Simplify recurring payment collections with

DigiCollect

An easy to integrate and secure multi-mode offering for recurring payment collections, using the NACH & UPI

Sponsor Banks

Extensive integrations with major Indian sponsor banks to initiate e-Mandates for enterprises

Banks

Destination Banks

Enable recurring debits at a customizable frequency from any bank account used by your customers

All Indian Banks

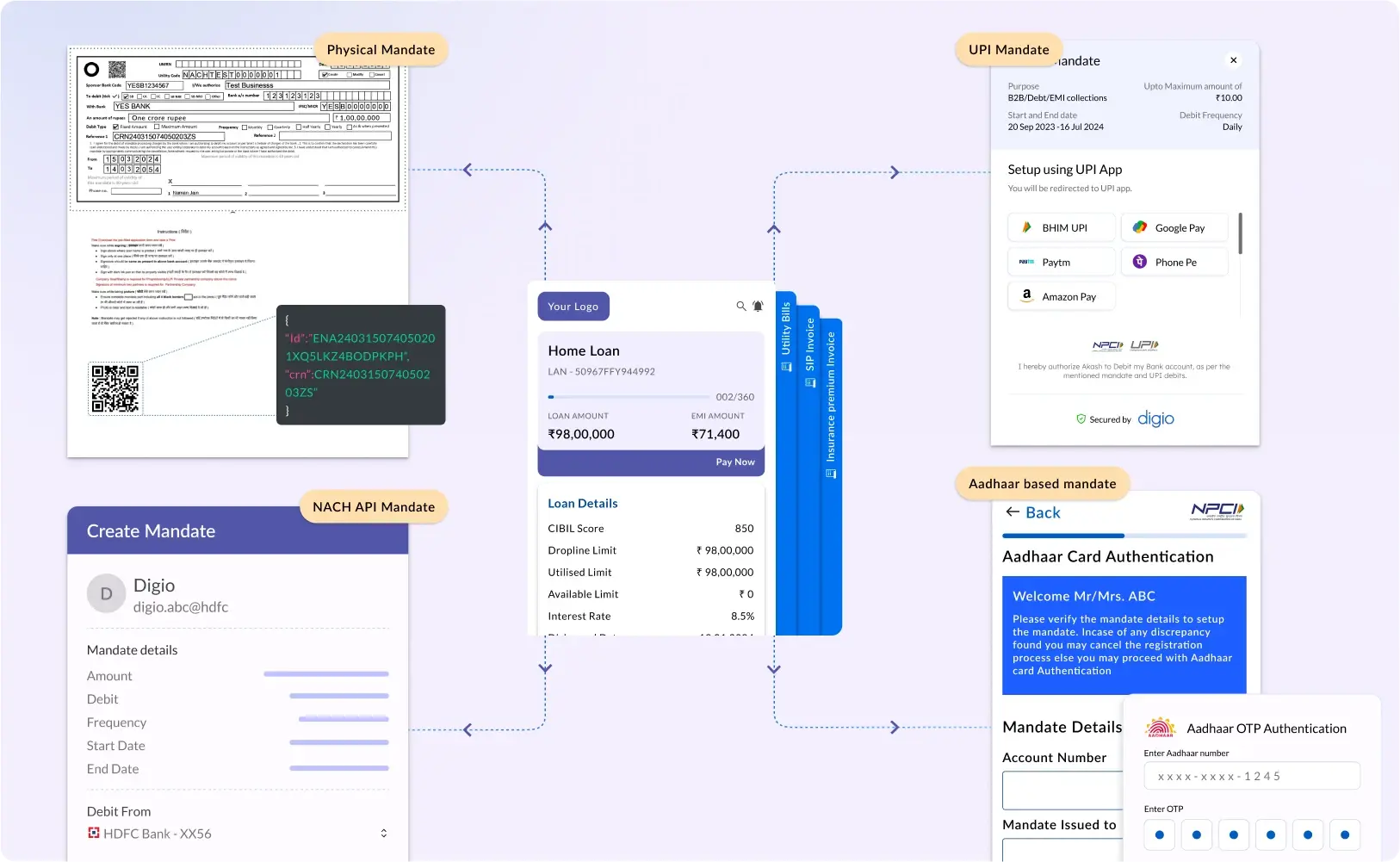

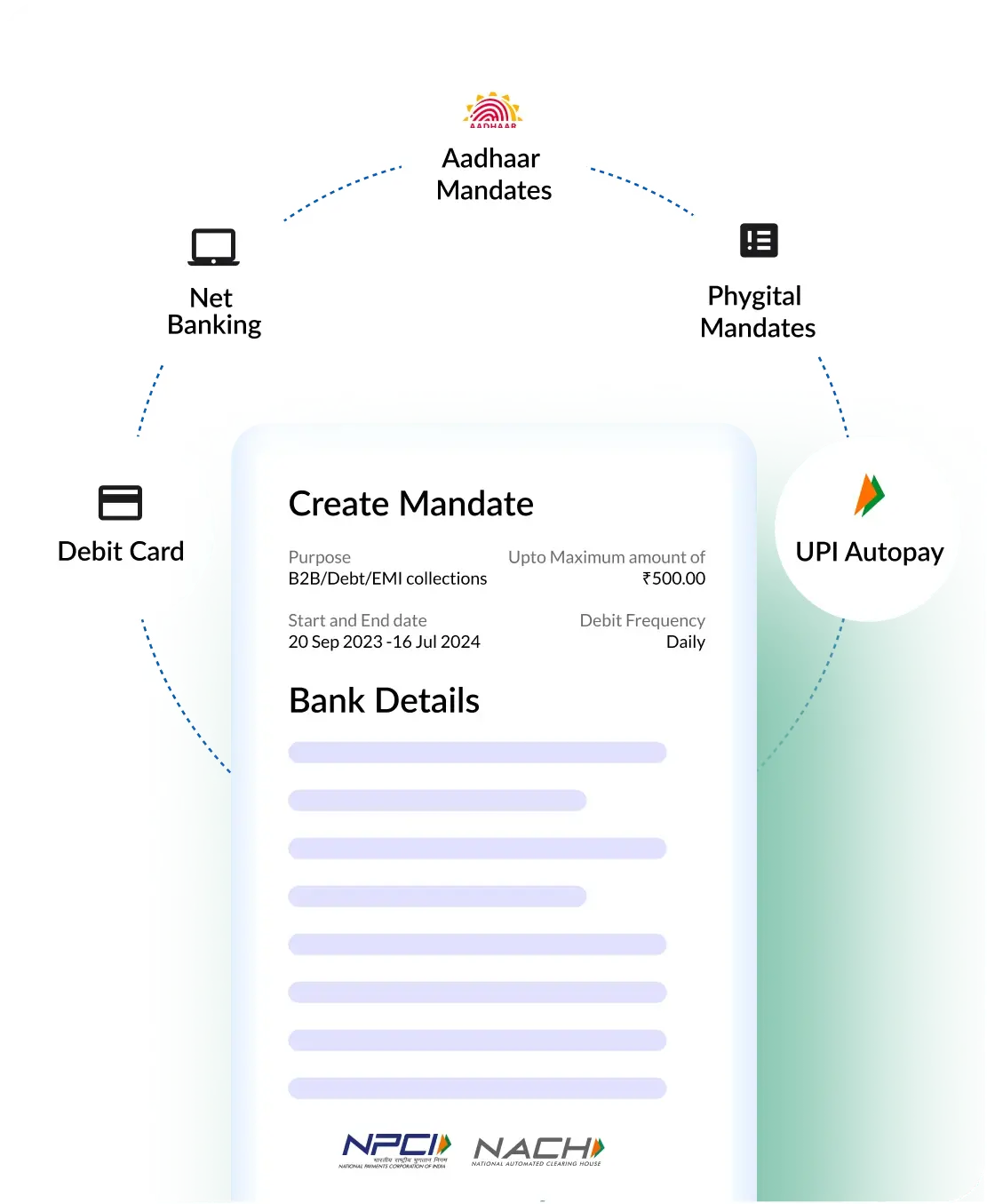

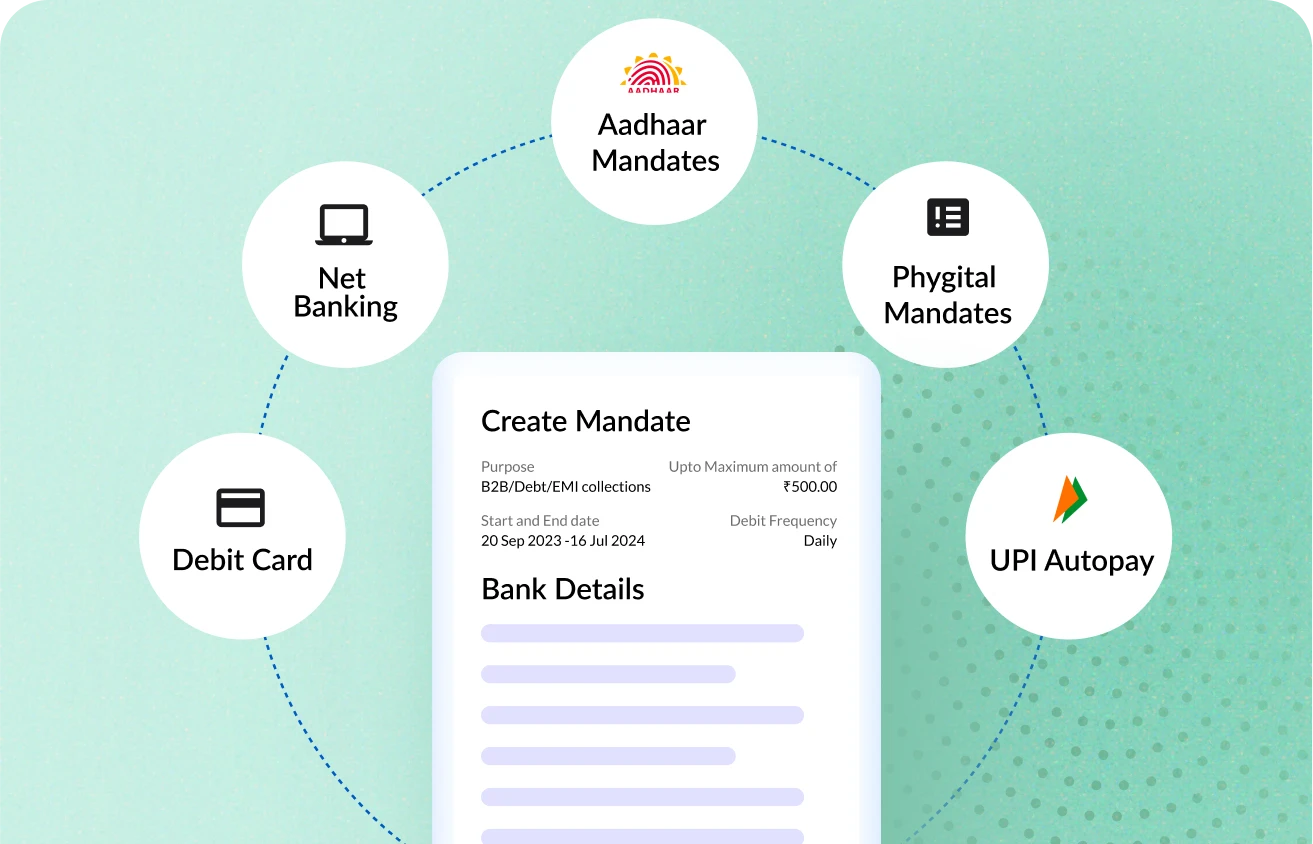

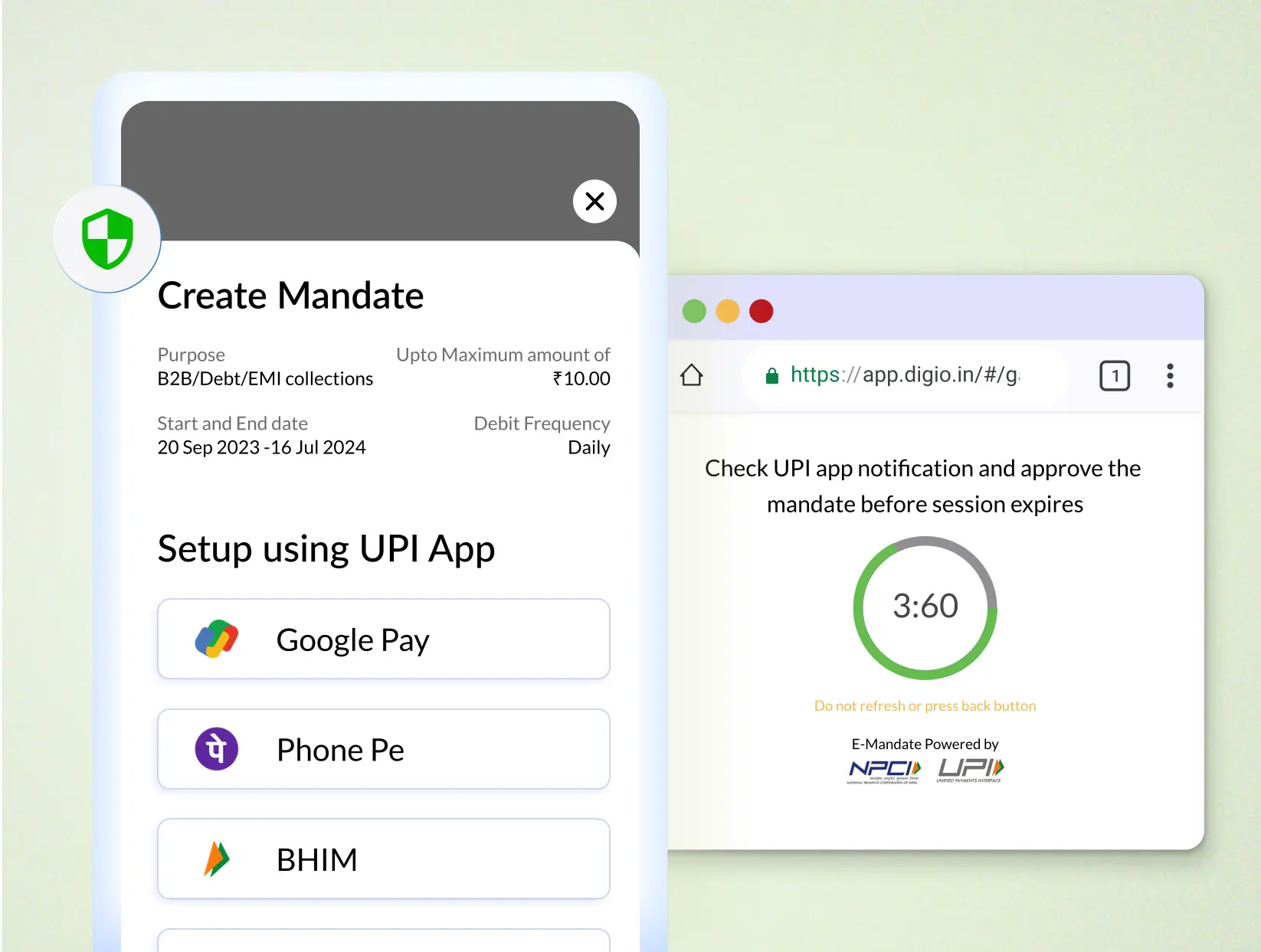

UPI 2.0 Autopay Mandates

Enable recurring e-mandates using customers VPA/UPI ID to initiate seamless bank a/c authentication on any UPI app

Immediate & easy registration for faster turnaround

Timely payments from customers using the seamless UPI experience

Upper limit of ₹2 Lakh for a debit transaction

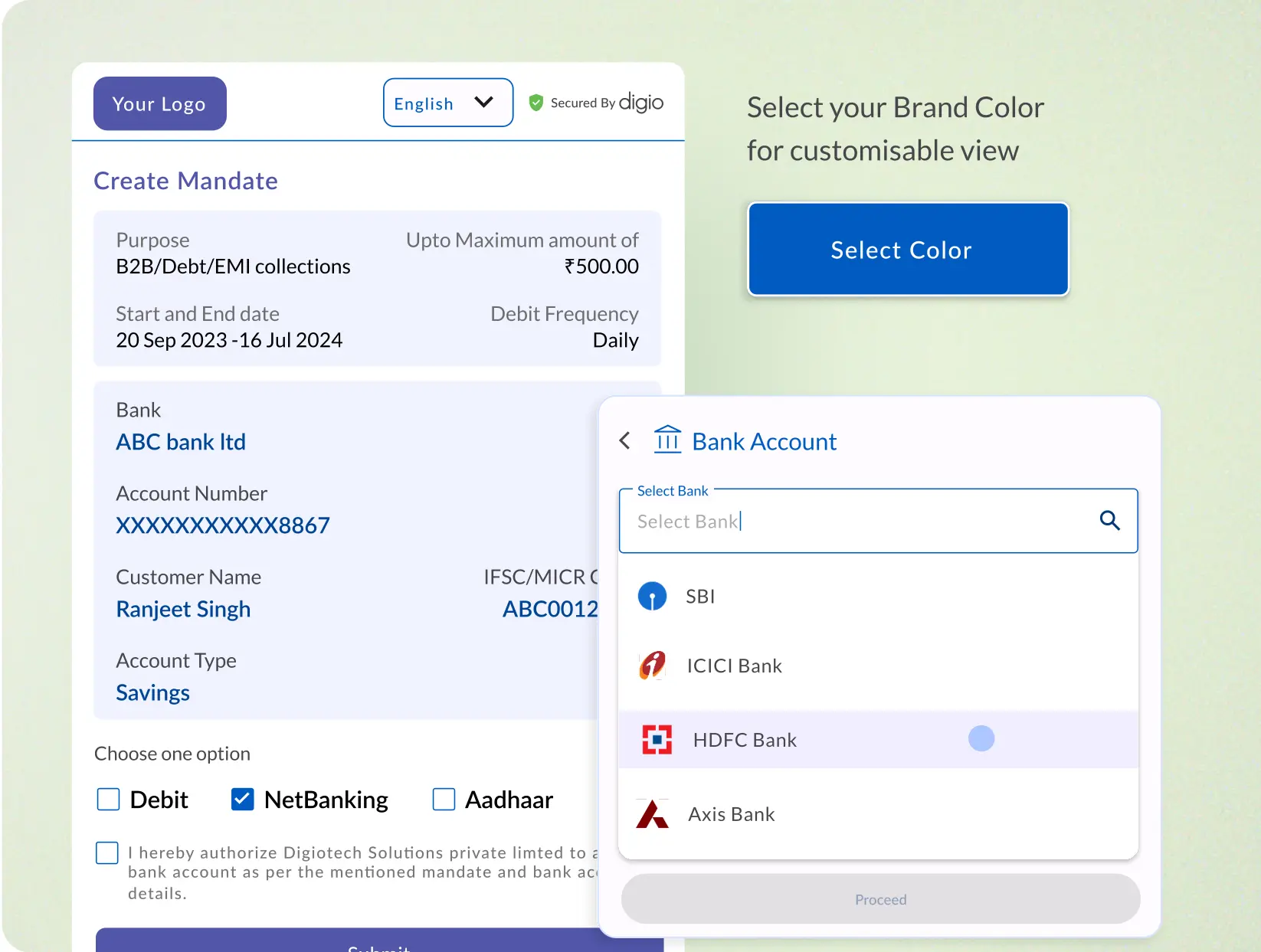

NACH API Mandate

Allow customers to setup an e-Mandate using their Net-banking or Debit card credentials

Real-time mandate registration with callback capability in the event of failures

Control user experience with an end-to-end API based flow

Upper limit of ₹1cr for a debit transaction

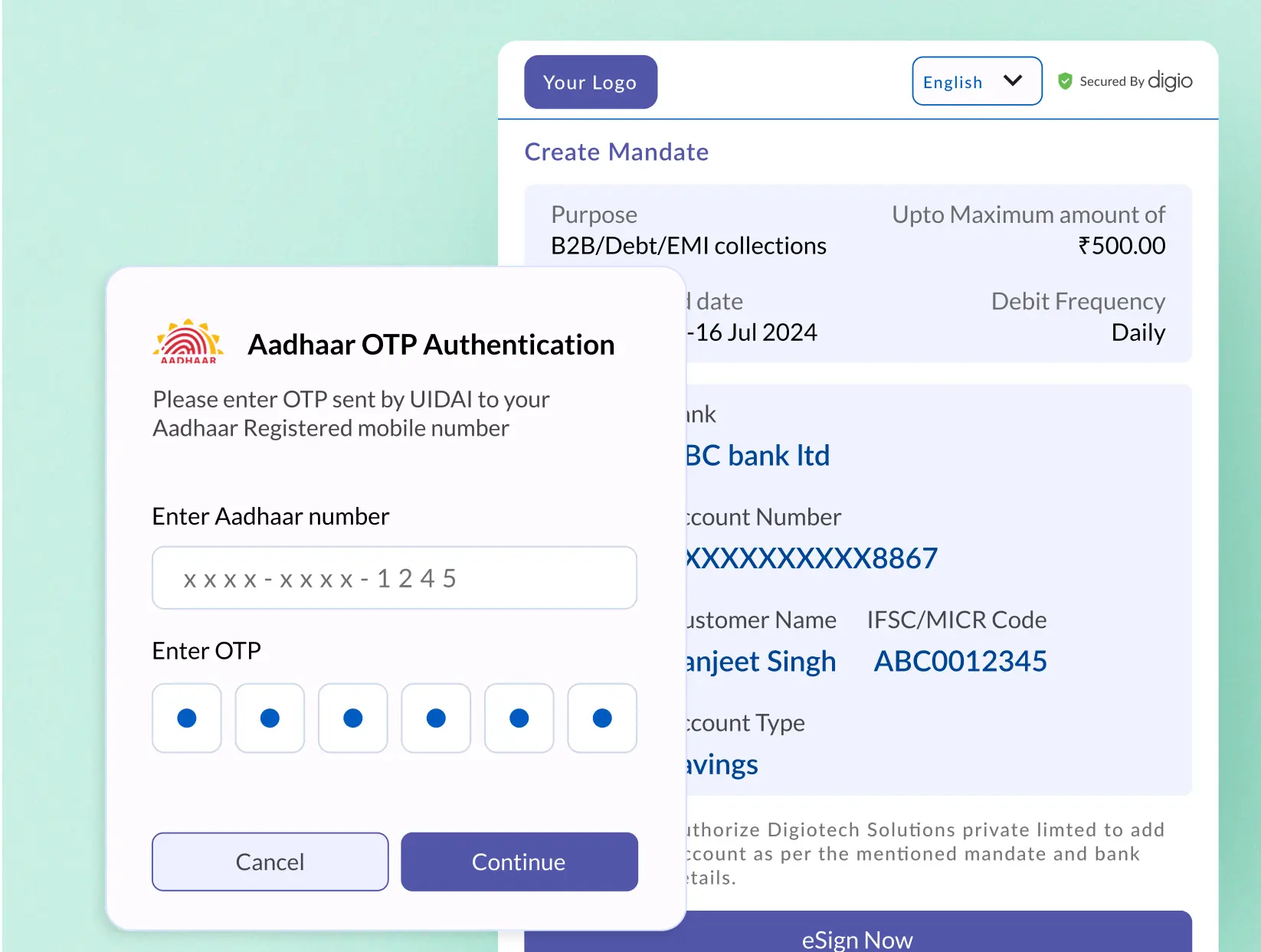

Aadhaar Based Mandates

Integrate Aadhar based mandates for customers without net banking & debit card facility

Only applicable if customer’s Aadhaar is linked to their bank account

End User initiates the Aadhaar eSign OTP for mandate registration

Upper limit of ₹1cr for a debit transaction

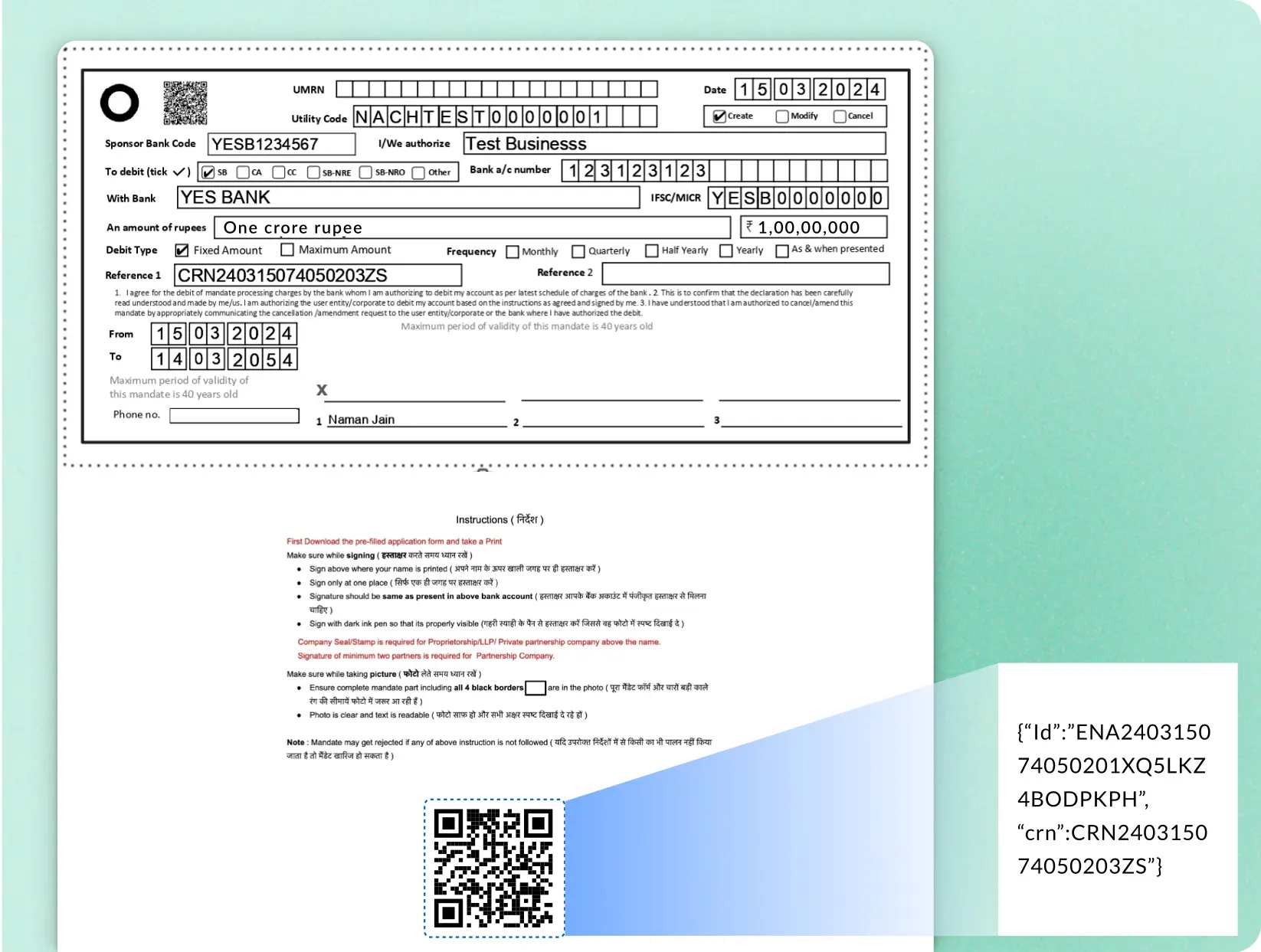

Physical Mandates

Setup high value recurring mandates in an assisted/non-assisted journey for joint account holders

Pre-filled NACH forms with a powerful OCR engine for signature and error detection

Partner app to generate and authenticate mandates

Upper limit of ₹1 crore for a debit transaction

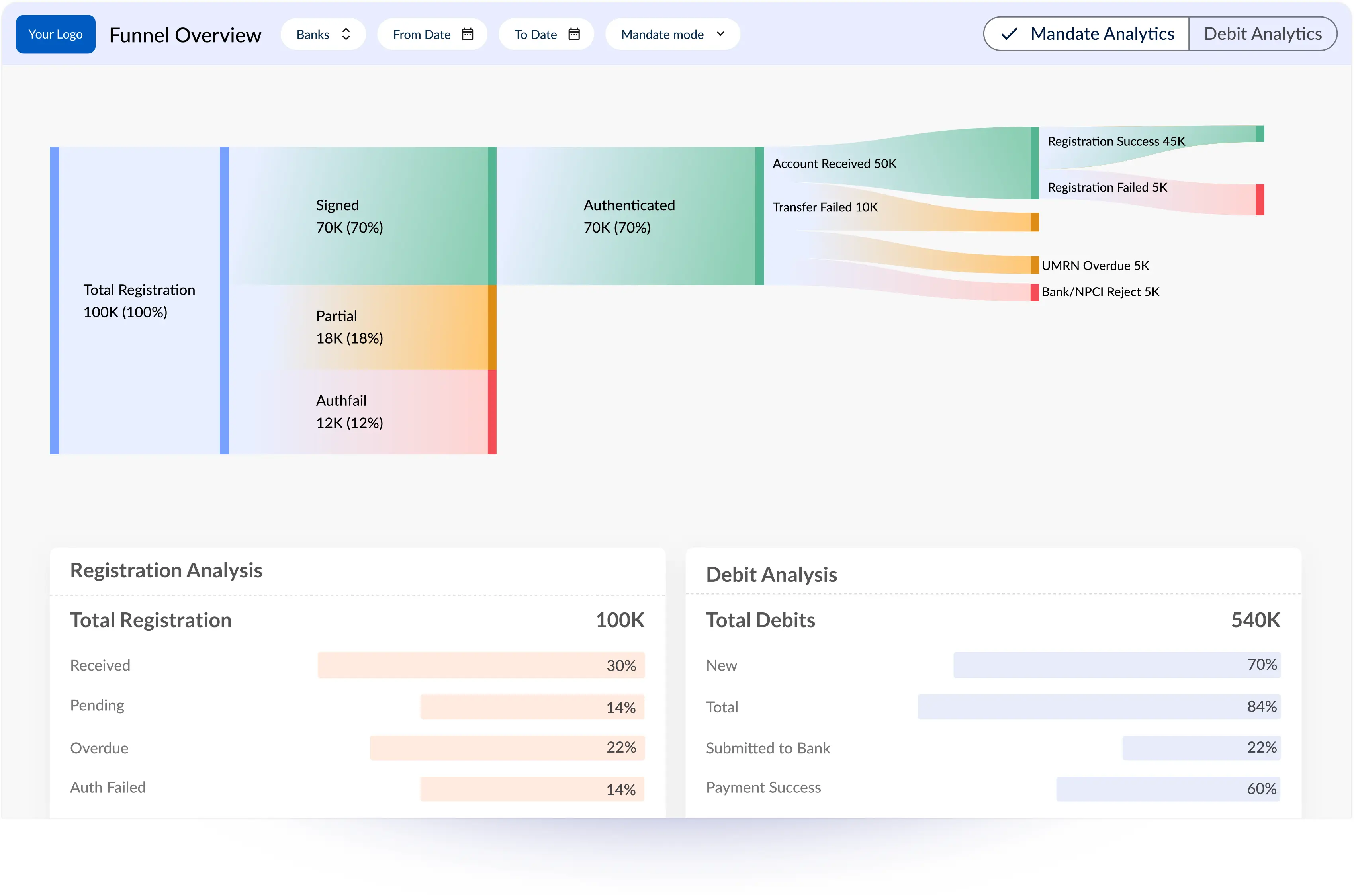

Automate reconciliations, enhance collections

Payments processed $ 5.6 Billion and $ 2.2 Billion, Total vs Aggregator in CY - 2023

23X YoY

CY 2023 vs 2022

Payments processed by value

28X YoY

CY 2023 vs 2022

Payments processed by value on Aggregator

472,000 Crore

Payments processed by value, CY 2023

186,000 Crore

Payments processed by value on Aggregator, CY 2023

Explore Digio’s Other Solutions

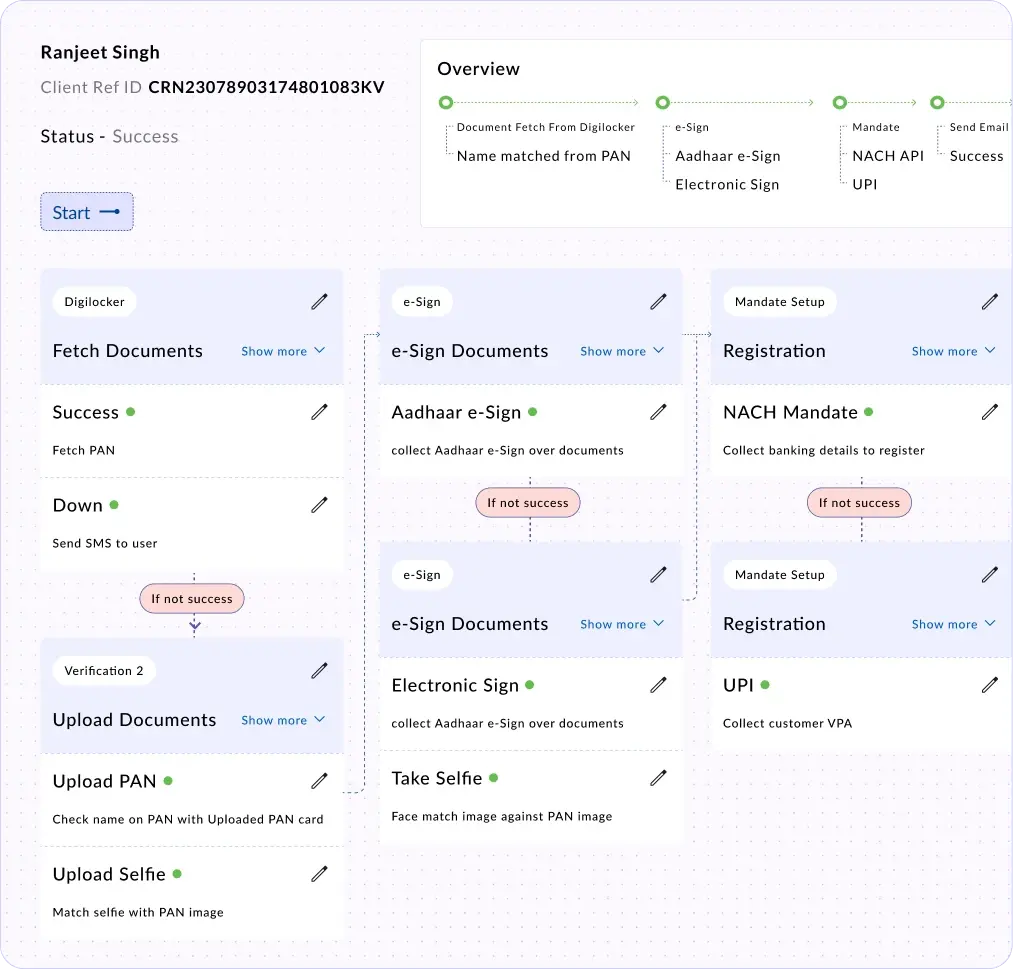

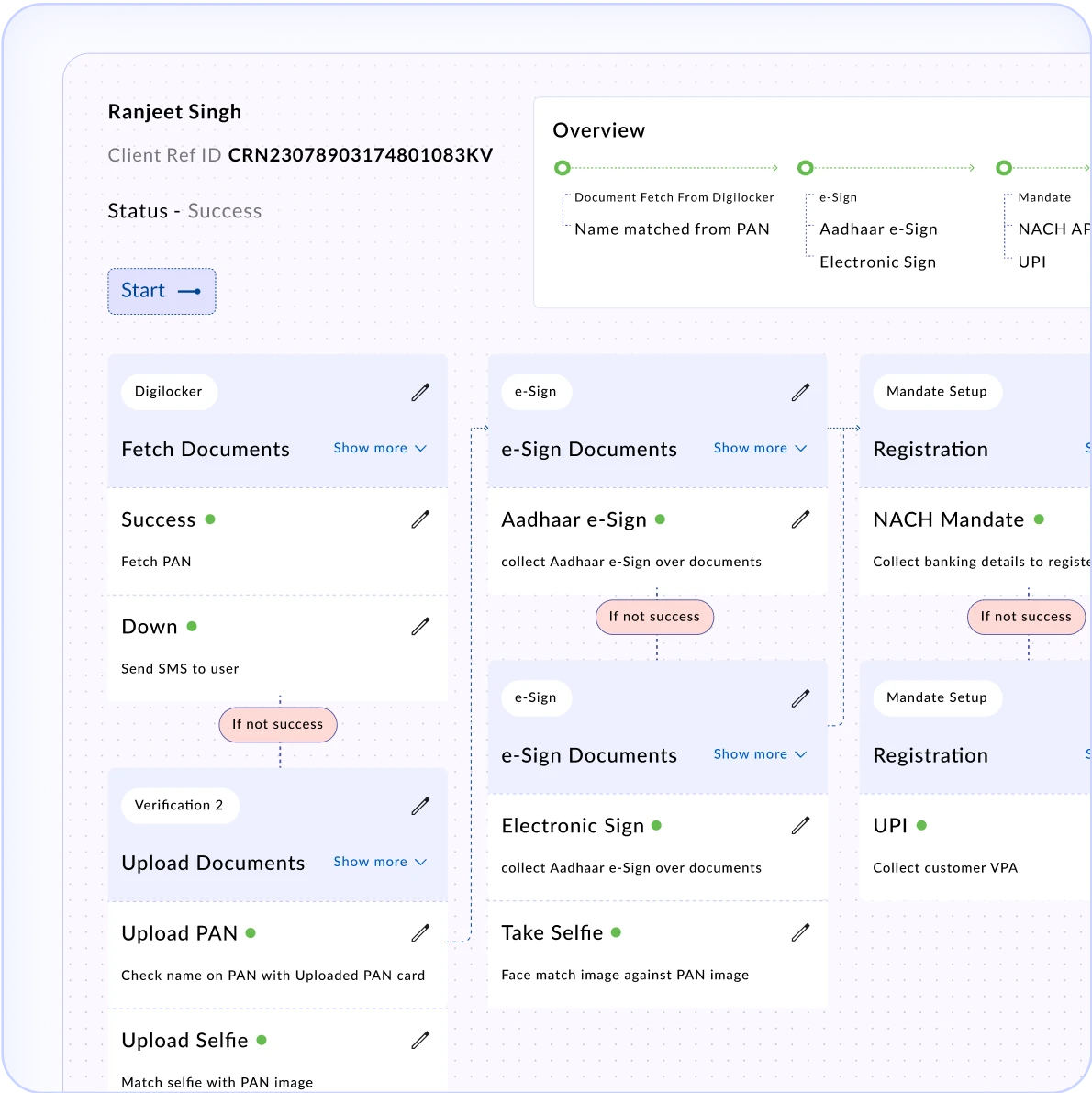

DigiStudio

Business Workflow builder for end-to-end onboarding

Drag & Drop reconfigurability with auto-approval mechanisms

Onboarding journey traceability and analytics

Configurable business validations to ensure full compliance

Drag & Drop reconfigurability with auto-approval mechanisms

Onboarding journey traceability and analytics

Configurable business validations to ensure full compliance

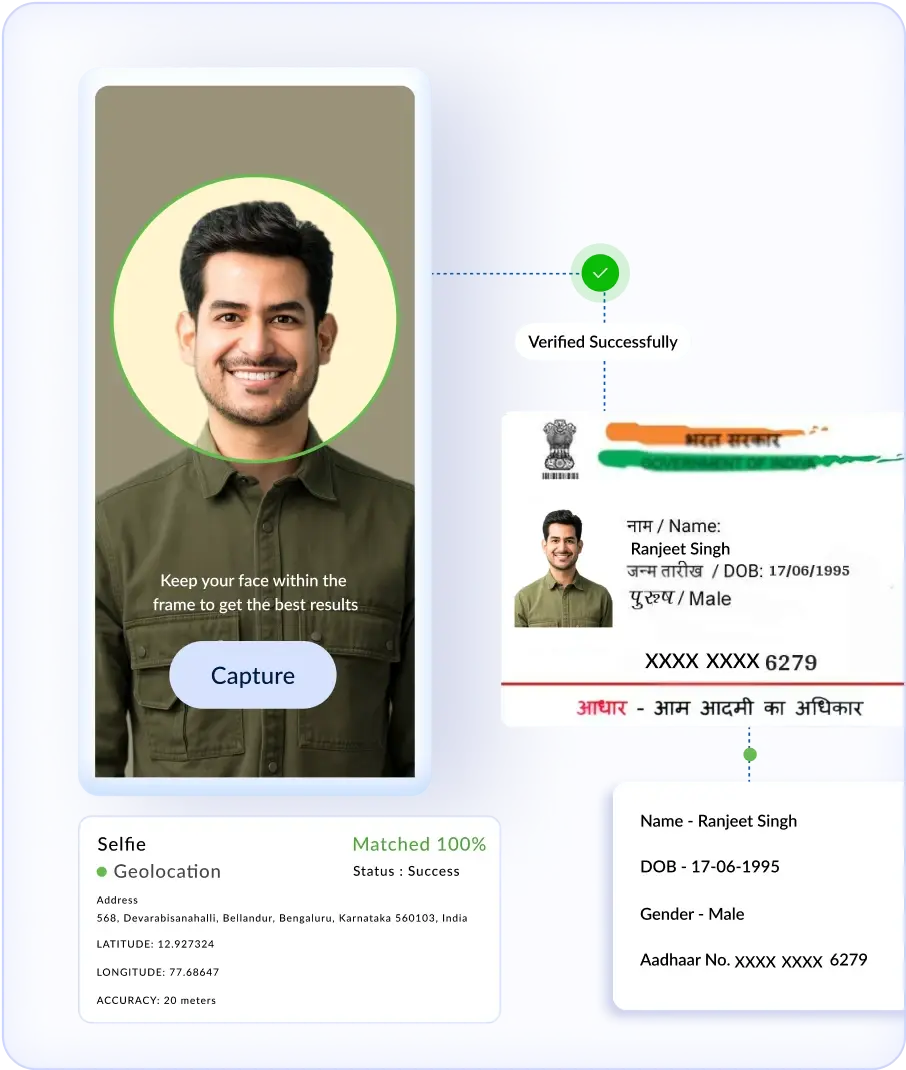

DigiKYC

Comprehensive Identity and Business Verification with Enhanced Due Diligence

Digilocker Integration

ID OCR Analysis

Selfie Verification

Geolocation and VPN check

Video KYC

CKYC/KRA Submission and Fetch

Fuzzy Match

Bank Account Verification

PAN Verification

Aadhaar Masking

Aadhaar Offline KYC

Aadhaar-Based AUA/KUA Authentication

Digilocker Integration

ID OCR Analysis

Selfie Verification

Geolocation and VPN check

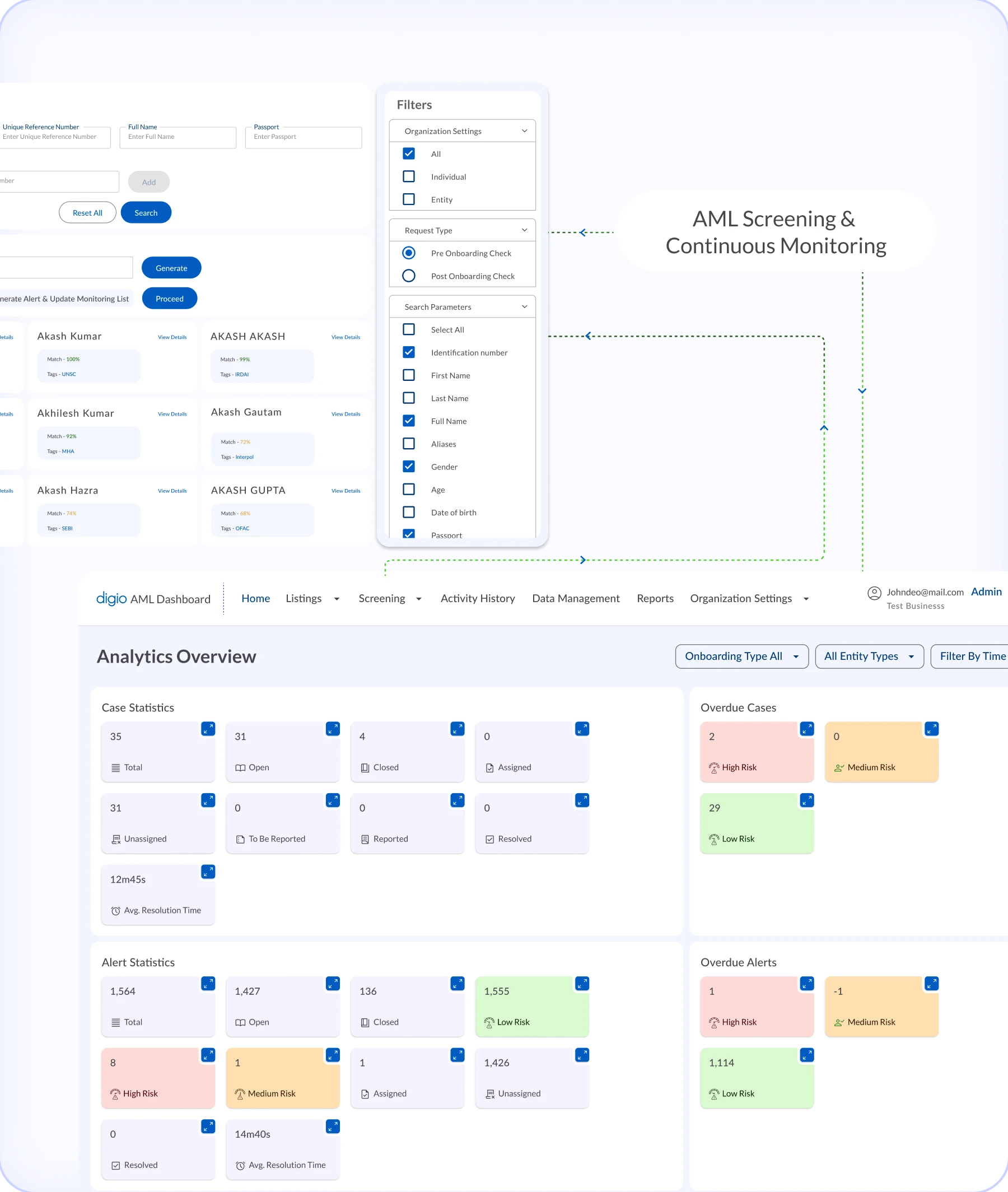

DigiShield

Intelligent screening and real-time monitoring ensure secure onboarding and compliance with regulatory standards, preventing inclusion on sanctions or embargo lists.

Robust Screening Engine

Enables Compliance Efficiency

Drilled-down Insights

Powerful Rule Orchestration

Private List Support

Test Bed

STR Filing

Robust Screening Engine

Enables Compliance Efficiency

Drilled-down Insights

Powerful Rule Orchestration

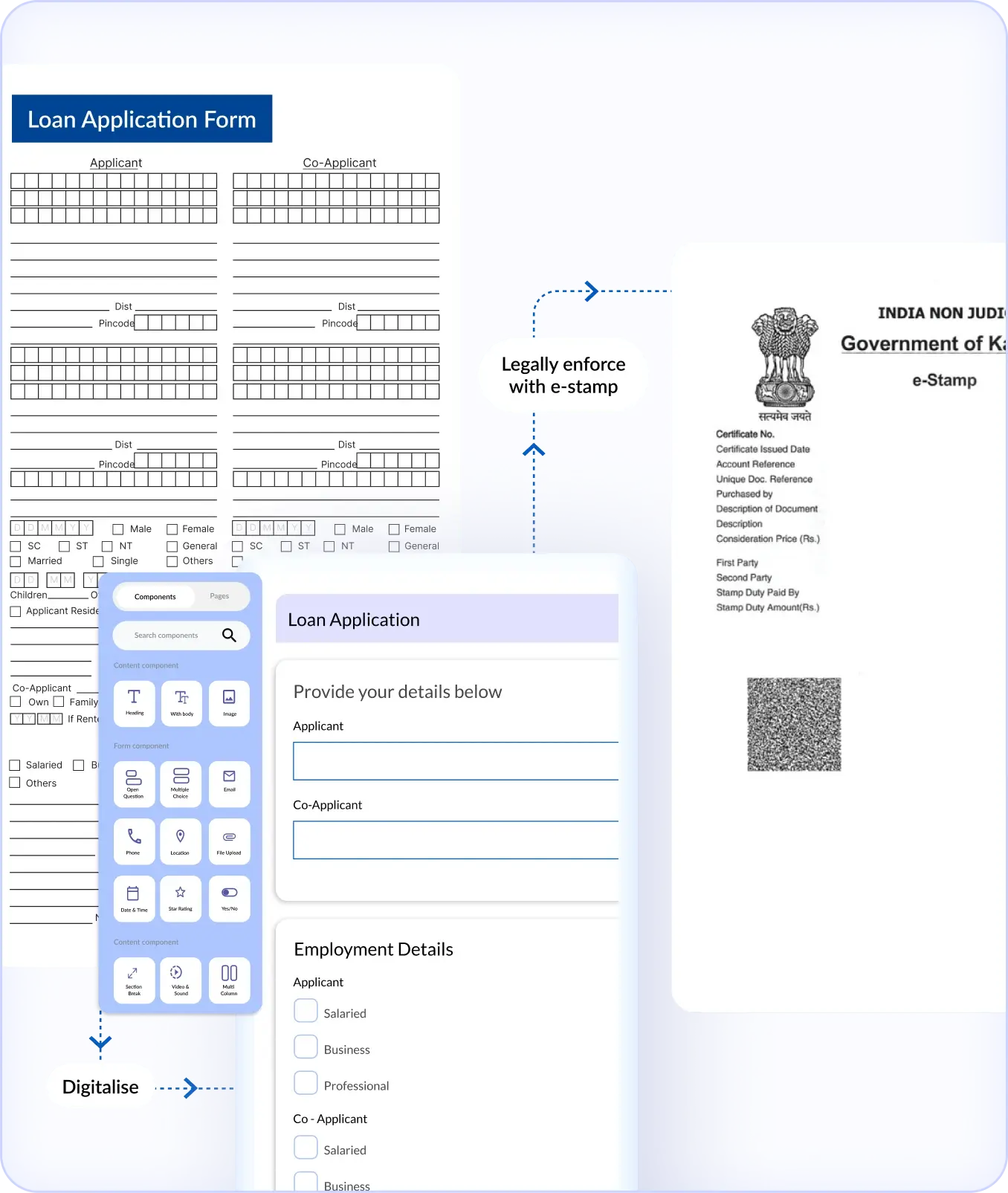

DigiDocs

All-Inclusive Platform for all your Document Creation and Management Needs

Document Template Creation

Secured Document Repository

Document Version Control

Form Builder with Drag & Drop UI, Field Validations, and Conditional Logic

Folder management of executed documents

Filters and tags for efficient document retrieval

E-stamp - Single platform with pan India multi denomination support

Document Template Creation

Secured Document Repository

Document Version Control

Form Builder with Drag & Drop UI, Field Validations, and Conditional Logic

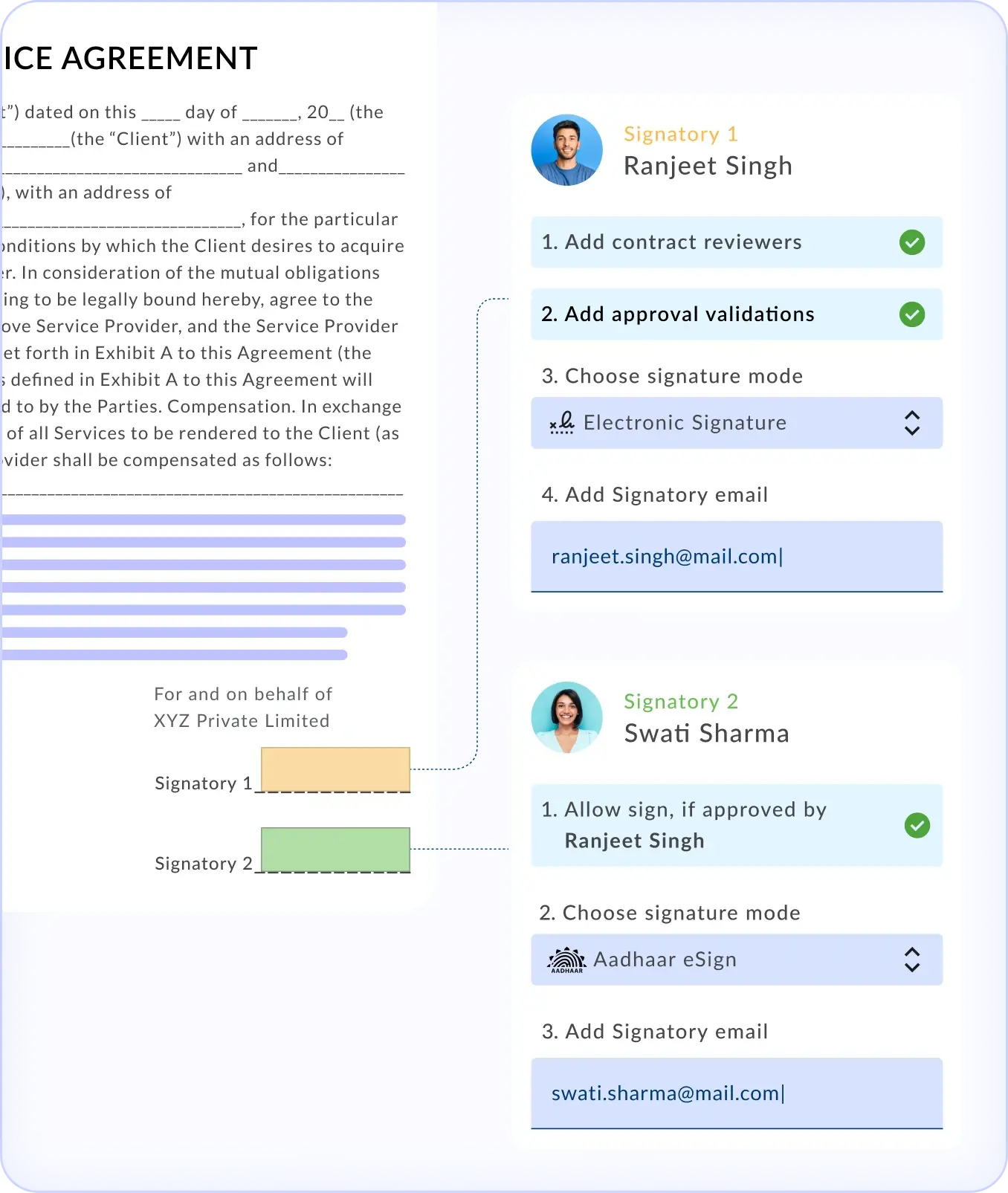

DigiSign

The Most Trusted Signing Solution in India, enabling you with highest configurability for digital signing

Aadhaar eSign

USB Based Digital Signer Certificate

Document Signer Certificate

Electronic Signatures

KYC Backed Signing

Aadhaar eSign

USB Based Digital Signer Certificate

Document Signer Certificate

Electronic Signatures

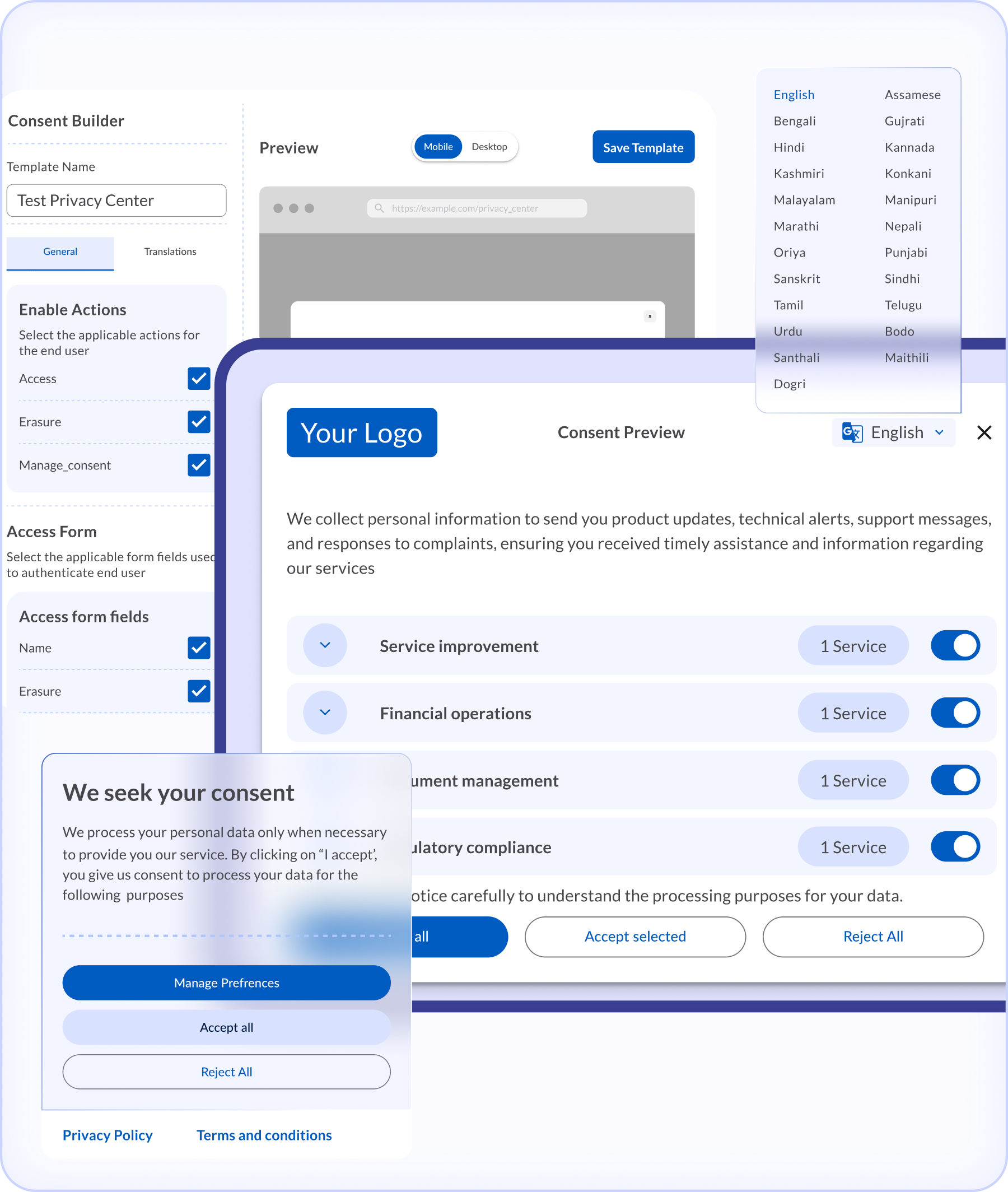

CoTrust

Effectively discover, classify your customer data and collect and manage their consent across all touchpoints - with an integrated solution.

Effectively Discover and Classify PII data across Data sources

Generate Purpose backed Consent Templates for your Website and Apps

Service Data Subject Requests from a customisable Privacy Centre

Design Custom Workflows to automate Privacy Requests

Get a bird's eye view Request fulfilment SLAs through a single Dashboard

Effectively Discover and Classify PII data across Data sources

Generate Purpose backed Consent Templates for your Website and Apps

Service Data Subject Requests from a customisable Privacy Centre

Design Custom Workflows to automate Privacy Requests

Digitally transform business operations with Digio!

Try first. Subscribe later.

Boost your legal ops efficiency by 80%

Learn how Digio can enhance your business productivity

Get 1-on-1 business use case solutioning

Speak with our business consultants to get a solution walkthrough for your business requirement

Test the APIs

Let your development team test our API suite to understand configurability and product integration

Subscribe

Get the best in industry commercials for your business usecase

FAQ

02

What is an E-Mandate?

03

What is a utility code?

04

What is the benefit of digitizing the mandate process?

05

Can I edit an eMandate?

06

Can a mandate be signed using Aadhaar?

07

Will the amount in my mandate form be the amount debited every month?

08

How does DigiCollect shorten the physical mandate registration process?

09

How does DigiCollect simplify the e-Mandate registration process?

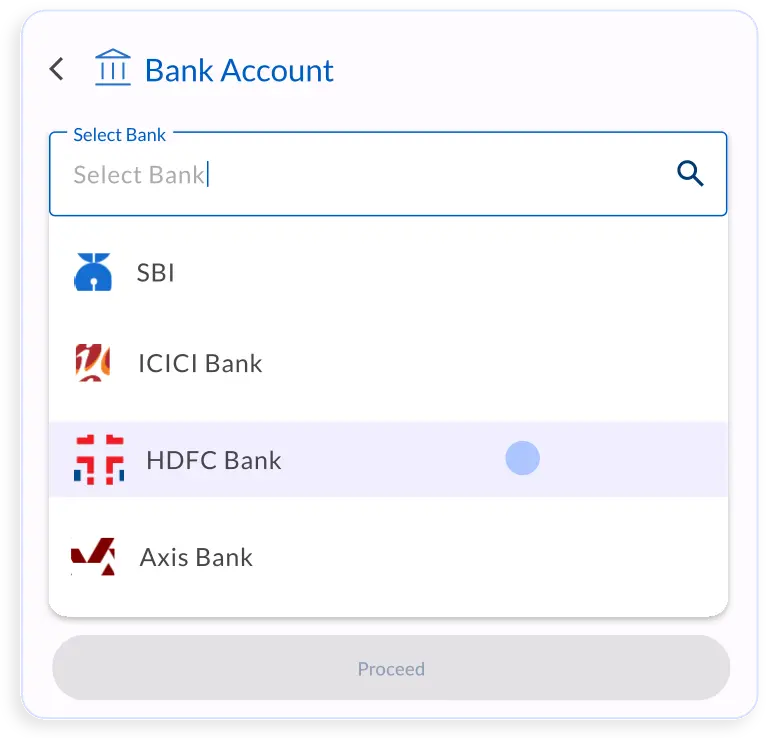

- The Digio widget opens as a native/overlay on the corporate’s web/mobile application with mandate values passed in the API.

- The user can then authenticate the mandate via Net Banking or Debit Card. Once successfully authenticated, NPCI returns a confirmation, which is, in turn, returned by Digio to the corporate’s application.

Lead time = 0, TAT reduces from T+2 days to T+1 days Full visibility on Dashboard with timestamps (no more blackbox situation that was the case with full physical mandates). Detailed MIS and Dashboard for both Mandate Registration and Debit status. Secured with two-factor authentication.

10

How can an individual authenticate an API-based/e-mandate?