Screen Customers & Continuously Monitor their Engagement with

DigiShield

Ensure compliance and prevent frauds with robust customer screening against global sanctions, criminal records and custom negative lists. Monitor every customer interaction with an intelligent trade surveillance & transaction monitoring engine

Why DigiShield ? Commonly Observed Challenges

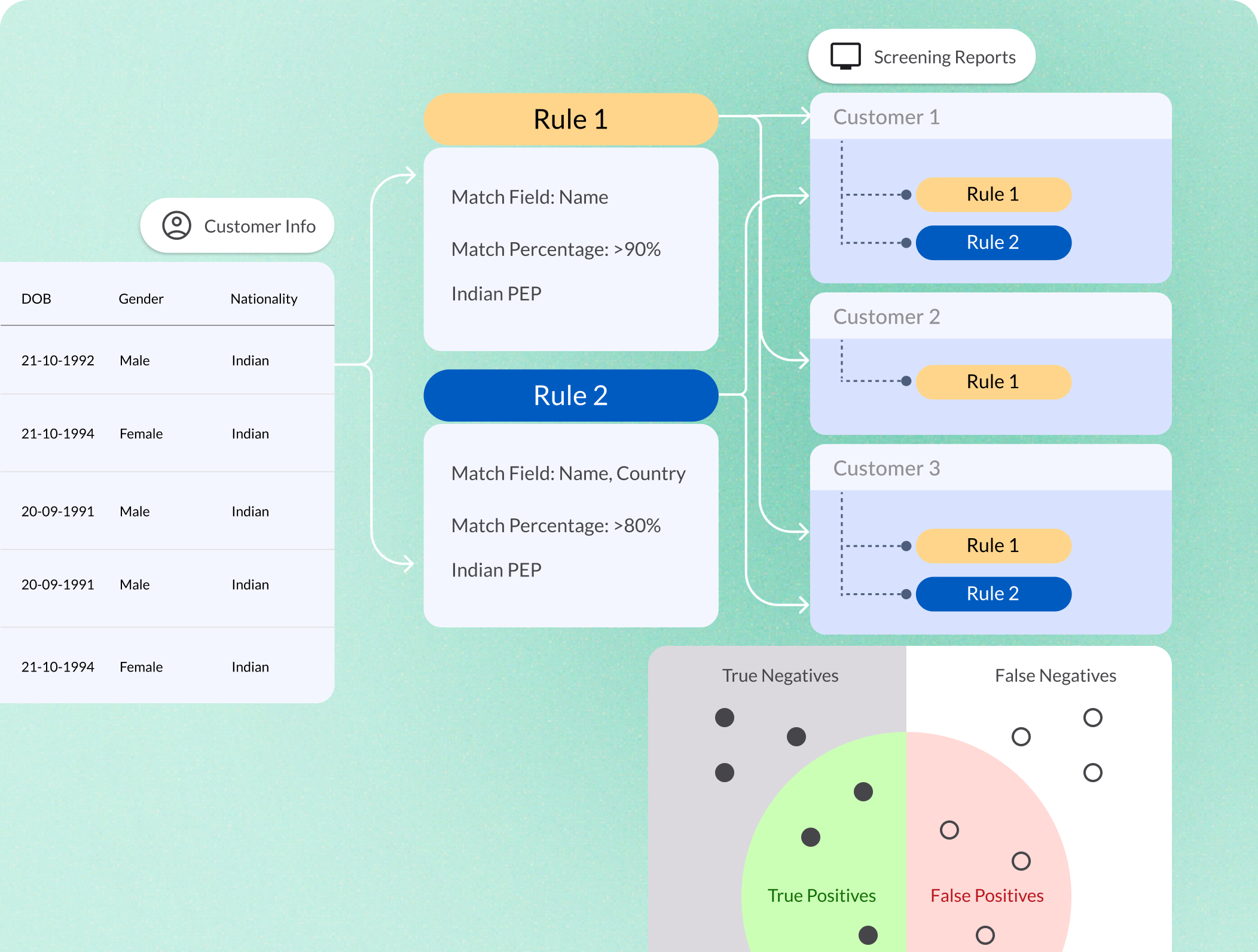

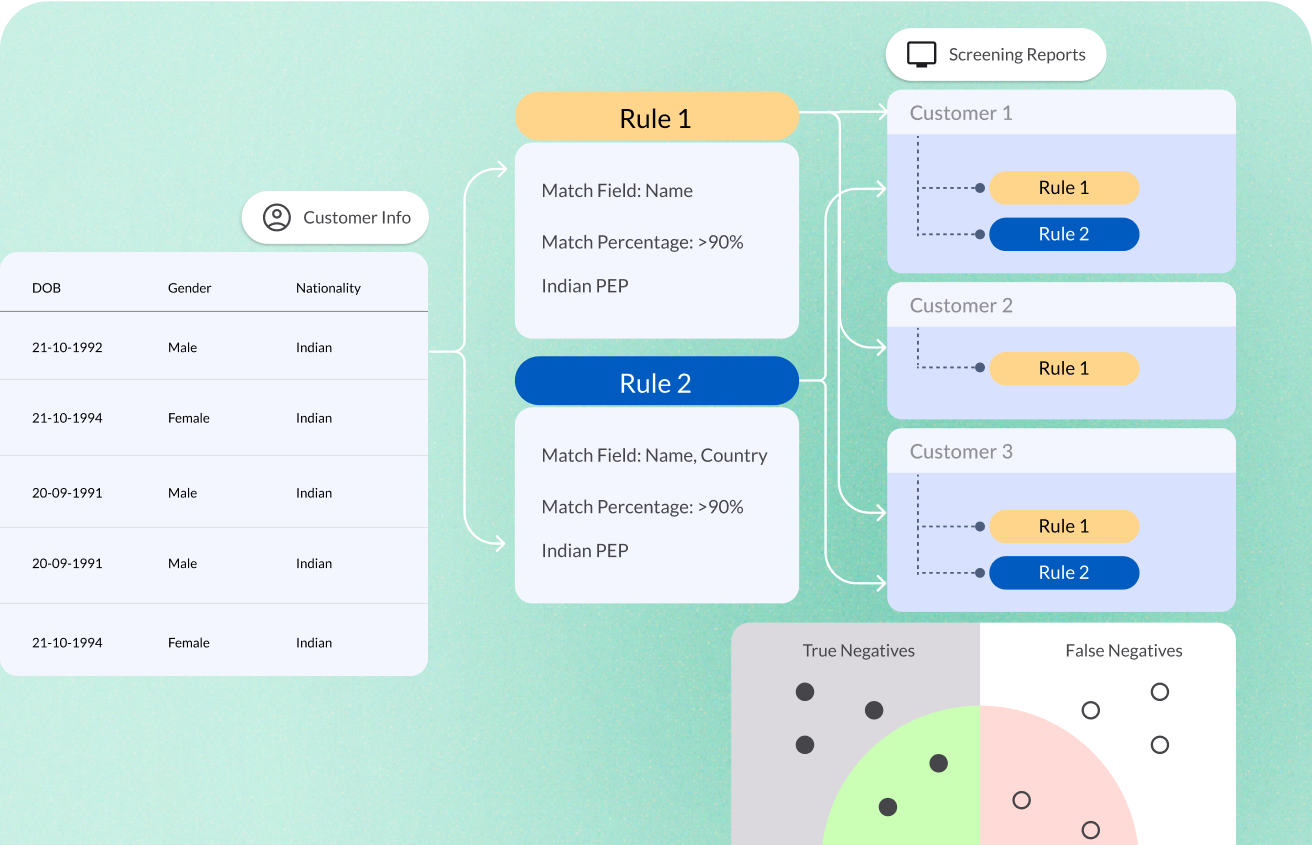

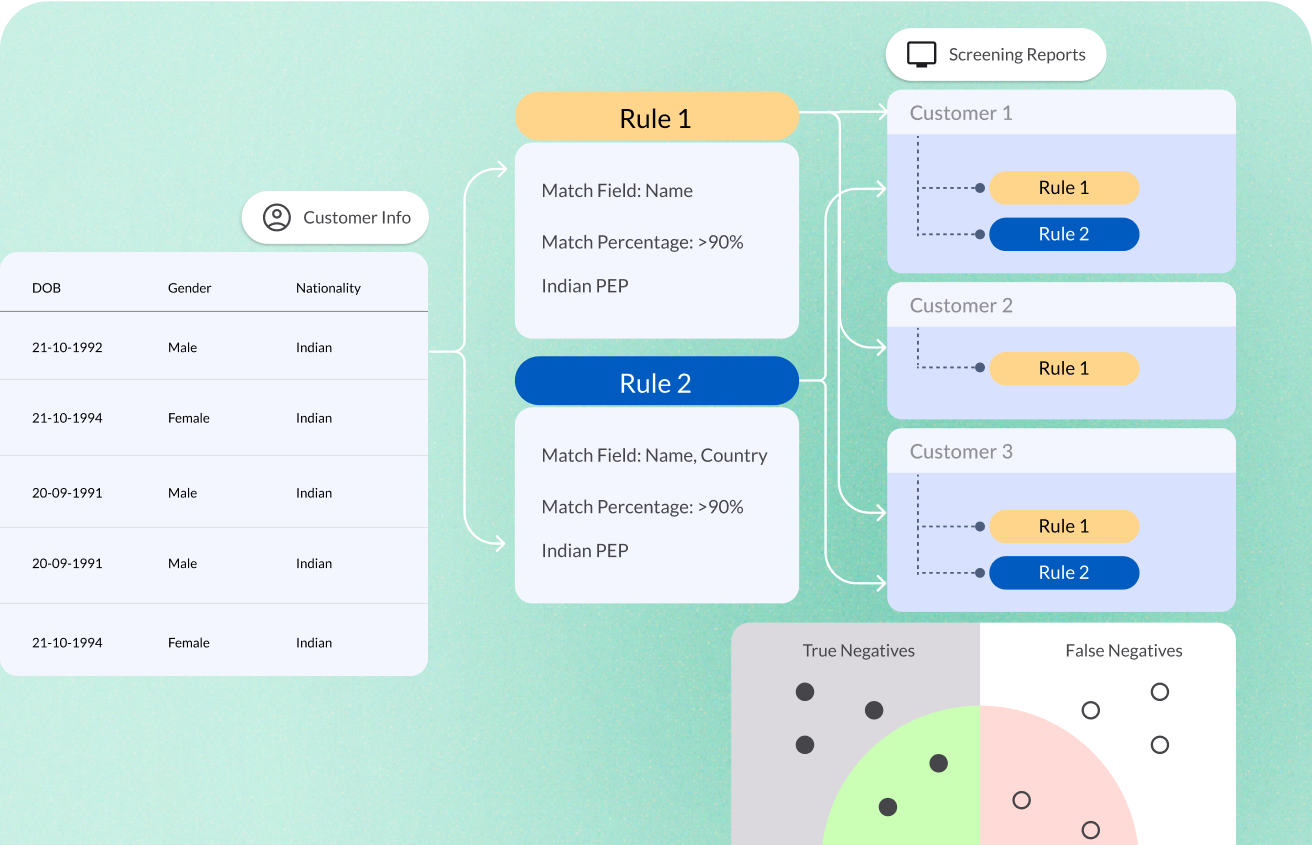

Control False Positives

Most AML solutions today generate >95% false positives, compromising the productivity of compliance teams.

How DigiShield Helps :

DigiShield's advanced architecture and algorithms help manage and control false positives, while transparent alert logic ensures teams focus on genuine risks.

Optimized Performance

Most AML solutions today offer high fuzzy match processing times (200-400ms per match) cause bottlenecks, operational delays, and backlogs.

How DigiShield Helps :

DigiShield screens most customers within ~50 milliseconds, allowing you to securely onboard more customers at high throughput.

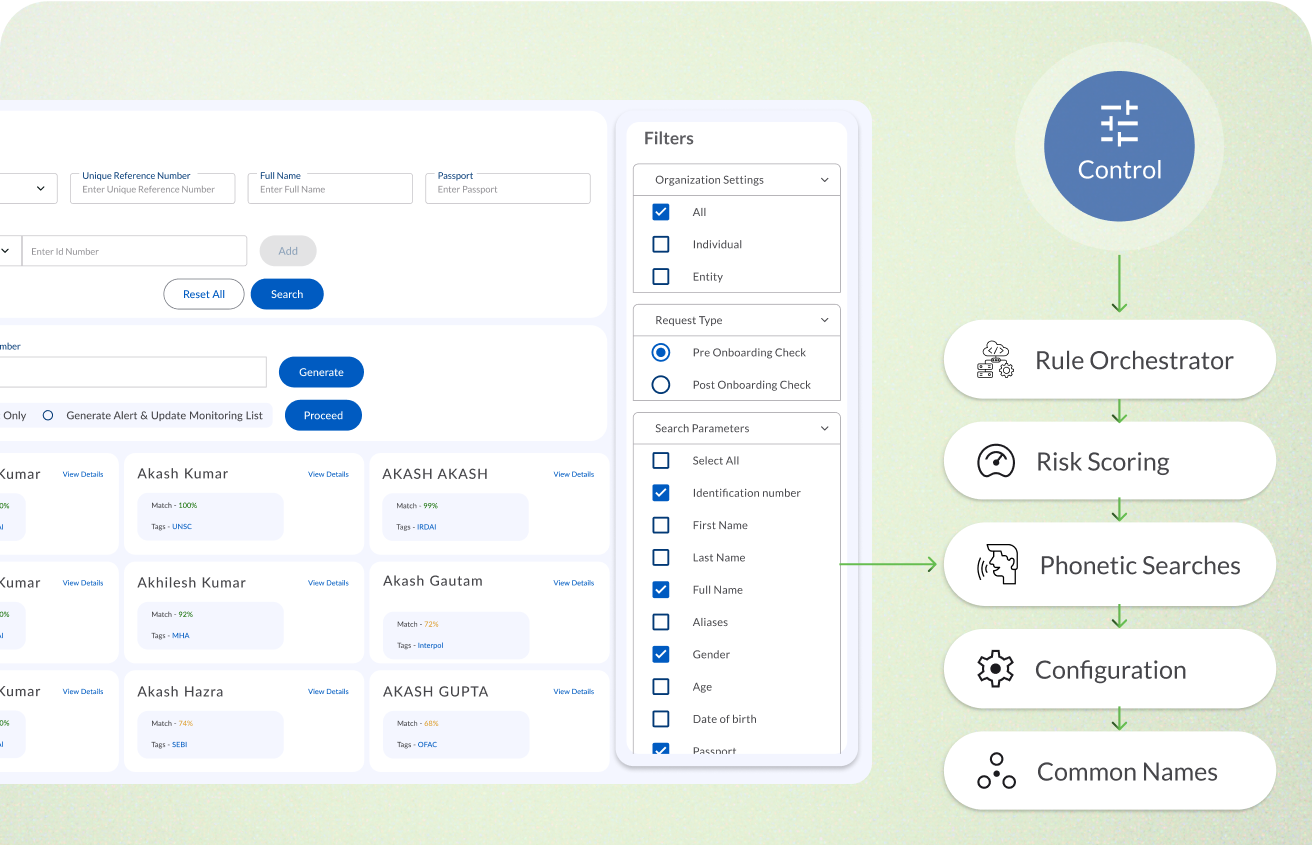

Custom Rule Development

Risk policies are internal to every entity, often requiring technical intervention to modify or test.

How DigiShield Helps :

Rule Orchestrator makes it easy to configure customer rules, along with regulatory compliance rules for your business.

Create and deploy your custom rules and back test against your customer records without any technical expertise.

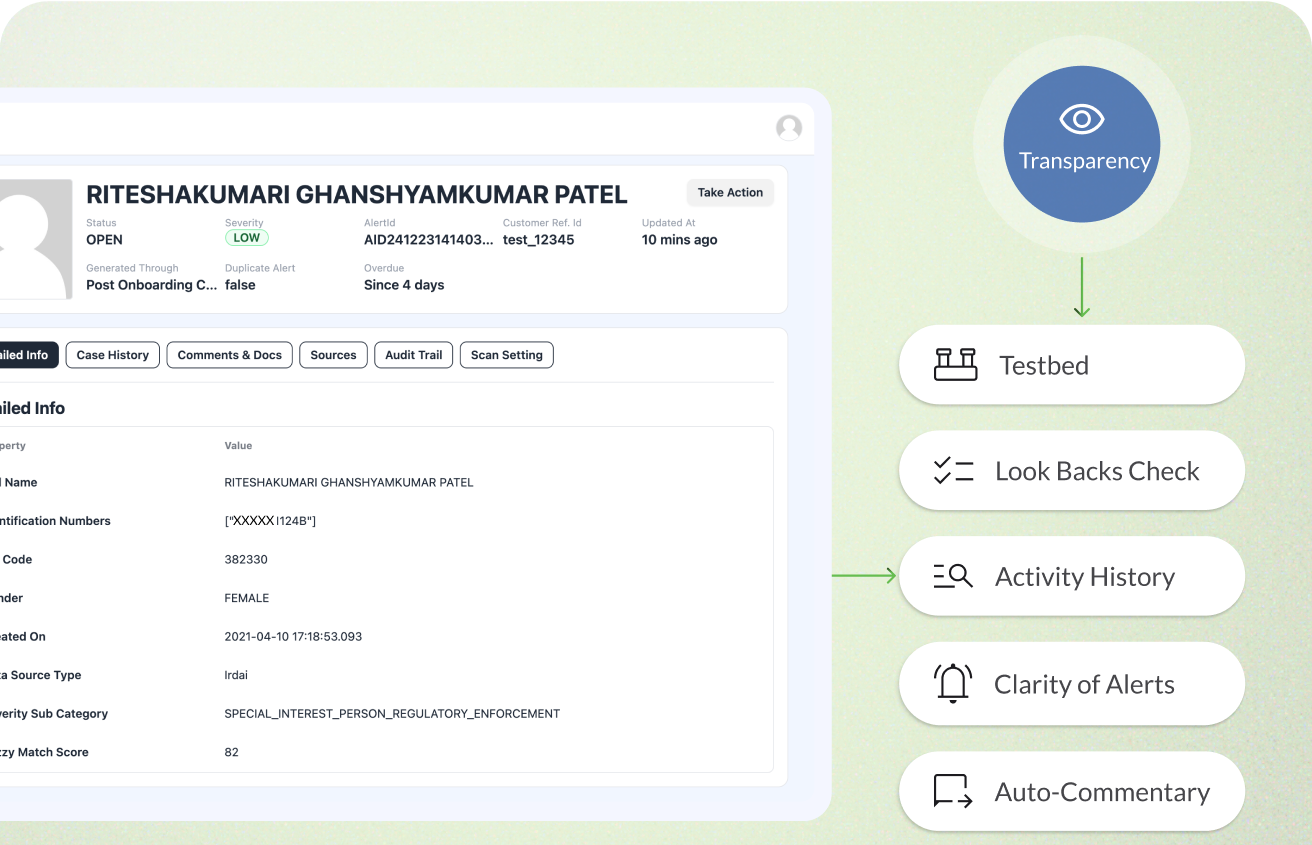

Enhanced Transparency

Unclear alerts slow down investigations. Compliance teams waste time deciphering why alerts are triggered.

How DigiShield Helps :

Detailed audit logs and alert RCA provide actionable insights on potential risks.

Group level risk visibility to ensure Compliance and Risk leaders are always vigilant.

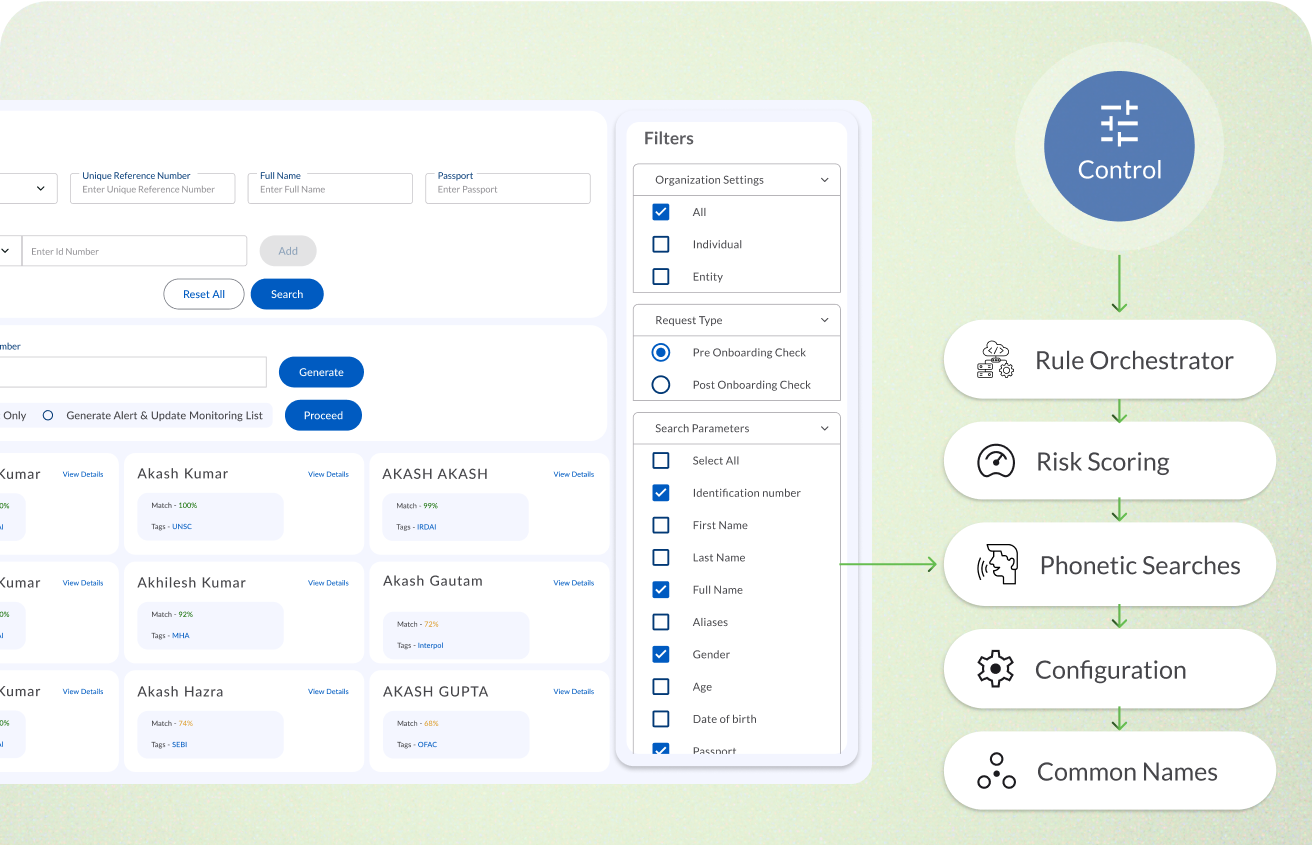

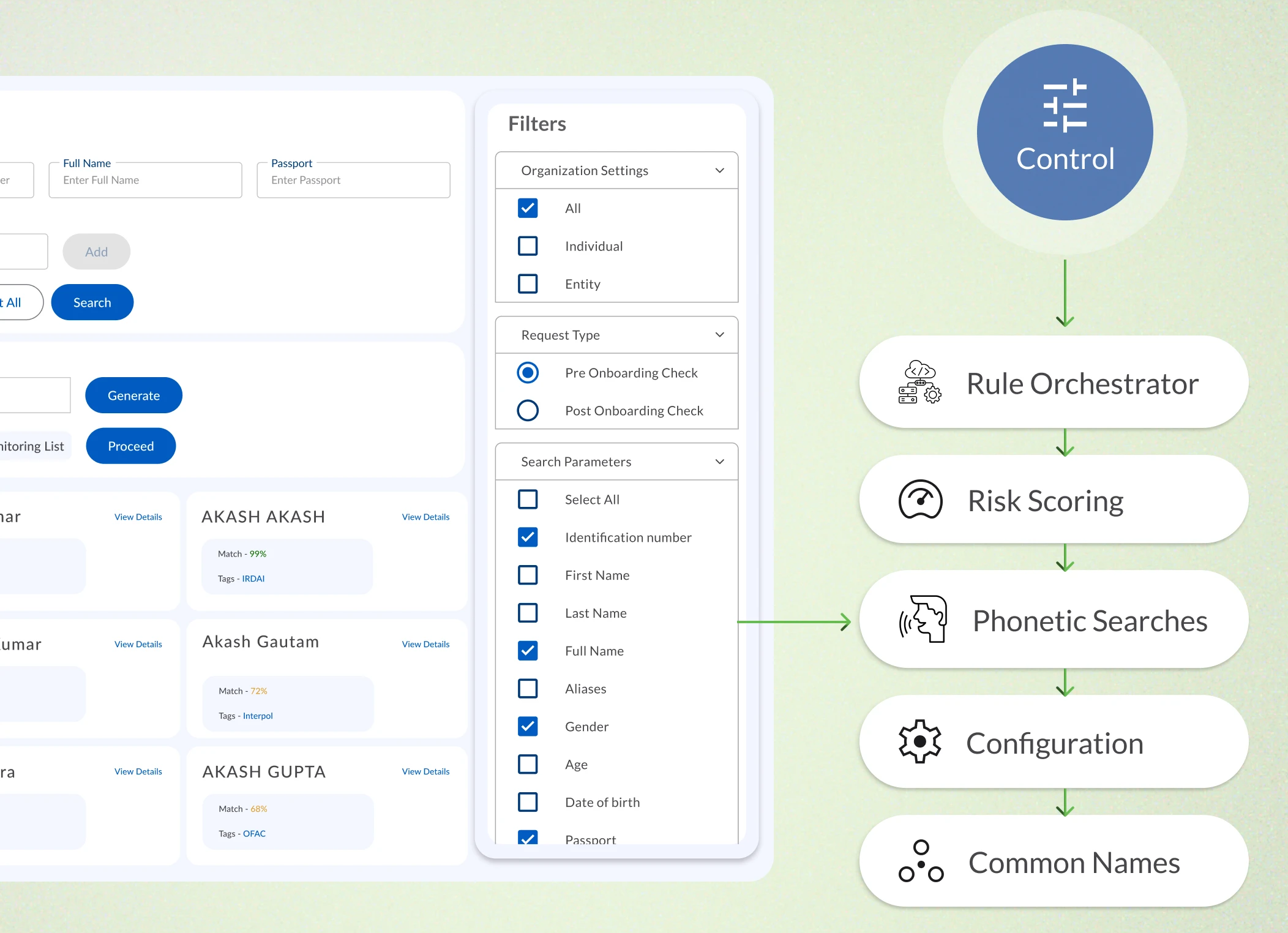

How DigiShield empowers your risk policy?

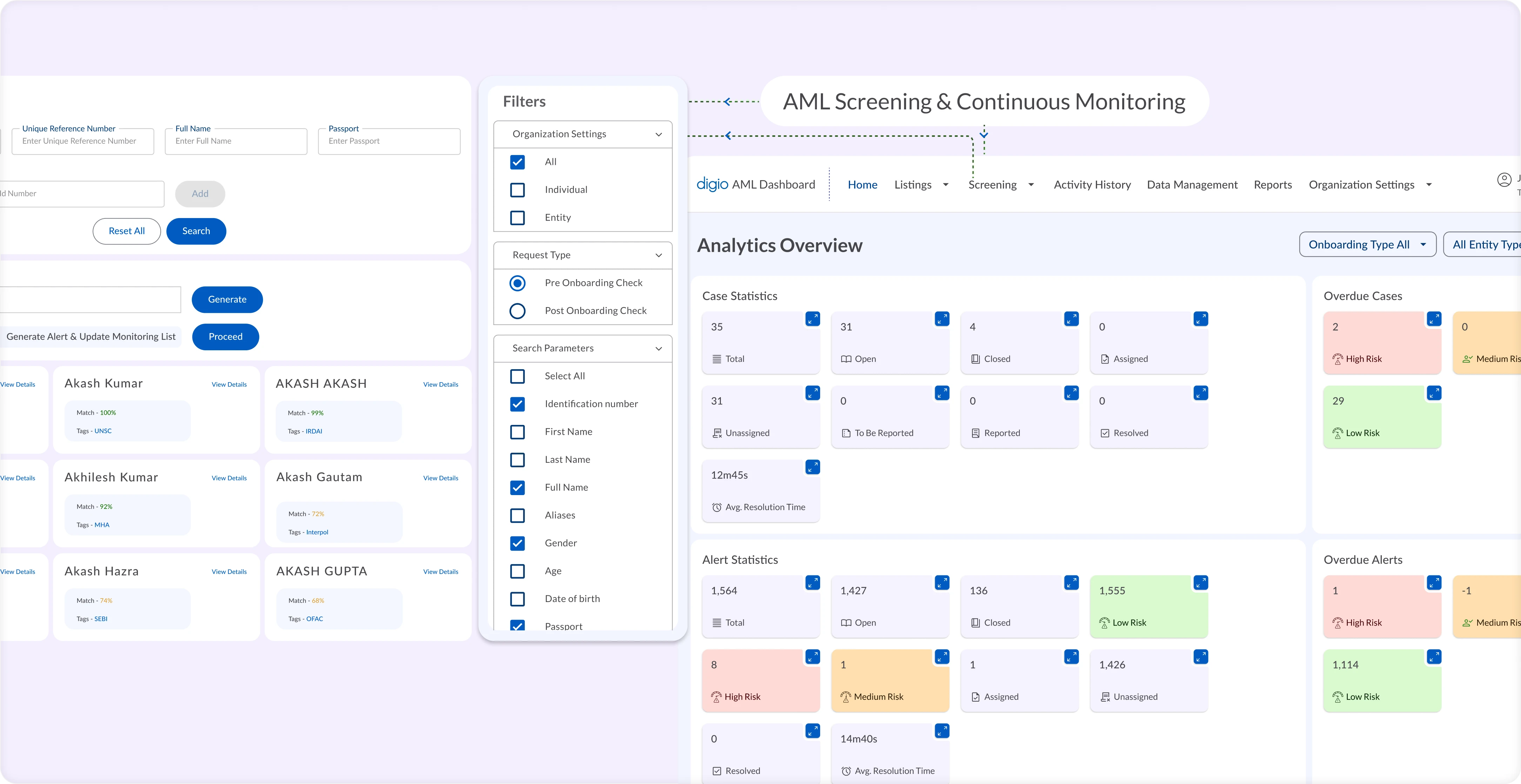

Robust Screening Engine

Gain

complete

control

of your customer due diligence

Manage your custom rules, combine simple functions with complex pattern matching.

Risk scoring using simple aggregation, weighted average, or custom formulas.

Get precise matches even for misspelt and similar sounding names.

Configurable customer screening and monitoring in a single solution.

Address naming challenges like common Indian & Arabic names and their aliases with AI-powered contextual insights.

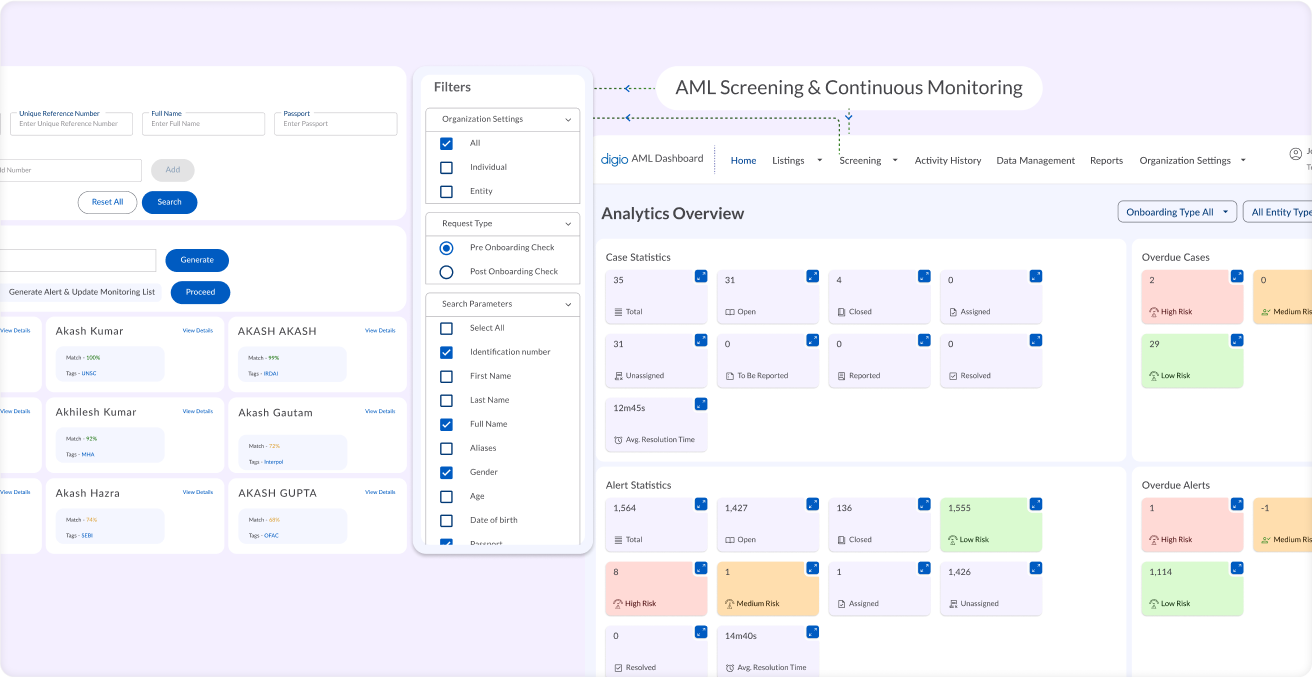

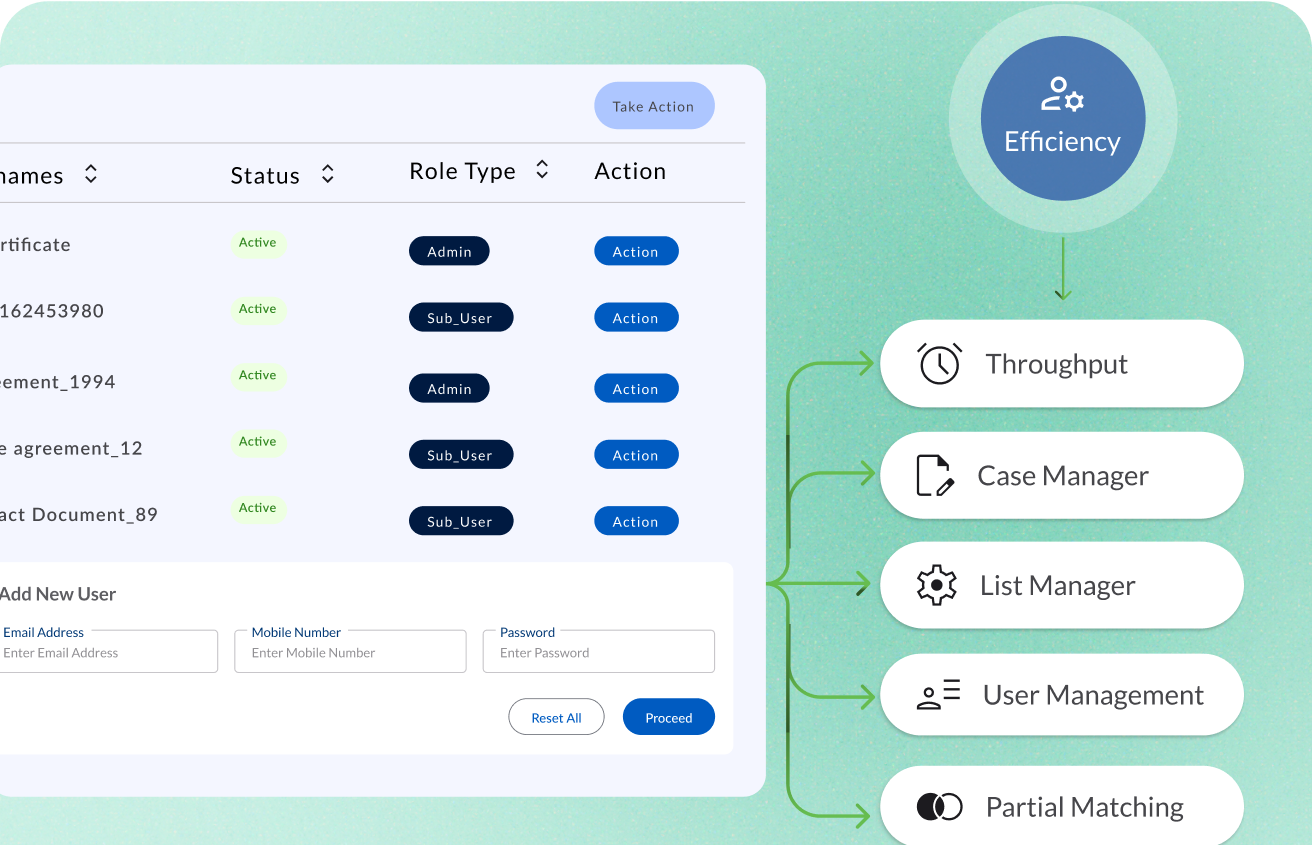

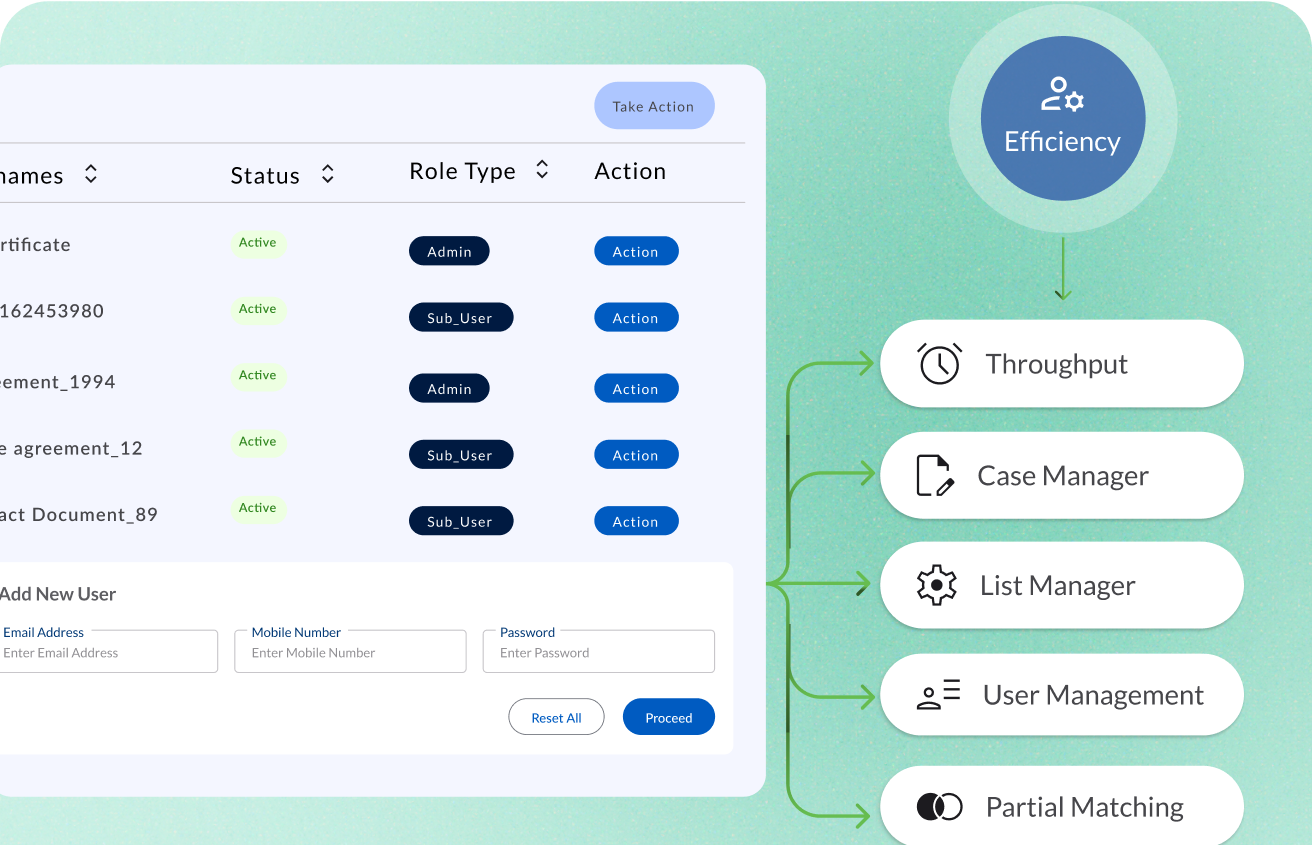

High Compliance Efficiency

Fast, high-throughput, high-volume processing with accuracy.

Fast, high-volume processing with accuracy.

Create structured workflows with maker-checker processes.

Simplify team collaboration with defined roles and access controls.

Manage public and private watchlists seamlessly and effectively.

Address data inconsistencies with flexible matching.

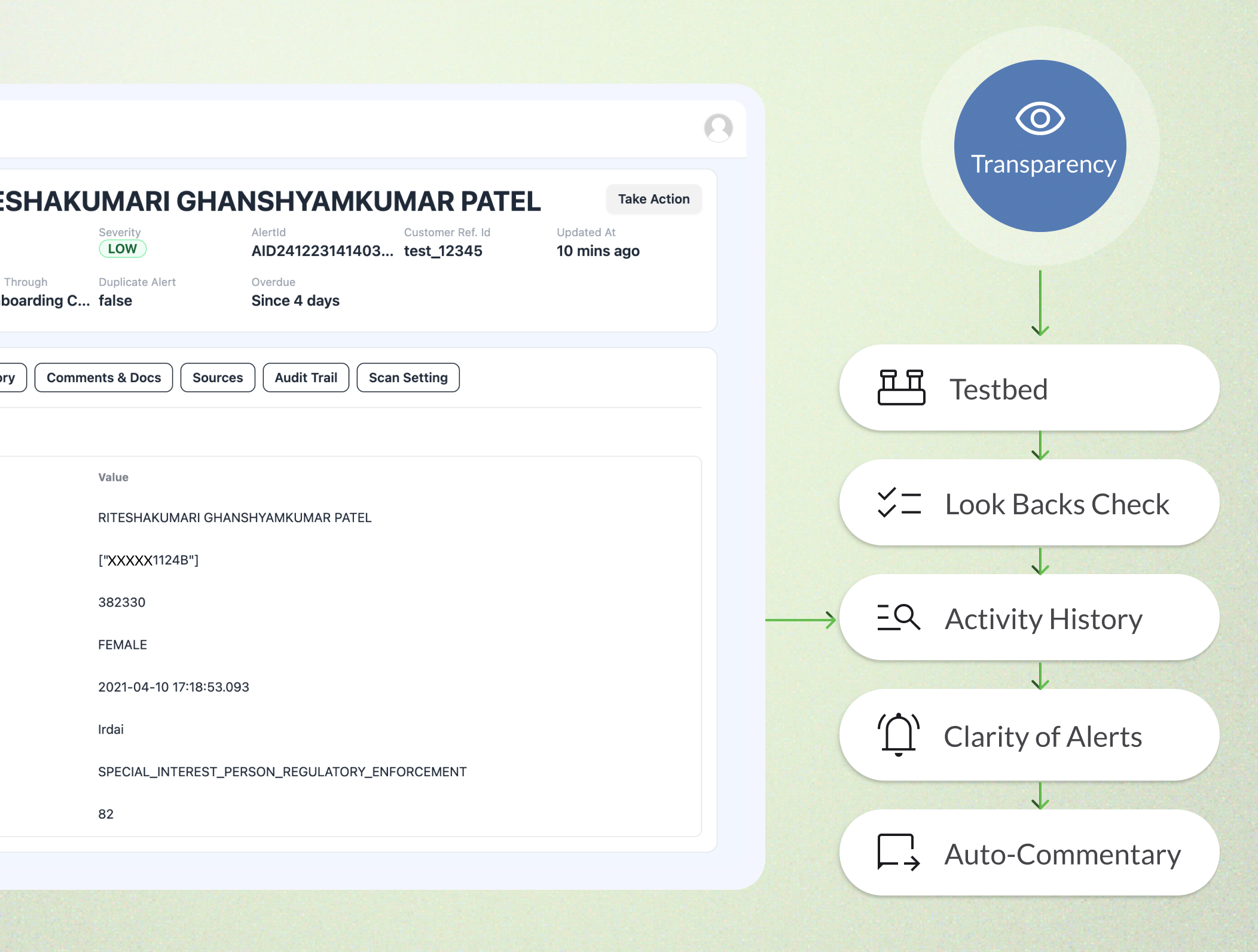

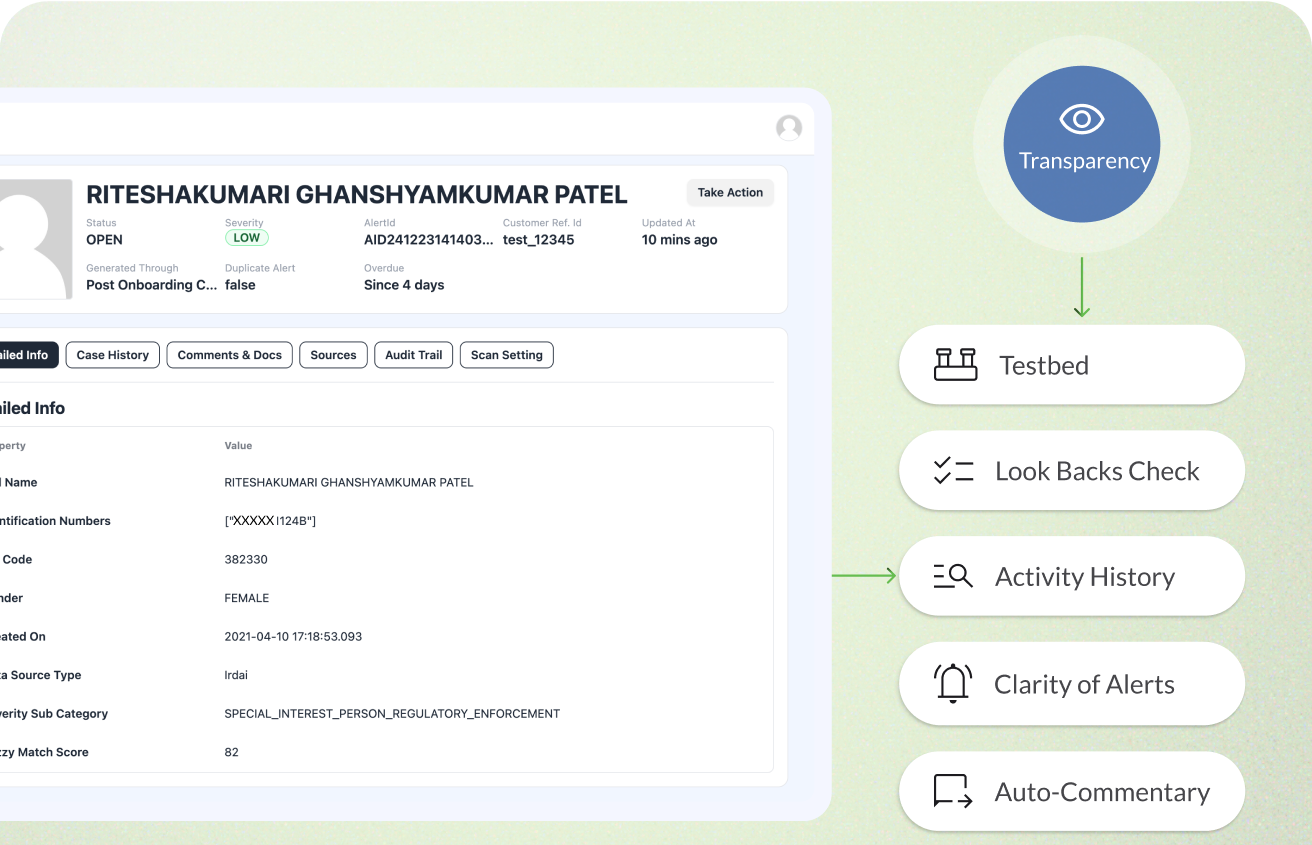

Drilled-down Insights

Enhanced decision-making and transparency into compliance processes.

Simulate configurations and rules to ensure accuracy.

Replicate past scenarios to assess rule changes' impact.

Maintain detailed audit trails for all actions and decisions.

Understand alert rationale with detailed explanations.

Provide your agents with pre-built agent comments for faster turn-around on cases.

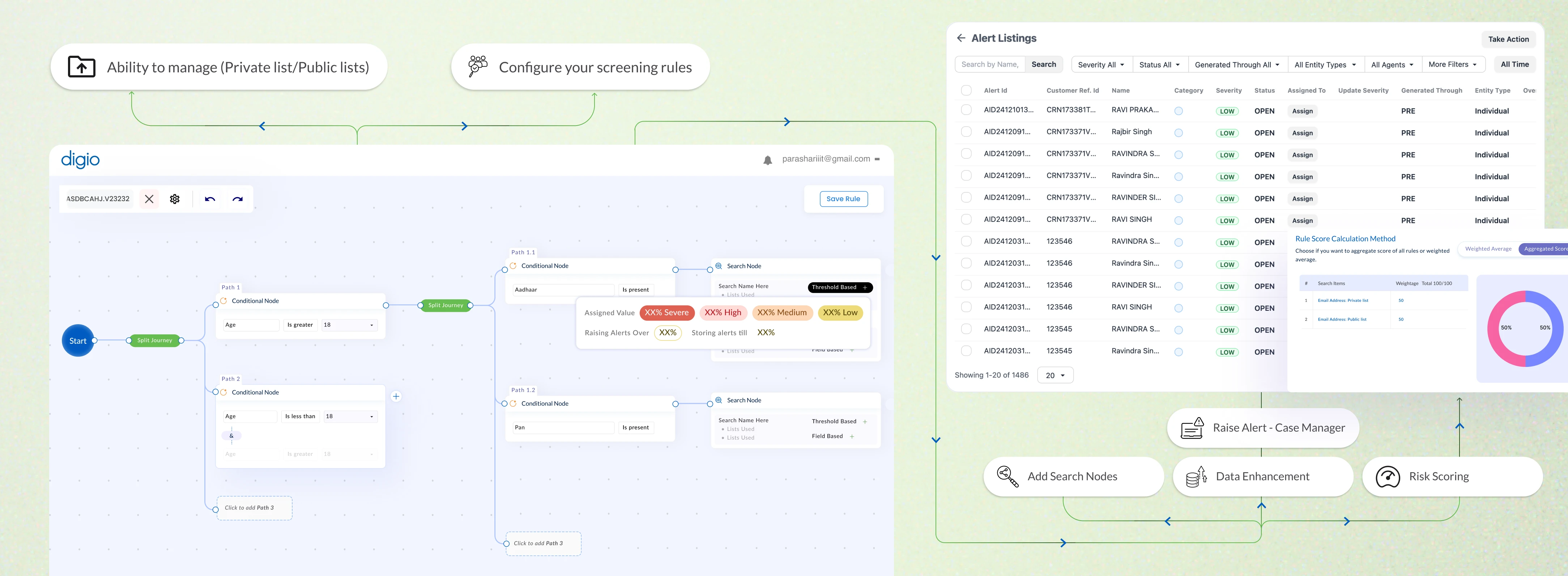

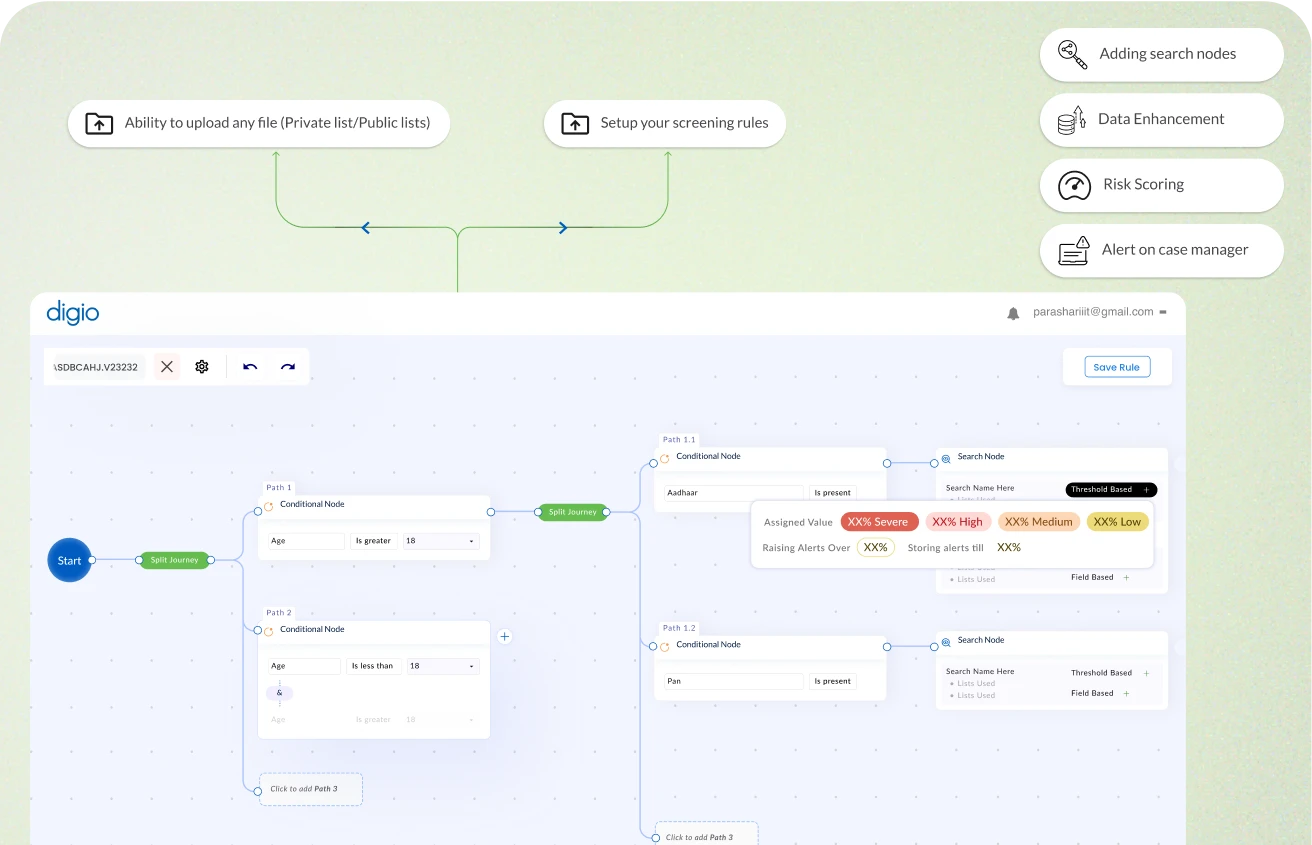

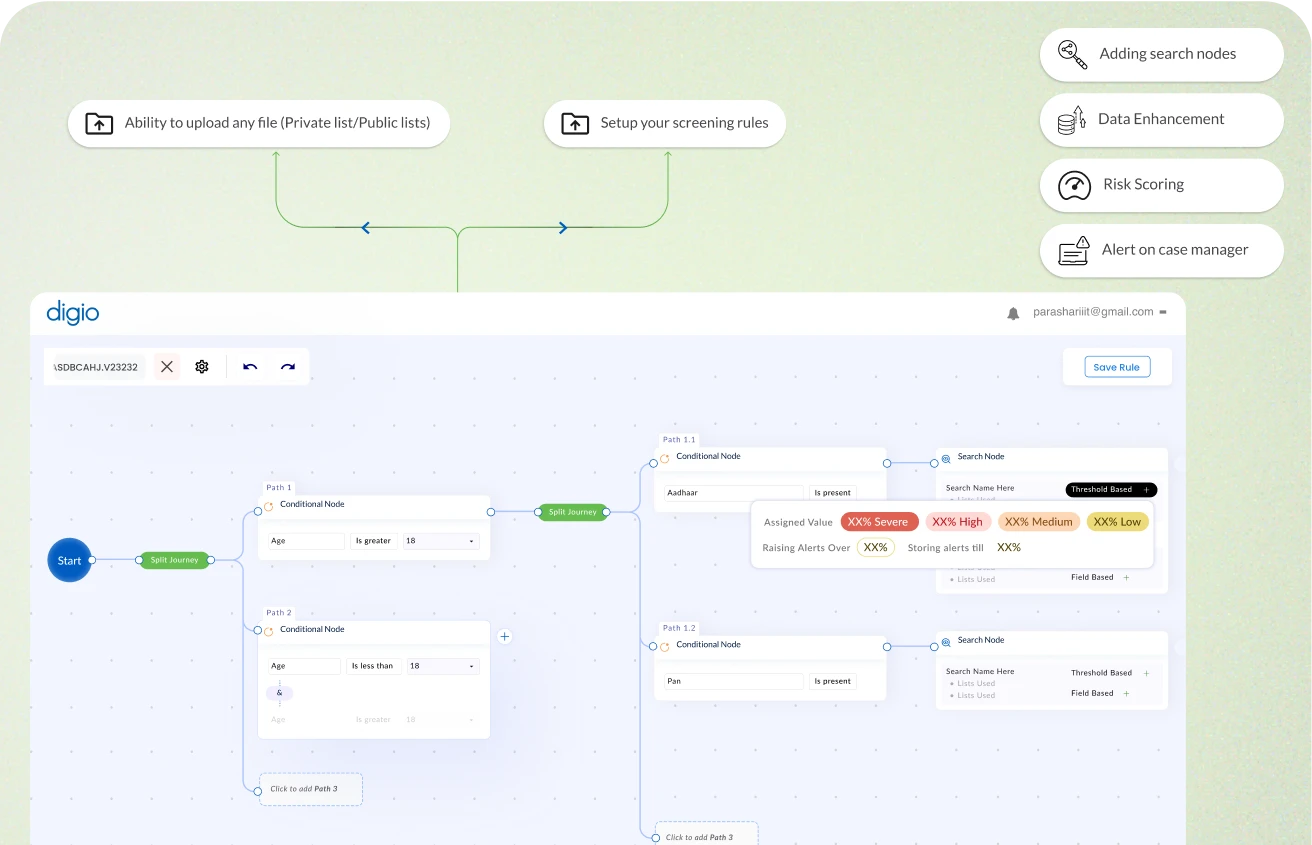

Powerful Rule Orchestration

The Rule Orchestrator provides a low-code/no-code interface to define, test, and deploy custom rules for your company's compliance needs.

Design rules to adapt to evolving regulations or organizational requirements.

Intuitive interface eliminates dependency on developers.

Test rules before going live.

Adjust sensitivity to minimize false positives and capture critical risks.

Handle complex rule scenarios efficiently across high-volume transactions.

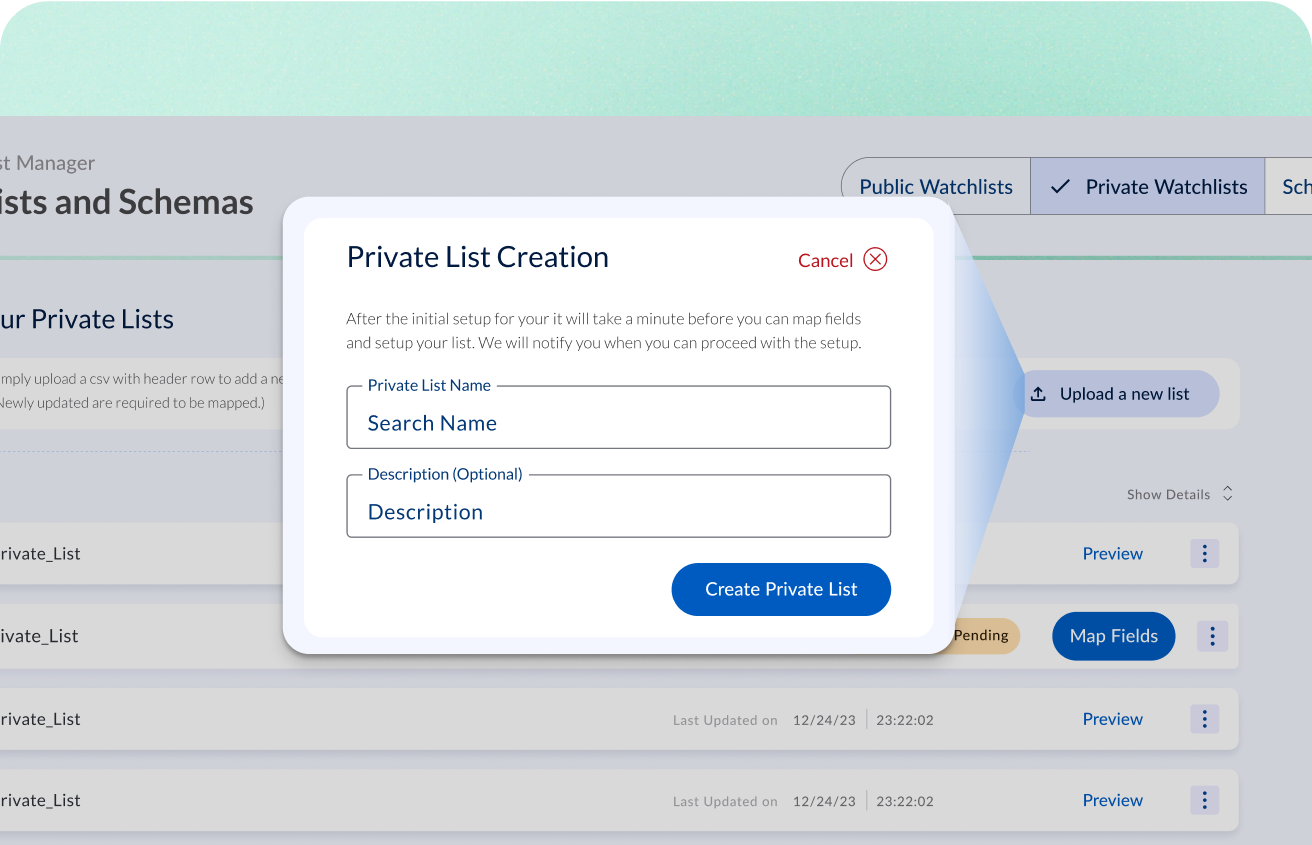

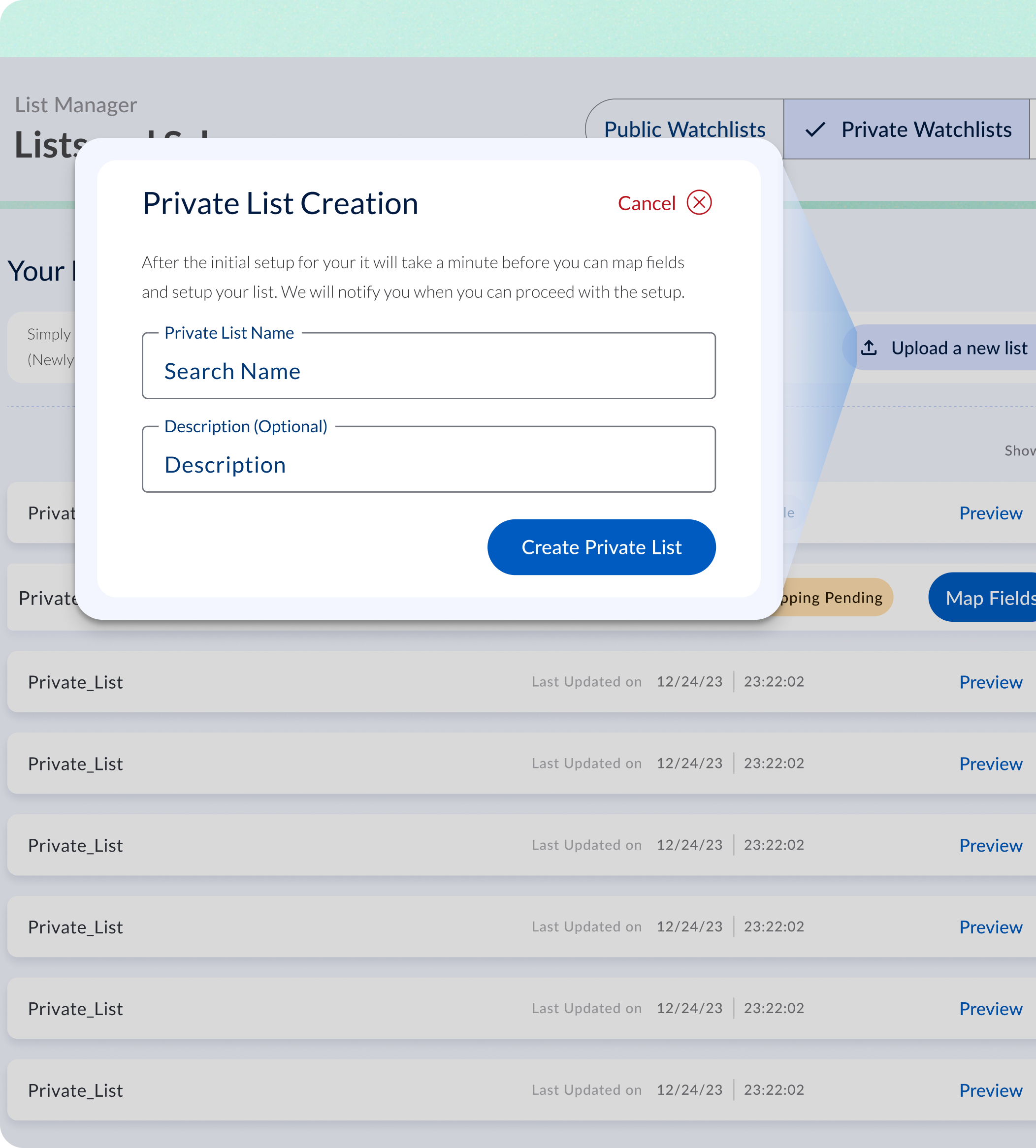

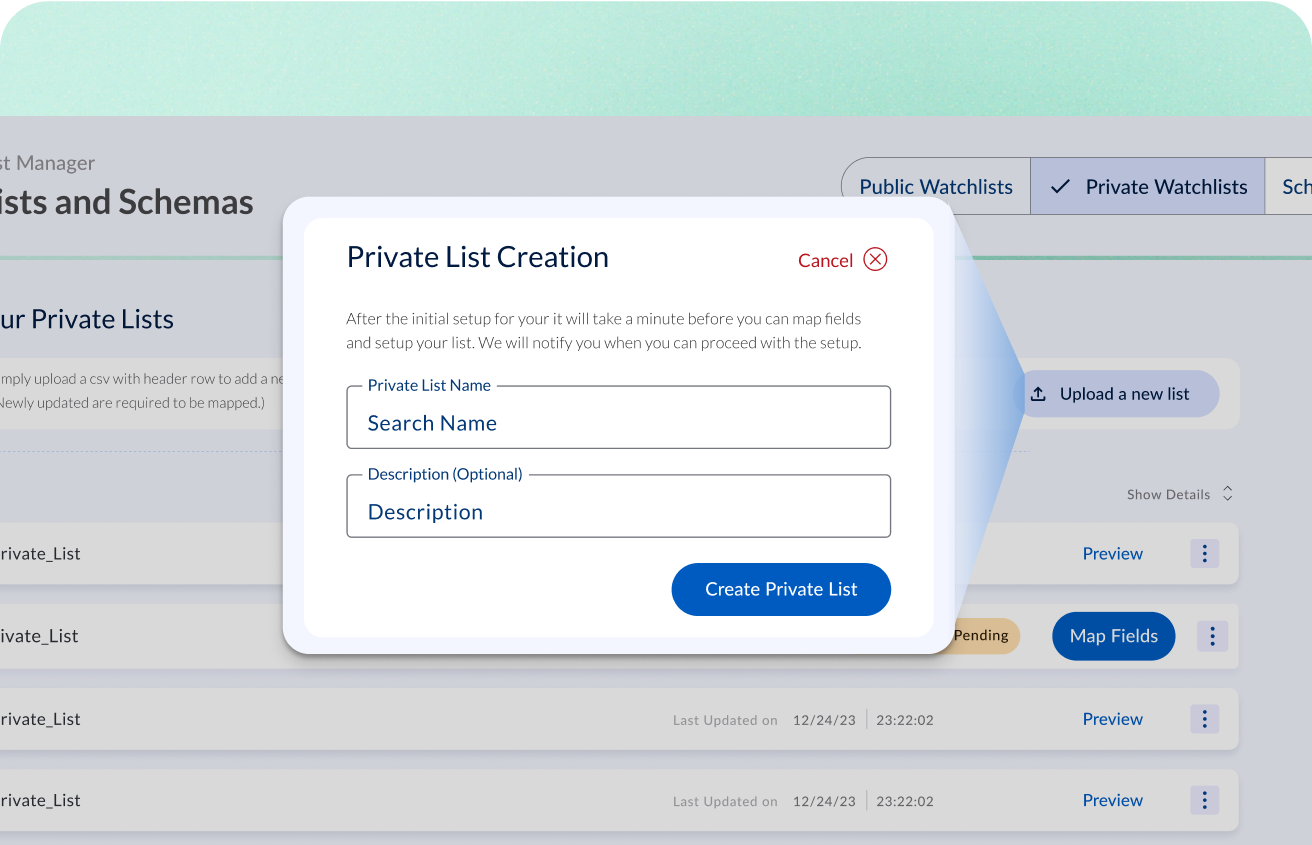

Private List Support

DigiShield enables organisations to maintain and manage custom, company specific watchlists. Their private lists ensures screening processes are fully aligned with internal policies and business specific risk criterion.

Maintain proprietary lists of entities, PEPs, or flagged individuals specific to your organization.

Combine private lists with public sanctions, PEP, and adverse media lists for holistic screening.

Enterprise-grade security ensures that your sensitive data is protected.

Add, modify, or delete entries with ease to keep lists current.

Combine private lists in standalone or hybrid modes to meet your goals.

Test Bed

Test Bed offers a sandbox to simulate scenarios, test configurations, and refine rules before live implementation.

Test how different rules, thresholds, and configurations impact number and type of alerts.

Identify bottlenecks or inefficiencies to improve your live operations.

Maintain a detailed record of testing results for audit and learning purposes.

Understand the impact of rule changes instantly.

Refine your configurations to reduce false positives and improve throughput.

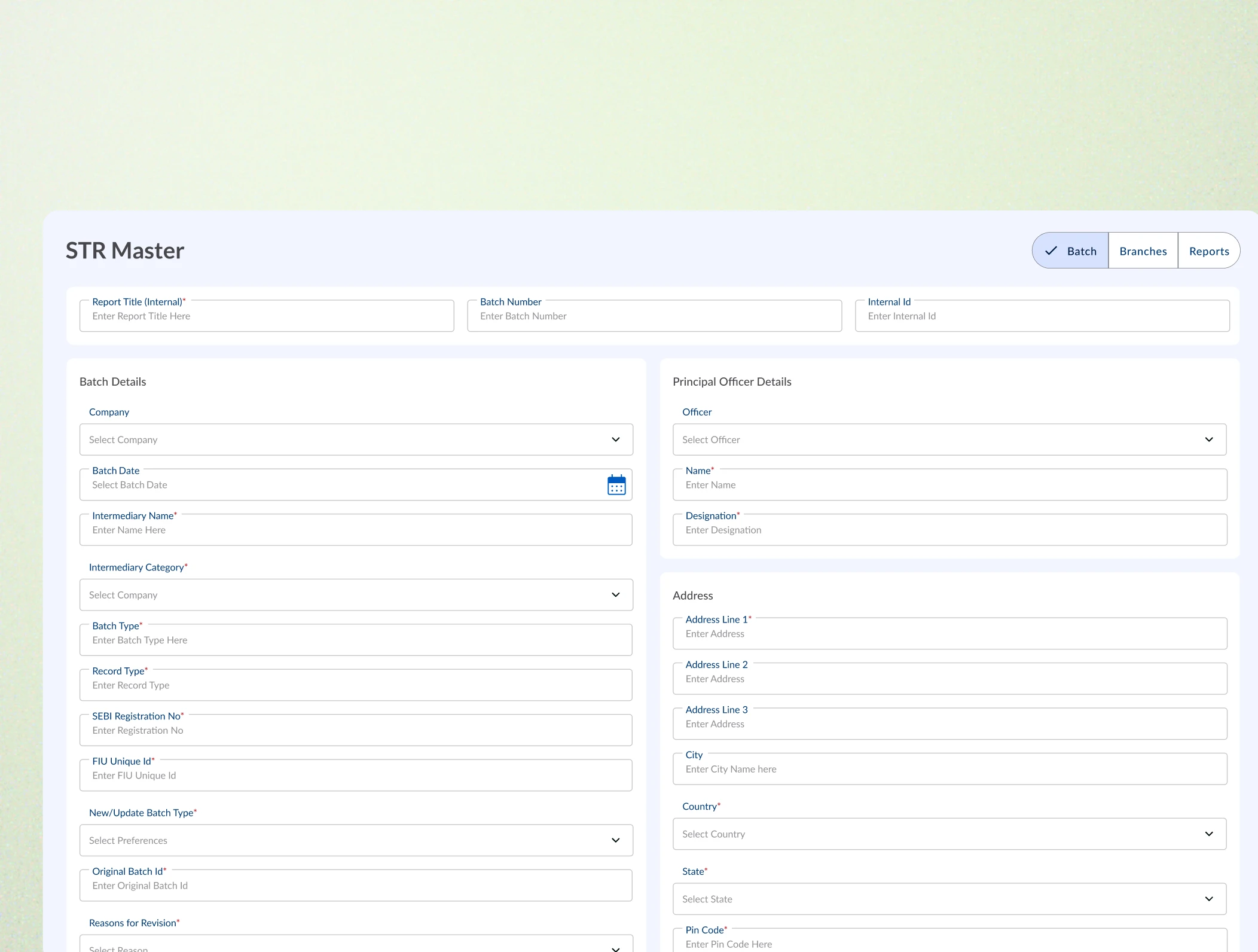

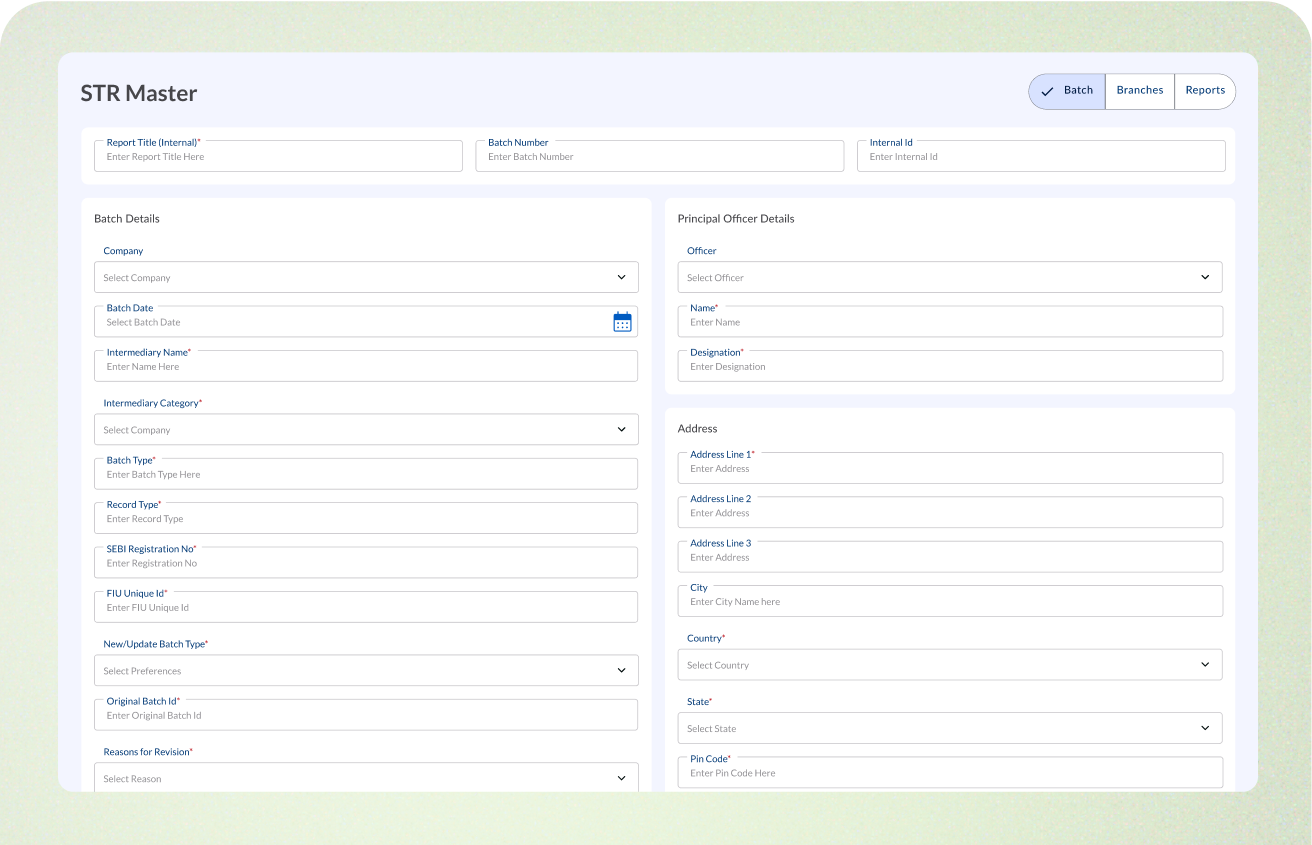

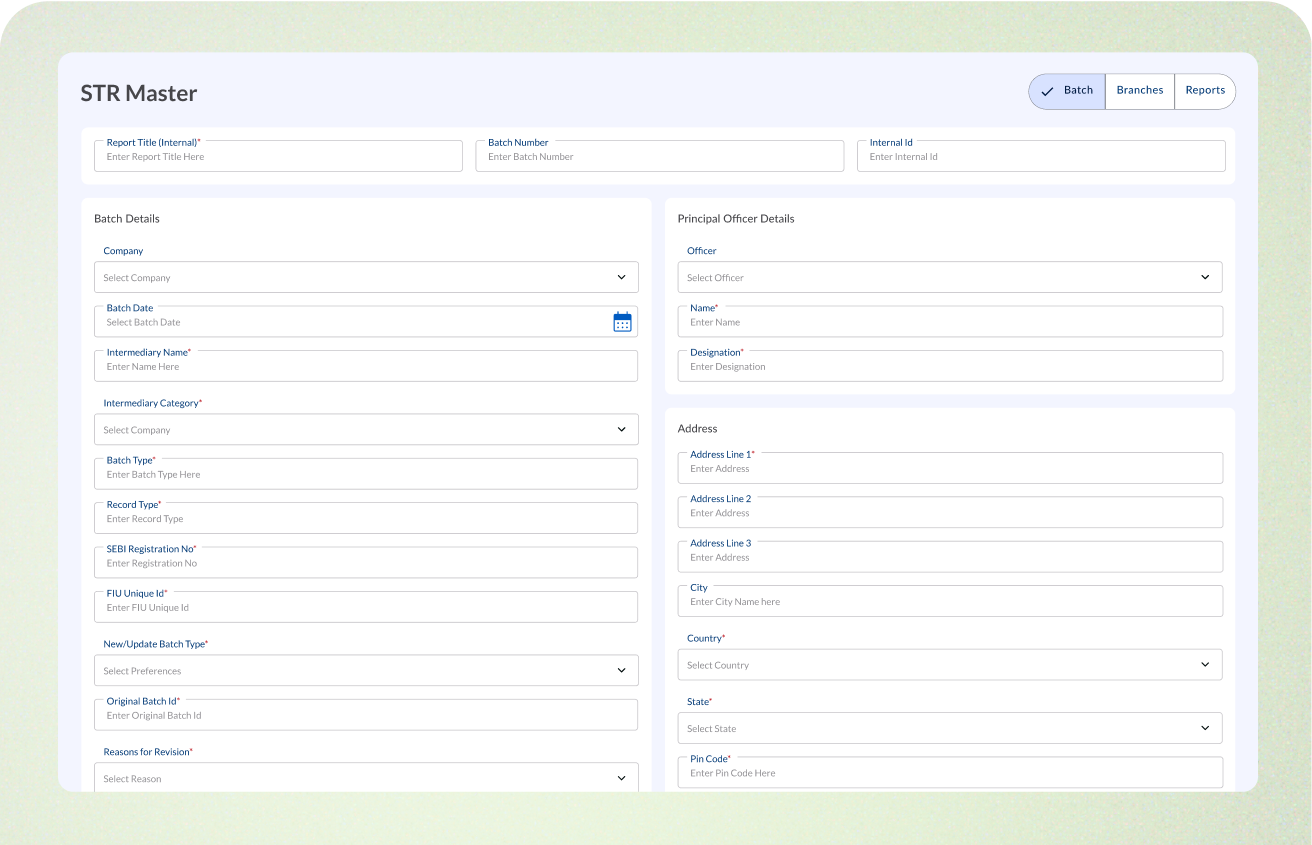

STR Filing

Streamlines Suspicious Transaction Reporting (STR) with an integrated system for accurate, timely, and complete filings.

File STRs directly from the platform without switching tools.

Pre-configured templates align with regulator-specific requirements.

Minimize manual entry with pre-filled details from customer profiles and alerts.

Keep tabs on the filing status and generate compliance reports.

Comprehensive history of filings ensures preparedness for audits or reviews.

Robust Screening Engine

Gain

complete

control

of your customer due diligence

Manage your custom rules, combine simple functions with complex pattern matching.

Risk scoring using simple aggregation, weighted average, or custom formulas.

Get precise matches even for misspelt and similar sounding names.

Configurable customer screening and monitoring in a single solution.

Address naming challenges like common Indian & Arabic names and their aliases with AI-powered contextual insights.

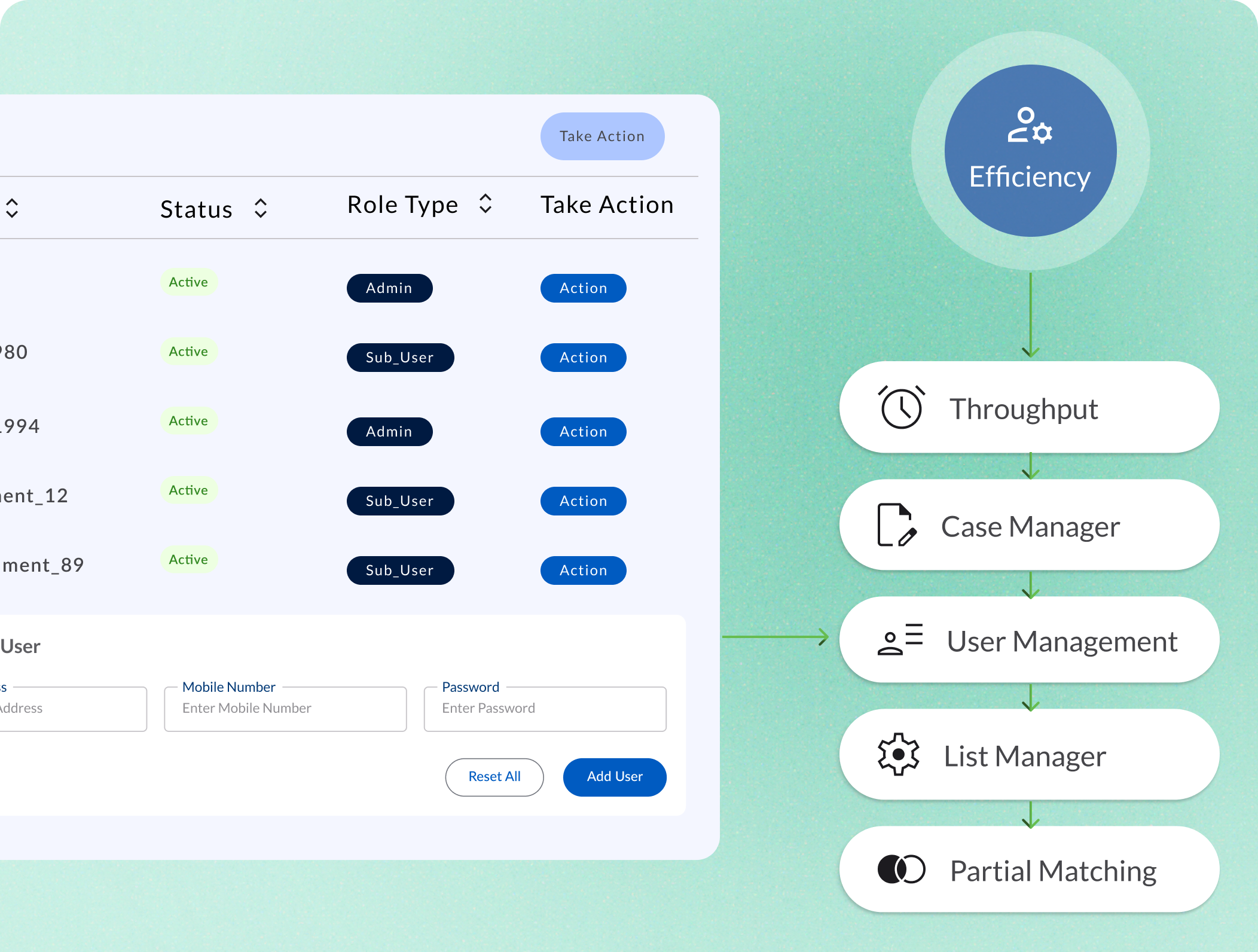

High Compliance Efficiency

Fast, high-throughput, high-volume processing with accuracy.

Fast, high-volume processing with accuracy.

Create structured workflows with maker-checker processes.

Simplify team collaboration with defined roles and access controls.

Manage public and private watchlists seamlessly and effectively.

Address data inconsistencies with flexible matching.

Drilled-down Insights

Enhanced decision-making and transparency into compliance processes.

Simulate configurations and rules to ensure accuracy.

Replicate past scenarios to assess rule changes' impact.

Maintain detailed audit trails for all actions and decisions.

Understand alert rationale with detailed explanations.

Provide your agents with pre-built agent comments for faster turn-around on cases.

Powerful Rule Orchestration

The Rule Orchestrator provides a low-code/no-code interface to define, test, and deploy custom rules for your company's compliance needs.

Design rules to adapt to evolving regulations or organizational requirements.

Intuitive interface eliminates dependency on developers.

Test rules before going live.

Adjust sensitivity to minimize false positives and capture critical risks.

Handle complex rule scenarios efficiently across high-volume transactions.

Private List Support

DigiShield enables organisations to maintain and manage custom, company specific watchlists. Their private lists ensures screening processes are fully aligned with internal policies and business specific risk criterion.

Maintain proprietary lists of entities, PEPs, or flagged individuals specific to your organization.

Combine private lists with public sanctions, PEP, and adverse media lists for holistic screening.

Enterprise-grade security ensures that your sensitive data is protected.

Add, modify, or delete entries with ease to keep lists current.

Combine private lists in standalone or hybrid modes to meet your goals.

Test Bed

Test Bed offers a sandbox to simulate scenarios, test configurations, and refine rules before live implementation.

Test how different rules, thresholds, and configurations impact number and type of alerts.

Identify bottlenecks or inefficiencies to improve your live operations.

Maintain a detailed record of testing results for audit and learning purposes.

Understand the impact of rule changes instantly.

Refine your configurations to reduce false positives and improve throughput.

STR Filing

Streamlines Suspicious Transaction Reporting (STR) with an integrated system for accurate, timely, and complete filings.

File STRs directly from the platform without switching tools.

Pre-configured templates align with regulator-specific requirements.

Minimize manual entry with pre-filled details from customer profiles and alerts.

Keep tabs on the filing status and generate compliance reports.

Comprehensive history of filings ensures preparedness for audits or reviews.

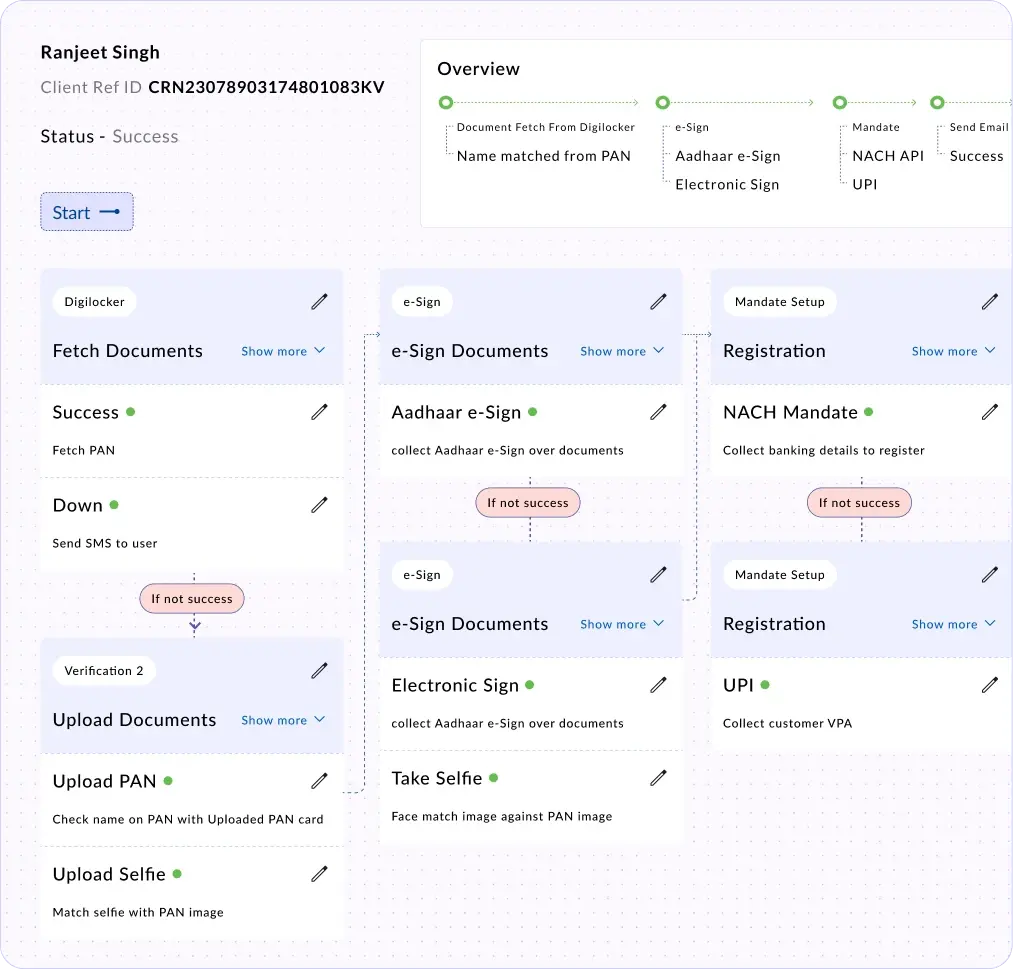

Explore Digio’s Other Solutions

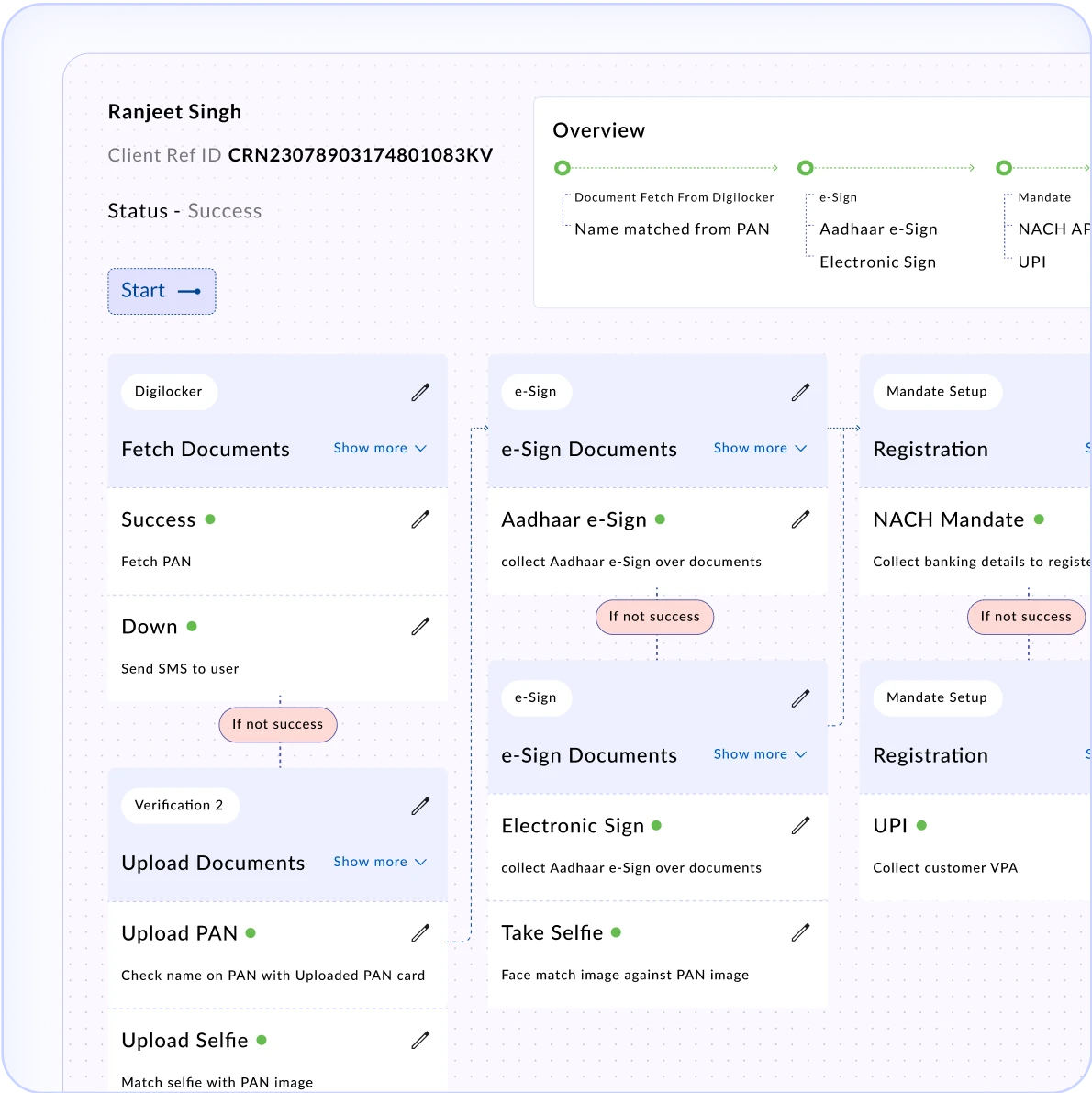

DigiStudio

Business Workflow builder for end-to-end onboarding

Drag & Drop reconfigurability with auto-approval mechanisms

Onboarding journey traceability and analytics

Configurable business validations to ensure full compliance

Drag & Drop reconfigurability with auto-approval mechanisms

Onboarding journey traceability and analytics

Configurable business validations to ensure full compliance

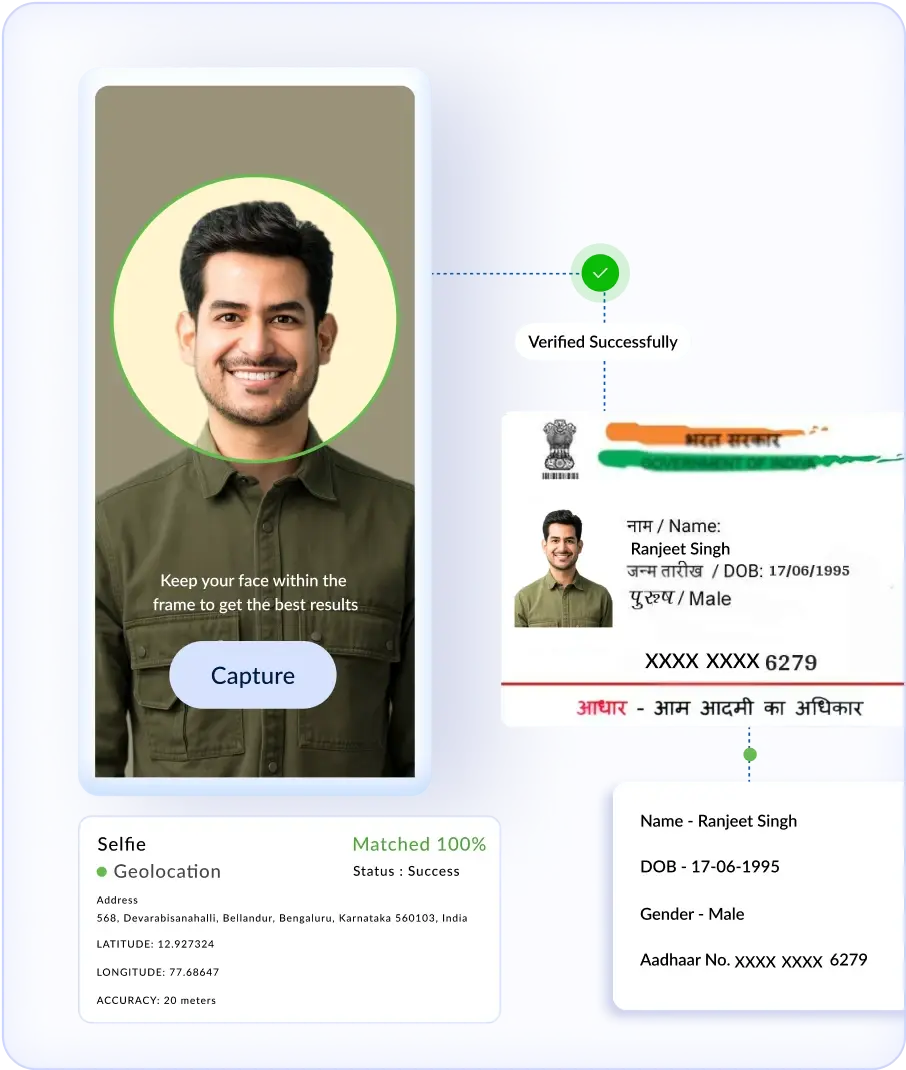

DigiKYC

Comprehensive Identity and Business Verification with Enhanced Due Diligence

Digilocker Integration

ID OCR Analysis

Selfie Verification

Geolocation and VPN check

Video KYC

CKYC/KRA Submission and Fetch

Fuzzy Match

Bank Account Verification

PAN Verification

Aadhaar Masking

Aadhaar Offline KYC

Aadhaar-Based AUA/KUA Authentication

Digilocker Integration

ID OCR Analysis

Selfie Verification

Geolocation and VPN check

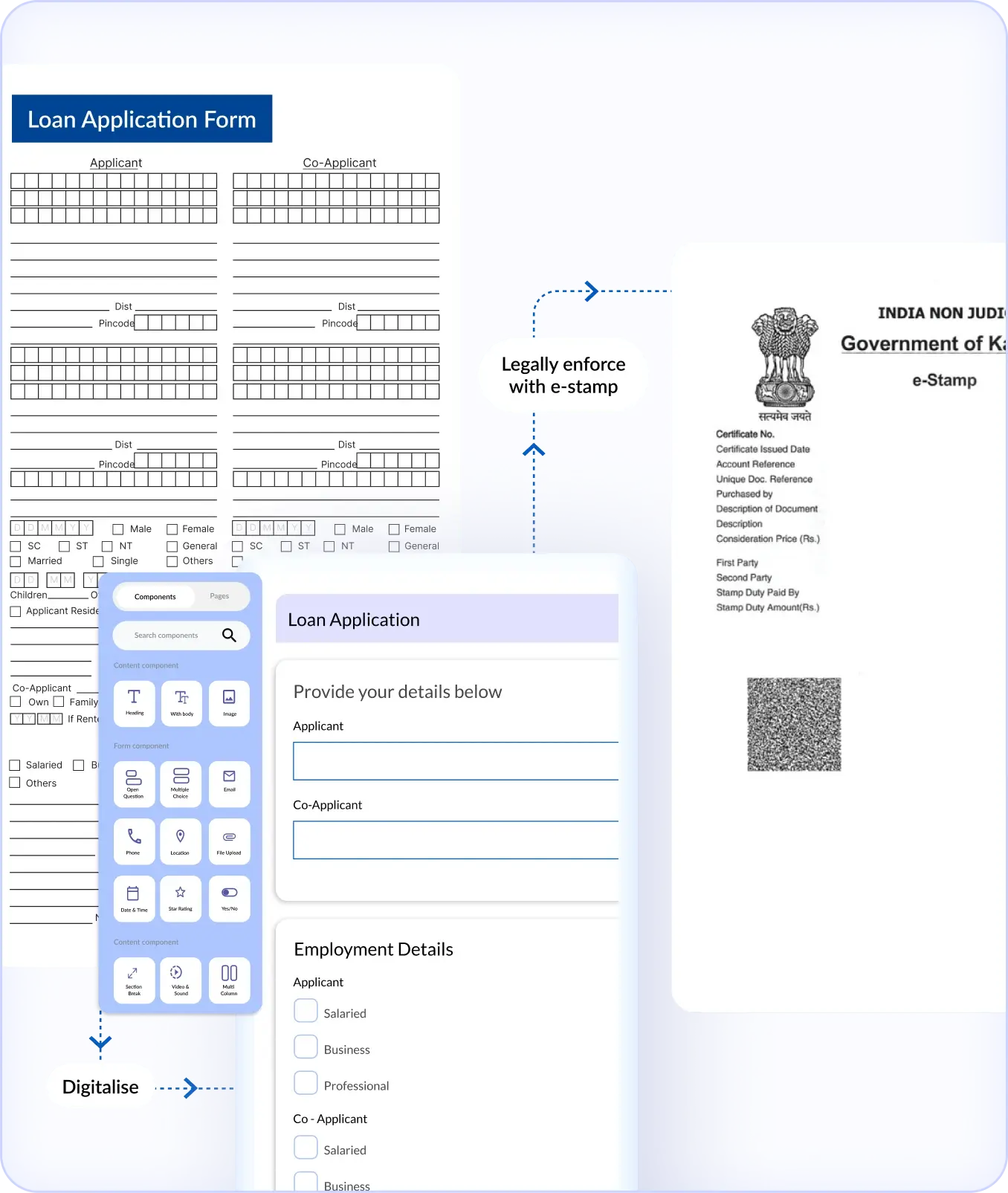

DigiDocs

All-Inclusive Platform for all your Document Creation and Management Needs

Document Template Creation

Secured Document Repository

Document Version Control

Form Builder with Drag & Drop UI, Field Validations, and Conditional Logic

Folder management of executed documents

Filters and tags for efficient document retrieval

E-stamp - Single platform with pan India multi denomination support

Document Template Creation

Secured Document Repository

Document Version Control

Form Builder with Drag & Drop UI, Field Validations, and Conditional Logic

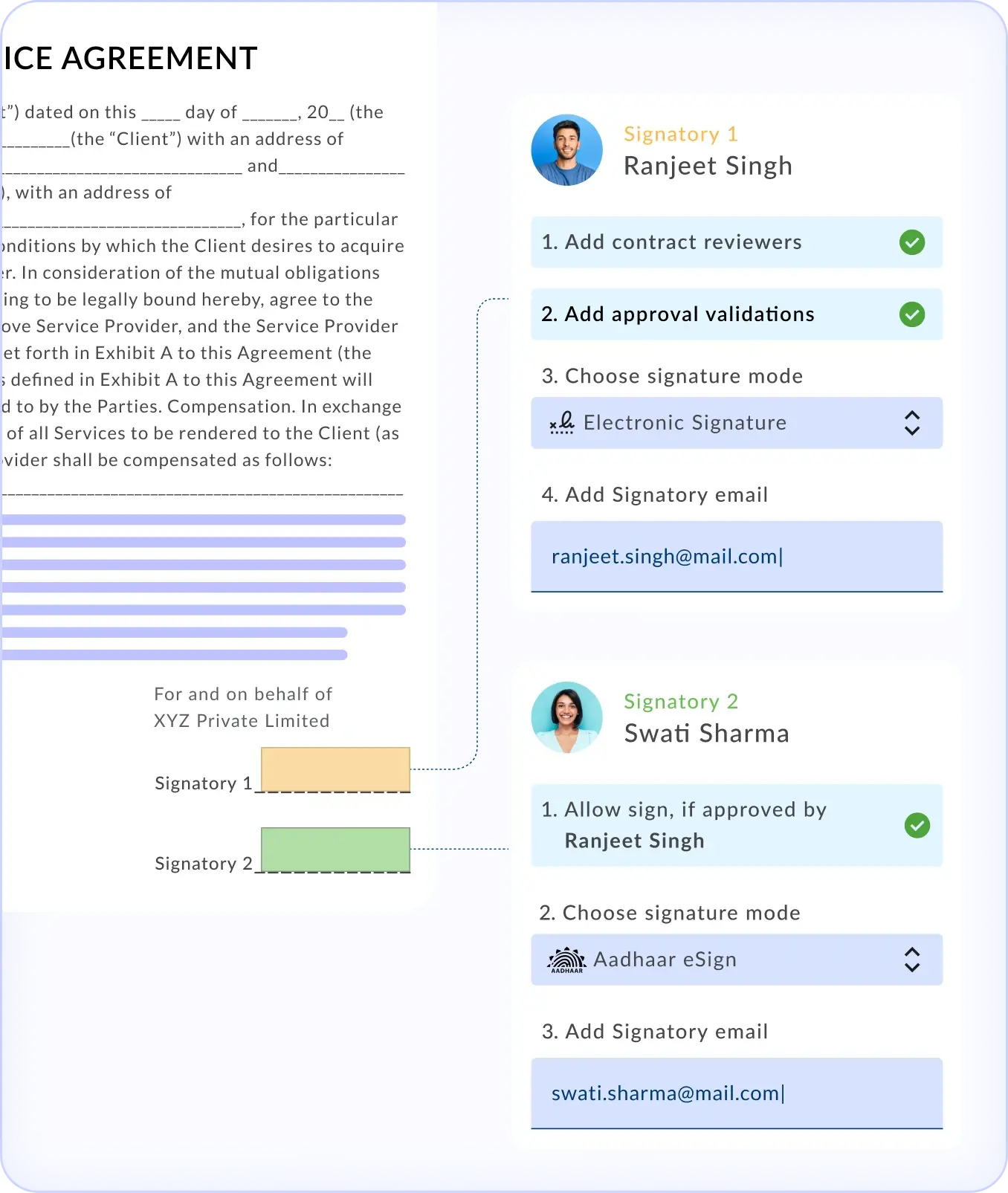

DigiSign

The Most Trusted Signing Solution in India, enabling you with highest configurability for digital signing

Aadhaar eSign

USB Based Digital Signer Certificate

Document Signer Certificate

Electronic Signatures

KYC Backed Signing

Aadhaar eSign

USB Based Digital Signer Certificate

Document Signer Certificate

Electronic Signatures

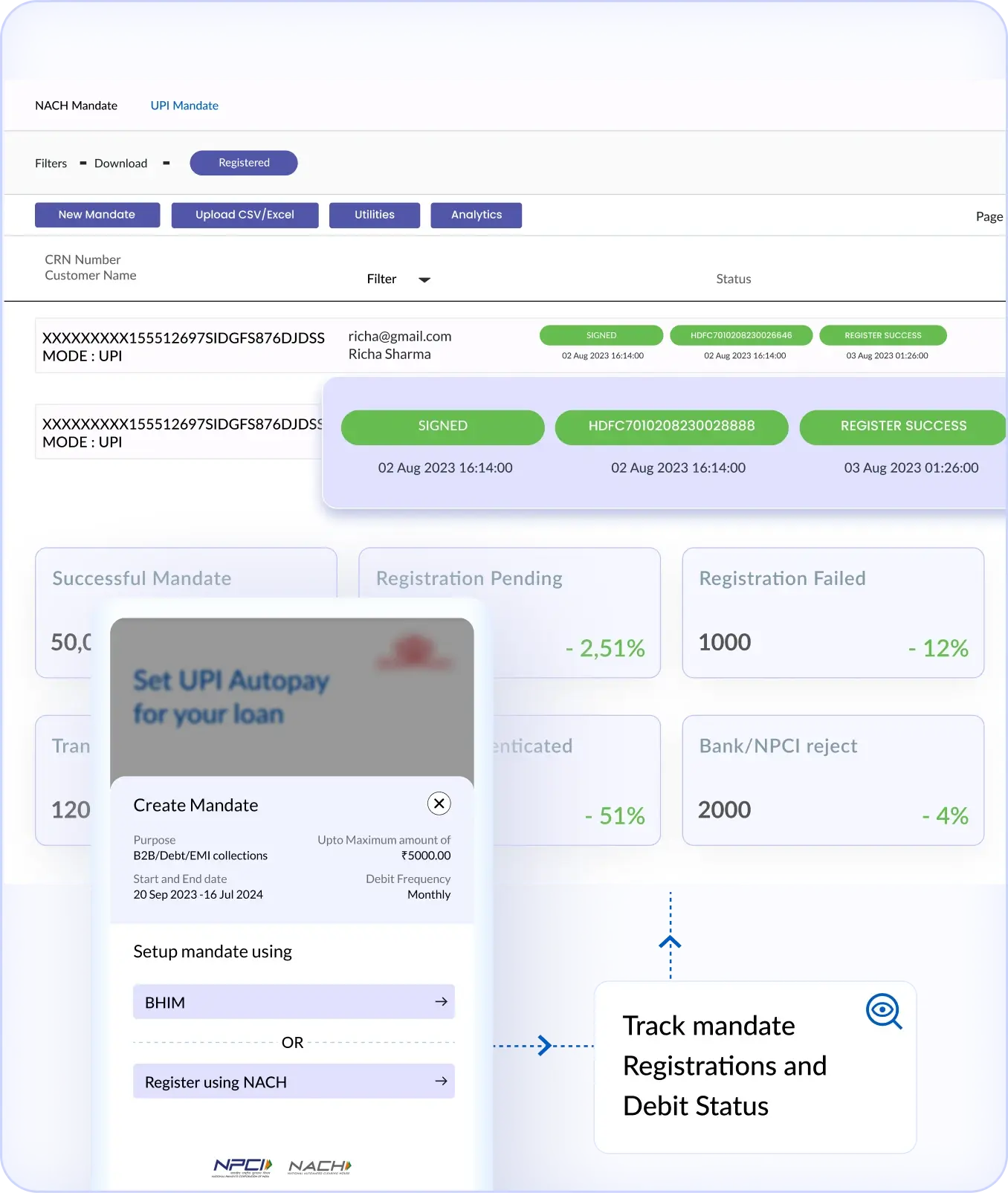

DigiCollect

Automate NACH-Compliant Recurring Collections with Multiple Sponsor Bank integrations

API Mandates via Debit Card and Net Banking

360 degree view of collectibles with single integration and dashboard for effective tracking

NACH Mandates

UPI Mandates

Physical Mandates

Mandate Book

Debit Presentations

Sponsor Bank Dashboard

Alternate Collection Mechanisms

API Mandates via Debit Card and Net Banking

360 degree view of collectibles with single integration and dashboard for effective tracking

NACH Mandates

UPI Mandates

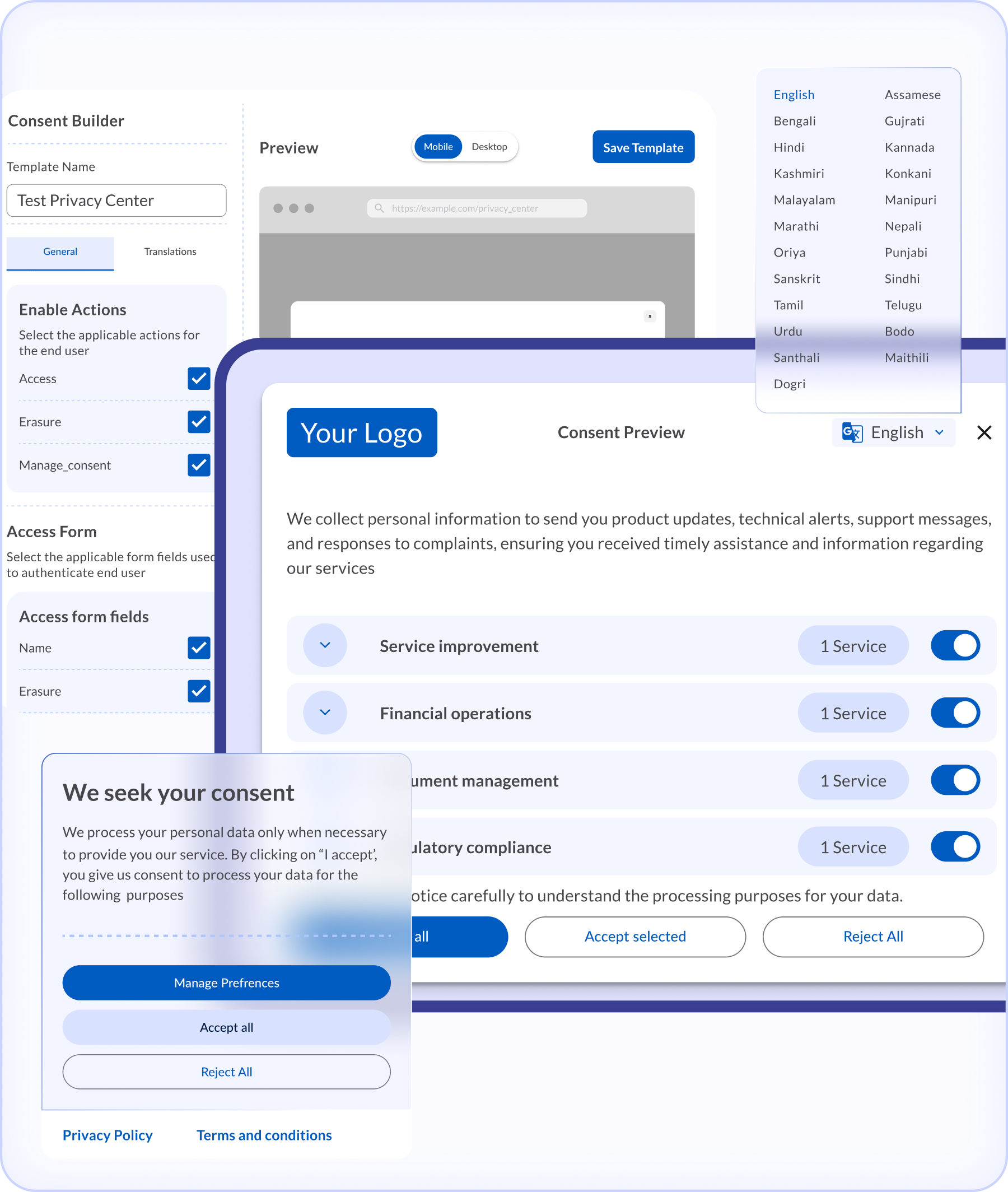

CoTrust

Effectively discover, classify your customer data and collect and manage their consent across all touchpoints - with an integrated solution.

Effectively Discover and Classify PII data across Data sources

Generate Purpose backed Consent Templates for your Website and Apps

Service Data Subject Requests from a customisable Privacy Centre

Design Custom Workflows to automate Privacy Requests

Get a bird's eye view Request fulfilment SLAs through a single Dashboard

Effectively Discover and Classify PII data across Data sources

Generate Purpose backed Consent Templates for your Website and Apps

Service Data Subject Requests from a customisable Privacy Centre

Design Custom Workflows to automate Privacy Requests

Digitally transform business operations with Digio!

Try first. Subscribe later.

Boost your legal ops efficiency by 80%

Learn how Digio can enhance your business productivity

Get 1-on-1 business use case solutioning

Speak with our business consultants to get a solution walkthrough for your business requirement

Test the APIs

Let your development team test our API suite to understand configurability and product integration

Subscribe

Get the best in industry commercials for your business usecase