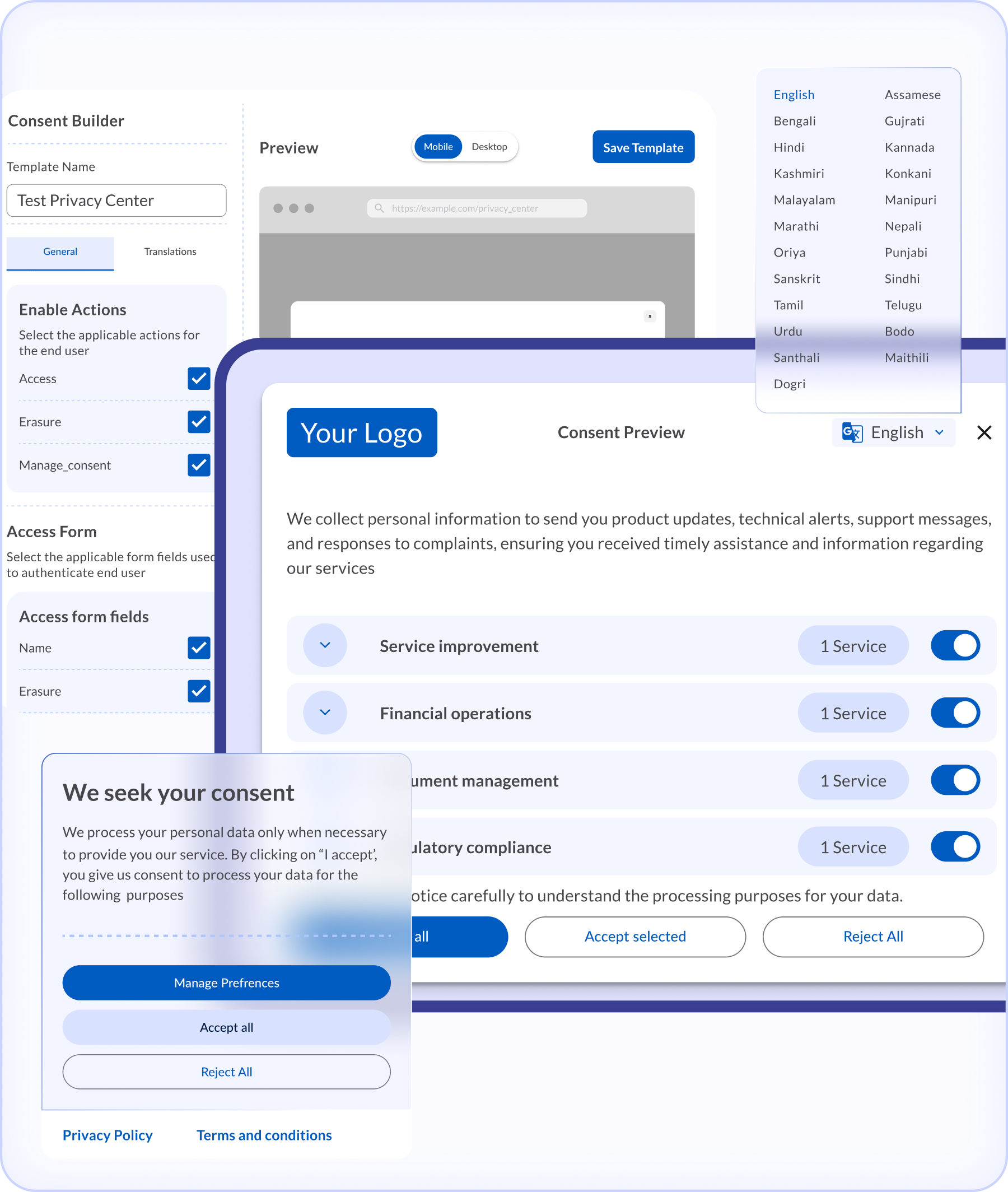

CoTrust

Effectively discover, classify your customer data and collect and manage their consent across all touchpoints - with an integrated solution.

Effectively Discover and Classify PII data across Data sources

Generate Purpose backed Consent Templates for your Website and Apps

Service Data Subject Requests from a customisable Privacy Centre

Design Custom Workflows to automate Privacy Requests

Get a bird's eye view Request fulfilment SLAs through a single Dashboard

Effectively Discover and Classify PII data across Data sources

Generate Purpose backed Consent Templates for your Website and Apps

Service Data Subject Requests from a customisable Privacy Centre

Design Custom Workflows to automate Privacy Requests

Digitally transform business operations with Digio!

Try first. Subscribe later.

Boost your legal ops efficiency by 80%

Learn how Digio can enhance your business productivity

Get 1-on-1 business use case solutioning

Speak with our business consultants to get a solution walkthrough for your business requirement

Test the APIs

Let your development team test our API suite to understand configurability and product integration

Subscribe

Get the best in industry commercials for your business usecase

FAQ

02

What is Aadhaar Offline XML KYC?

After the Supreme Court’s judgement in 2018 disallowing the use of Aadhaar-based KYC services by private companies, the Unique Identification Authority of India (UIDAI) proposed a solution - an offline Aadhaar verification system.

Offline Aadhaar KYC verification is voluntary, paperless, and driven solely by the Aadhaar-number holder. In addition, core biometrics are not required, and data is private and secure. Aadhaar Paperless Offline e-KYC eliminates the need for a holder to provide a physical copy of an Aadhaar letter. Instead, one can download the KYC XML file and provide it directly to the agency requesting KYC.

The XML file includes the following details:

- Resident Name

- Download Reference Number

- Address

- Photo

- Date/Year of Birth

- Mobile Number (in hashed form)

- Email ID (in hashed form)

This data is encrypted using a “share phrase” provided by the Aadhaar-holder at the time of file download, which is to be shared with the agency to read the KYC data.

03

What is ID Card parsing?

ID Card parsing refers to the extraction of data from a given identity card or document. Parsing can be done through effective Optical Character Recognition (OCR), which involves the identification of printed characters through computer software.

DIGIKYC allows you to upload images of PAN cards, Aadhaar cards, etc., and extract relevant data for KYC purposes.

04

How can I implement KYC processes using DigiKYC?

DigiKYC makes customer onboarding and KYC simpler through the following:

- Video In-Person Verification

- Aadhaar Offline XML/QR KYC

- DigiLocker Integration

- ID Card Parsing & Analysis

05

Is Aadhaar e-KYC legal?

In September 2018, the Supreme Court disallowed the use of Aadhaar-based eKYC services by private companies due to data privacy concerns.

Currently, Aadhaar-based eKYC is allowed only for select entities with licenses, such as banks, telcos, and government organizations. These entities have to pay a fee of Rs. 20/transaction to UIDAI.

On the other hand, Aadhaar offline KYC is available to all enterprises in the form of XML files or via QR codes. Aadhaar offline KYC is cheaper, voluntarily driven by the Aadhaar-number holder, and data is private and secure. The Aadhaar-holder just needs to download the XML file and share it directly with the agency requesting the KYC process.

06

How quickly can I integrate?

07

How much time can I save?

08

What can I use DigiKYC for?