Understanding Key Fact Statements (KFS): A Guide for Borrowers and Lenders

At a time where transparency and informed decision-making are paramount in financial transactions, the Reserve Bank of India (RBI) released the guidelines for the Key Fact Statements (KFS) on 15th April, 2024 as a pivotal tool for enhancing clarity in the lending process. This initiative is particularly significant for Micro, Small, and Medium Enterprises (MSMEs) and retail loans, aiming to empower borrowers with essential information about their loan. In this guide, we will understand the det

At a time where transparency and informed decision-making are paramount in financial transactions, the Reserve Bank of India (RBI) released the guidelines for the Key Fact Statements (KFS) on 15th April, 2024 as a pivotal tool for enhancing clarity in the lending process.

This initiative is particularly significant for Micro, Small, and Medium Enterprises (MSMEs) and retail loans, aiming to empower borrowers with essential information about their loan. In this guide, we will understand the details of the KFS template and its implications for borrowers and lenders, and its impact on the Indian financial landscape.

Key Points from RBI's KFS Guidelines

- Mandatory KFS: Required for all MSME and retail term loans; exception for credit card products.

- Standardized Format: KFS must follow RBI's specified format in Annexures A, B, and C.

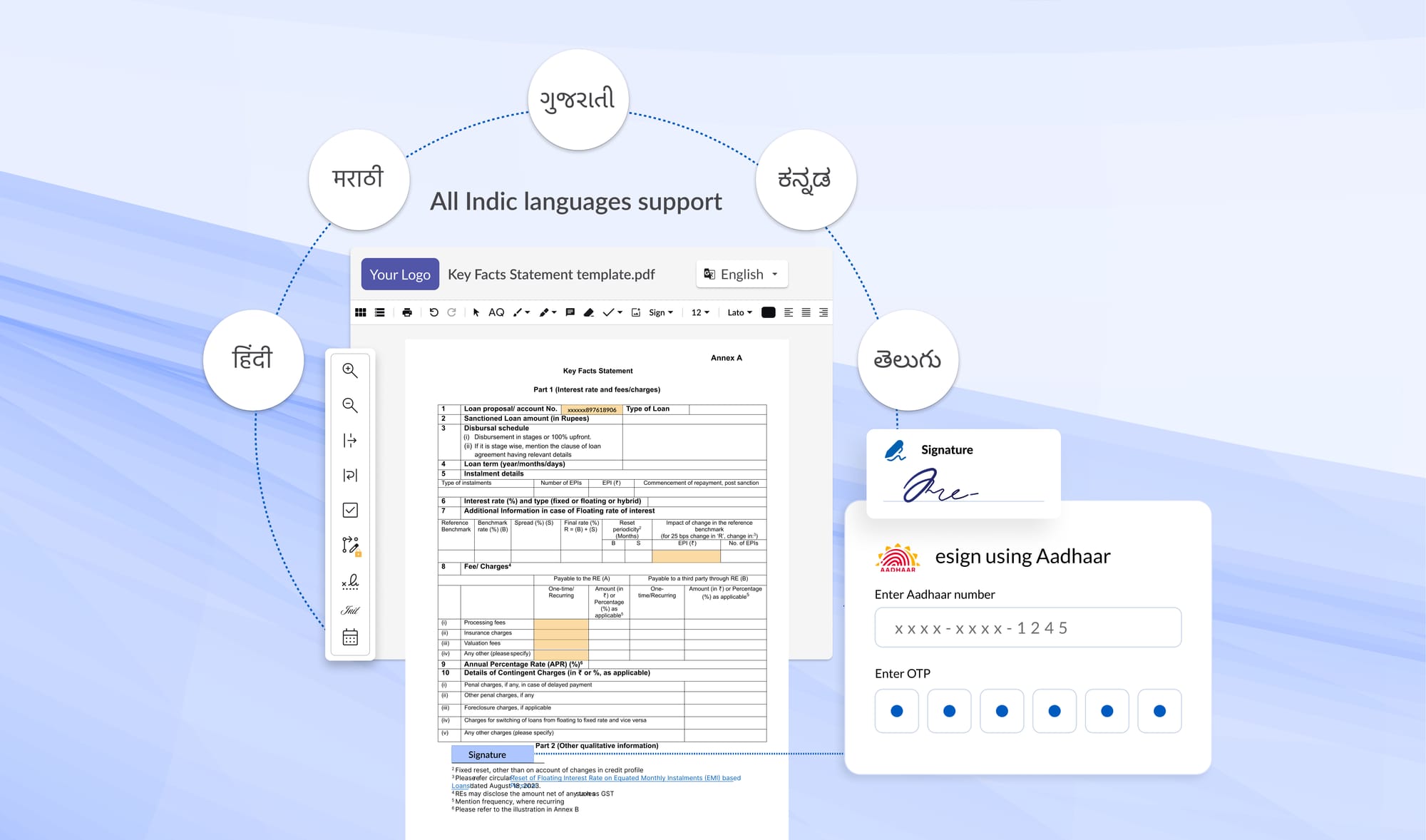

- Local Language Requirement: KFS must be provided in the language understood by the borrower.

- Borrower Acknowledgment: Lenders must obtain acknowledgment from borrowers that they understand the KFS before sending the loan agreement.

- KFS in Loan Agreement: KFS must be included as a summary box within the loan agreement

- Consent for Amendments: Any changes to the loan terms during the loan's tenure require explicit borrower consent.

- Evaluation Period: Borrowers have at least 3 days to evaluate the KFS for loans longer than a week and 1 day for shorter loans

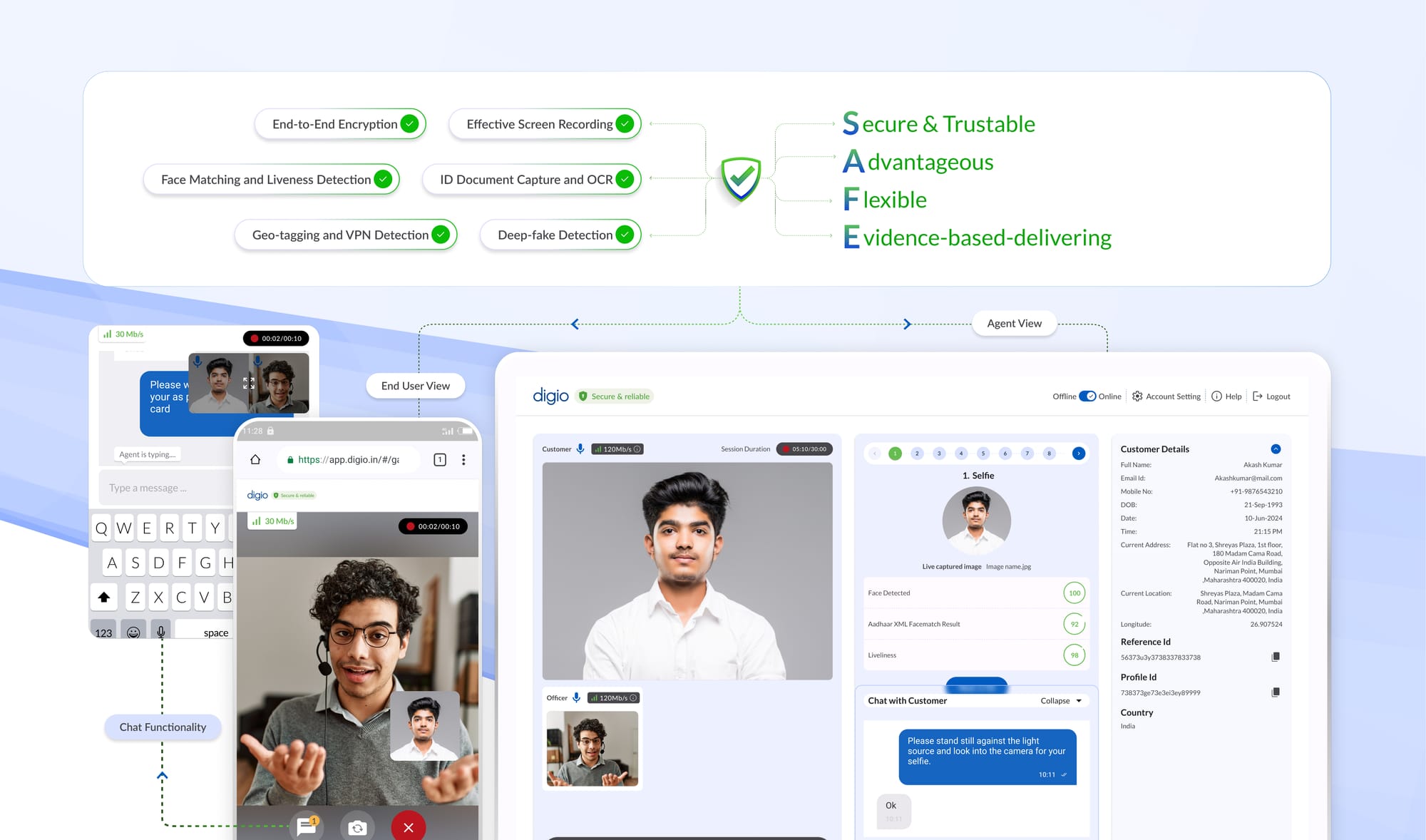

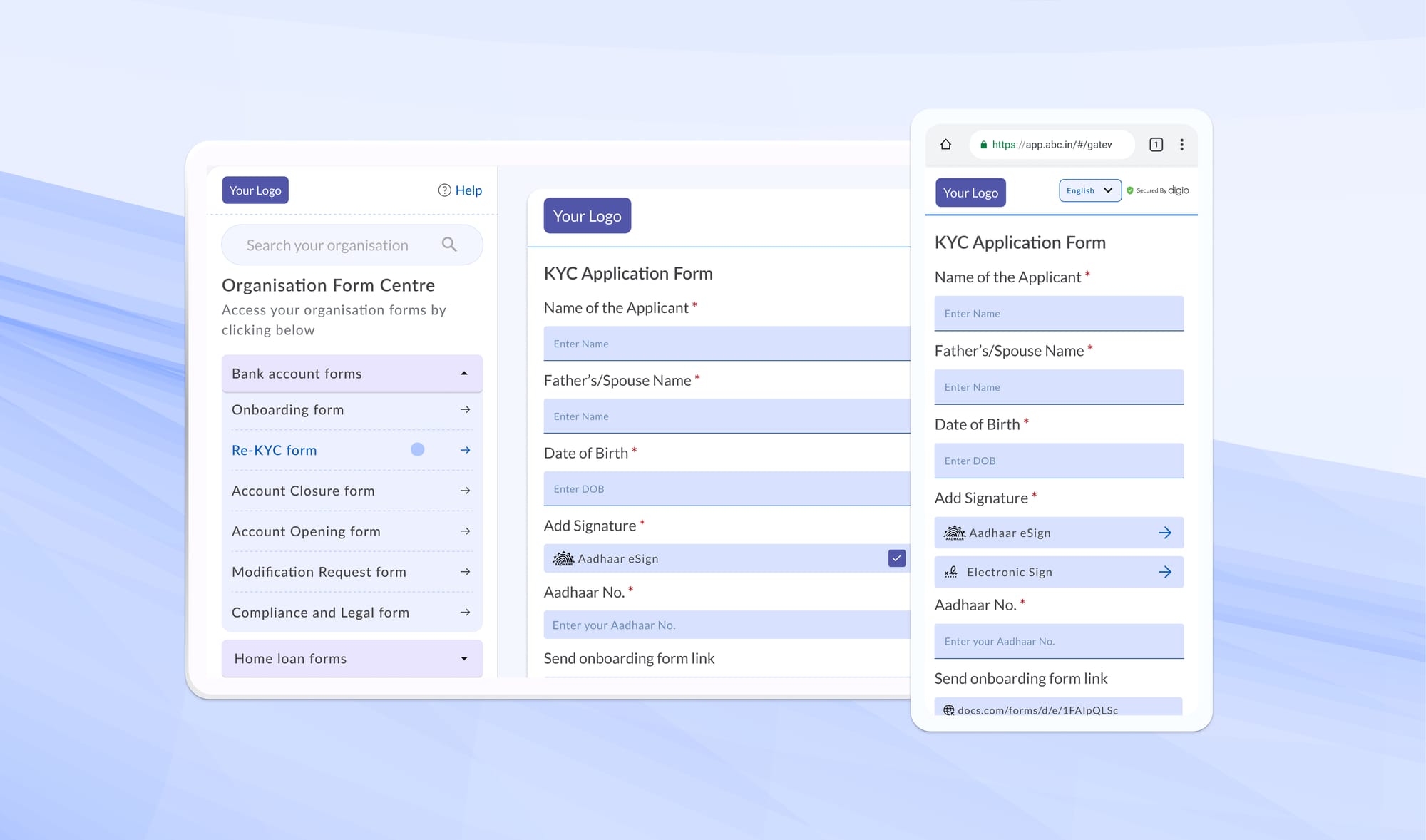

Digio KFS automation

- Templatized KFS and Loan agreement in segregated and standardized formats

- Multi-lingual support with English and all Indic languages

- Platform for collecting auditable KFS acknowledgement via Aadhaar eSign / Electronic signatures integrated with IP and geo-location capture

- Multi-party & automated counter signing

- PAN India e-Stamping facility

- Flexibility to provide Lender-defined evaluation period as per KFS guidelines

What is a Key Fact Statement (KFS)?

A Key Fact Statement is a standardised document that summarises critical information about a loan product. Its primary purpose is to ensure that borrowers understand the terms and conditions associated with their loans, thereby facilitating informed decision-making.

By providing a clear overview of loan specifics, the KFS aims to mitigate misunderstandings and disputes that may arise during the loan lifecycle for a borrower.

Purpose of the KFS document

The introduction of KFS is a significant stride towards enhancing consumer protection in the financial sector. It serves several key functions:

- Transparency: KFS lays out the essential details of the loan in a clear and concise manner.

- Informed Consent: By ensuring that borrowers acknowledge their understanding of the KFS, REs can incorporate informed consent and mitigate disputes during the loan tenure

- Standardization: The RBI guidelines establish a uniform template for the KFS, making it easier for borrowers to compare loan products across different lenders.

Key Changes Introduced by RBI

The RBI has implemented several important changes regarding KFS, which are crucial for both lenders and borrowers to understand:

1. Mandatory Implementation

KFS is now mandatory for all MSME and retail term loan products, excluding credit card products and corporate loans. This requirement ensures that a significant portion of borrowers benefit from the clarity that KFS provides.

All new retail and MSME term loans sanctioned on or after October 1, 2024, including fresh loans to existing customers, must fully comply with the new KFS guidelines, without exception.

Loans included

- Retail Lending by REs which include:

- Auto Loans

- Education Loans

- Home Loans

- Loan against securities

- Loan against property

- Loan against fixed deposit, etc.

- Term loans to MSMEs

- Digital lending by any RE

- Microfinance by MFIs

Loans excluded

- Credit card debt

- Corporate Loans

- Business Loans

- Lines of credit

- Loans to corporates(other than MSMEs)

- Dealer financing(other than individuals)

- Builder Finance(other than individuals)

2. Standardised Format

RBI has specified a standardised format for KFS that all REs must follow. This uniformity is intended to simplify the borrowing process, allowing borrowers to easily comprehend and compare loan offers.

3. Local Language Requirement

To enhance accessibility, KFS must be presented in a language that the borrower understands. This requirement is particularly important in a diverse country like India, where multiple languages are spoken across regions.

4. Borrower Acknowledgment

REs are required to obtain explicit, verifiable acknowledgment from borrowers that they have understood the KFS before proceeding with the loan agreement. This step is crucial in ensuring that borrowers are fully aware of their commitments.

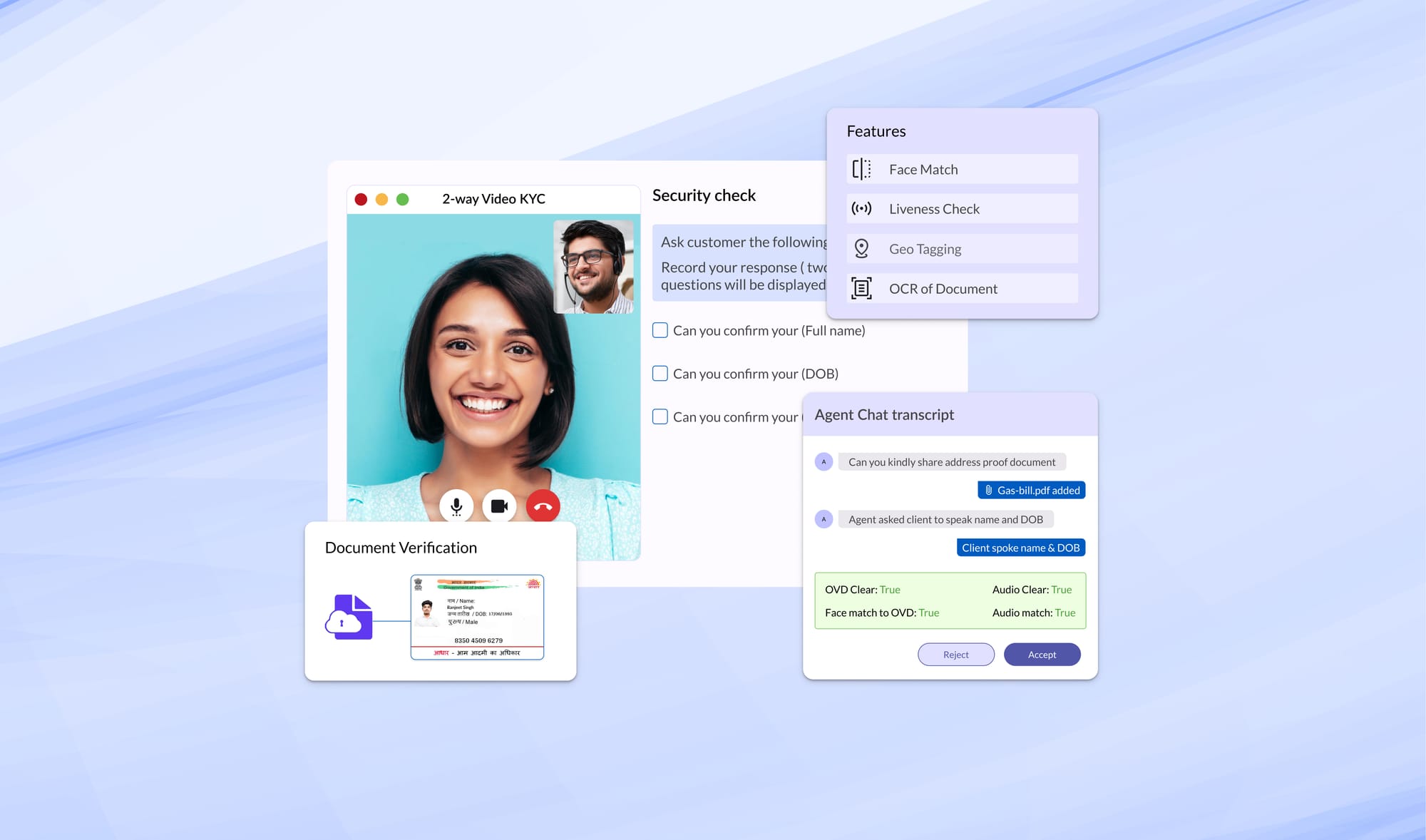

Acknowledgement can be obtained digitally via Aadhaar eSign, Secure virtual signatures or Physical sign uploads for Loan products which may require enforcement in the court of law.

5. Inclusion in Loan Agreement

KFS can be shared and acknowledged by the borrower before the loan agreement is shared with them. However, in this approach the acknowledgement from the customer would need to be collected once again for the loan agreement.

If shared together as part of the loan document kit, acknowledgement can simply be collected for the entire document kit. However, the KFS must be the first document in the kit.

6. Evaluation Period

Borrowers are entitled to a minimum offer evaluation period of three days for loans with a tenure greater than one week, and one day for shorter loans. This provision allows borrowers adequate time to consider the terms before making a commitment.

Lenders are not restricted due to this clause and can initiate loan disbursals immediately post customer acknowledgement is received.

Components of the KFS

The KFS comprises of the following main sections that provide essential information about the loan:

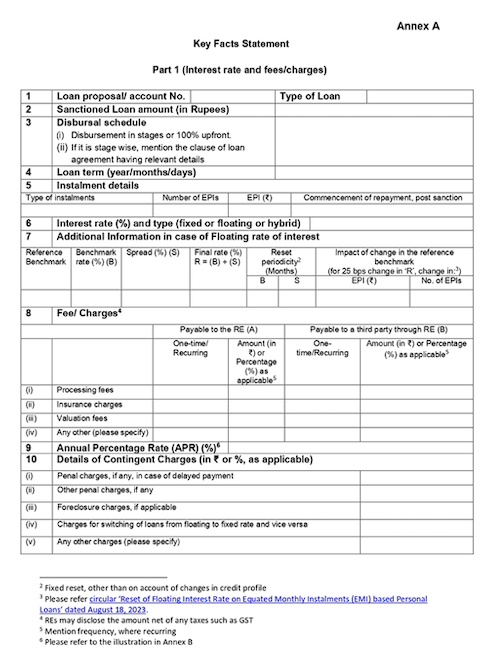

Annexure A: Key Quantitative Information

Annexure A focuses on the essential quantitative details and clauses of the loan agreement, ensuring that borrowers are aware of key financial and procedural terms

Part 1. Key Quantitative Information

- Account Number: Unique identifier for the loan account.

- Type of Loan: The specific category of the loan being applied for (e.g., personal, home, business).

- Sanctioned Loan Amount (in Rupees): The total amount approved for the loan.

- Disbursal Schedule: This outlines when the loan amount will be disbursed, including any stages involved and related clauses if the entire amount is not disbursed at once.

- Loan Term: The duration of the loan, specified in years, months, or days.

- Instalment Details: Information regarding the type of instalments, the total number of Equated Monthly Instalments (EMIs), the amount of each instalment, and when the repayment will commence.

- Interest Rate: The applicable interest rate expressed as a percentage, indicating whether it is fixed, floating, or hybrid.

- Additional Floating Rate Information: This includes:

- Reference Benchmark: The benchmark rate used for floating interest rates.

- Benchmark Rate: The specific rate that serves as a reference point.

- Spread: The additional margin added to the benchmark rate.

- Final Rate: The total interest rate after adding the spread to the benchmark rate.

- Reset Periodicity: The frequency with which the interest rate will be adjusted.

- Impact of Benchmark Change on EPI: How changes in the benchmark rate affect the Equated Monthly Instalment (EMI) and the total number of EMIs.

- Fees/Charges: Details of any fees or charges applicable, including:

- Payable to the RE: Fees that are paid directly to the lending institution.

- Payable to a Third Party through RE: Charges that may be incurred through third-party services, such as processing fees or insurance charges.

- Annual Percentage Rate (APR): The total cost of borrowing expressed as a percentage, which includes the interest rate and any associated fees.

- Details of Contingent Charges: Information on any potential additional charges that may apply, such as:

- Penal Charges: Fees imposed for late payments or defaults.

- Foreclosure Charges: Costs associated with paying off the loan early.

- Switching Charges: Fees for changing the loan terms or interest rate type.

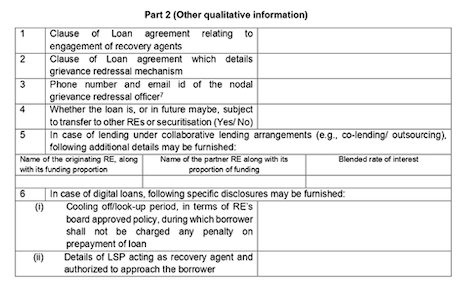

Part 2. Key Contractual Clauses

- Engagement of Recovery Agents: This clause specifies the engagement of recovery agents, detailing the procedures and protocols they must follow during the recovery process.

- Grievance Redressal Mechanism: This outlines the grievance redressal mechanism, ensuring borrowers have clear guidance on how to lodge complaints and seek resolutions.

- Contact Information for Nodal Grievance Redressal Officer: Contact details of the nodal grievance redressal officer, including their phone number and email address, to facilitate communication regarding any issues.

- Potential Loan Transfer or Securitization: Information regarding the possibility of transferring the loan to other lending entities (REs) or its securitization should be clearly stated in the agreement.

- Collaborative Lending Arrangements: Details about any collaborative lending arrangements, including the names of the originating and partner REs, the proportions of funding provided by each, and the blended interest rate applicable.

- Specific Disclosures for Digital Loans: Disclosures related to digital loans, ensuring borrowers are fully informed about the terms and conditions associated with these products.

- Cooling-Off/Look-Up Period: this clause specifies the cooling-off or look-up period, allowing borrowers a designated timeframe to reconsider their loan agreement after signing.

- Details of the LSP Acting as a Recovery Agent: Information about the Loan Service Provider (LSP) acting as a recovery agent, including their role and responsibilities in the recovery process.

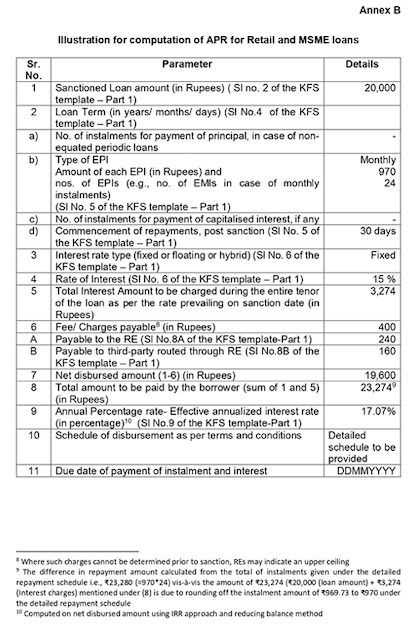

Annexure B: Key Contractual Clauses

Annexure B provides a clear picture of the overall cost of borrowing, promoting transparency in lending practices. It’s breakdown includes:

- Interest Rate: The percentage charged by the lender for borrowing money.

- Fees and Costs: This can include various fees such as origination fees, closing costs, processing fees, and any other charges that might be associated with the loan.

- Annualization: APR is expressed as an annual rate, which helps in comparing loans of different amounts and terms on a like-for-like basis.

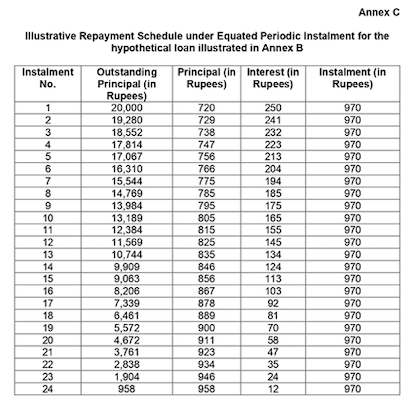

Annexure C: Grievance Redressal Mechanism

Annexure C outlines the repayment process of a loan over its term. It breaks down each payment into two components: principal and interest. This annexure is vital for managing and understanding the loan, ensuring that borrowers are aware of their payment structure and the progression towards full repayment.

and Implementation by REs

Providing the KFS

REs must deliver the KFS to borrowers before the loan agreement is sent. This proactive approach ensures that borrowers have the necessary information available to them. The acknowledgment of receipt and understanding of the KFS can be obtained through various means, including physical signatures or digital methods like Aadhaar eSign, Secure virtual signatures or Physical sign uploads

Alternatively, to avoid multiple stages of customer acknowledgement the KFS can be included in the loan kit with the KFS document being the first document chronologically. A single instance of acknowledgment would suffice in this mode.

Amendments and Changes

In the event of any amendments to the loan terms and charges , REs must seek explicit consent from the borrower. This requirement reinforces the principle of informed consent and ensures that borrowers are not taken by surprise by any changes.

Language and Accessibility

To comply with the local language requirement, REs should prepare KFS documents in multiple languages commonly spoken in the borrower’s region. This practice not only enhances comprehension but also fosters trust between borrowers and lenders.

The Impact of KFS on Borrowers and Lenders

For Borrowers

- Empowerment: KFS empowers borrowers by providing them with the necessary information to make informed financial decisions.

- Reduced Misunderstandings: With clear terms laid out in the KFS, borrowers are less likely to encounter misunderstandings or disputes regarding their loans.

- Enhanced Trust: The transparency fostered by KFS can enhance trust between borrowers and lenders, leading to more positive lending experiences.

For Lenders

- Regulatory Compliance: Adhering to KFS guidelines ensures that lenders remain compliant with RBI regulations, reducing the risk of penalties.

- Improved Customer Relations: By providing clear and transparent information, lenders can improve their relationships with borrowers, leading to higher customer satisfaction and loyalty.

- Competitive Advantage: Lenders that effectively communicate the terms of their loans through KFS may gain a competitive edge in the market, attracting more borrowers.

How can Digio help REs comply with KFS guidelines?

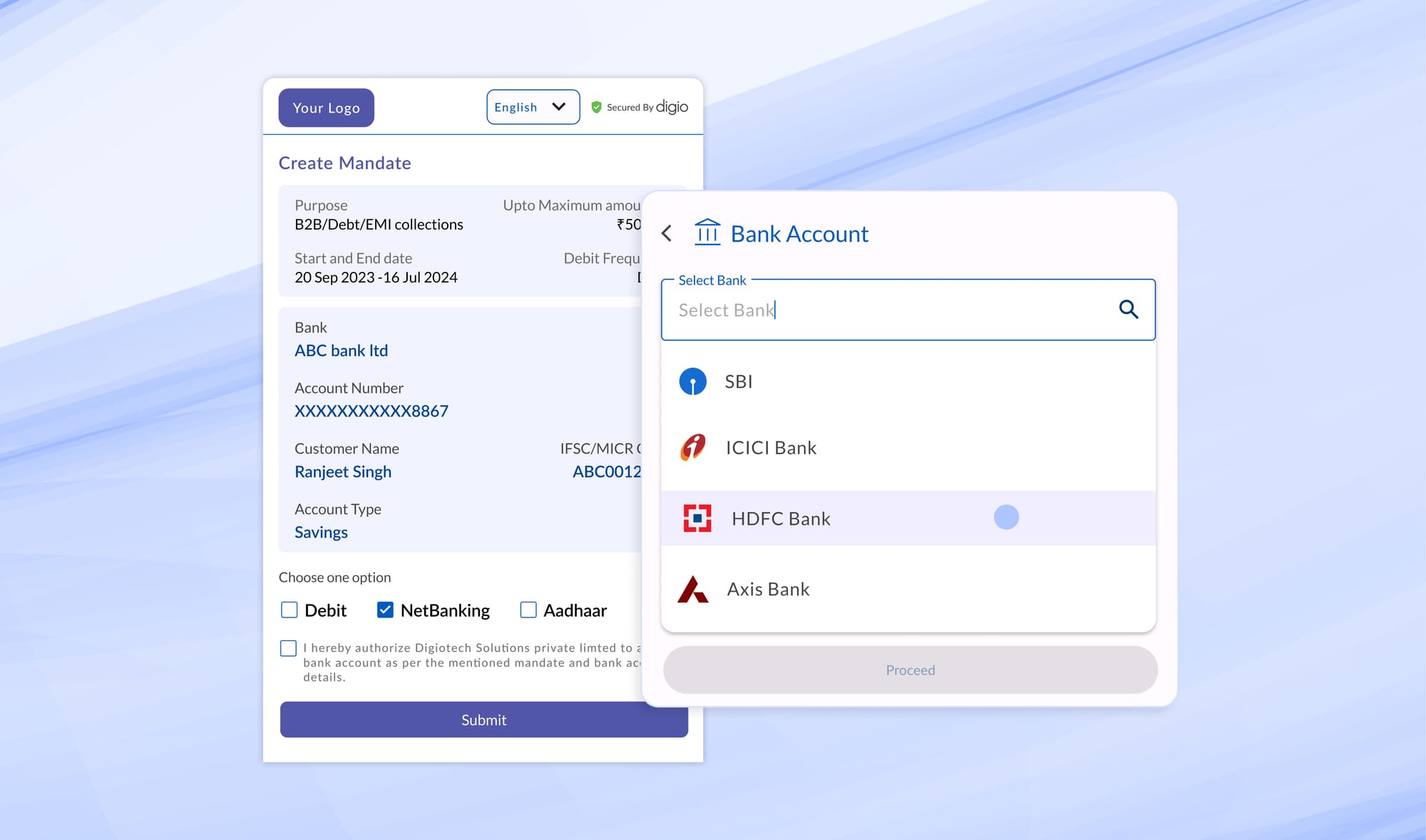

- Integrating the KFS flow into the existing lending journey

- Templatized KFS and Loan agreement in segregated and standardised formats

- Multi-lingual support with English and all Indic languages

- Platform for collecting auditable KFS acknowledgement via Aadhaar eSign / Electronic signatures integrated with IP and geo-location capture

- Multi-party & automated counter signing

- PAN India e-Stamping facility

- Flexibility to provide Lender-defined evaluation period as per KFS guidelines

Conclusion

The introduction of Key Fact Statements (KFS) by the RBI marks a significant advancement in promoting transparency and consumer protection in the lending landscape. By mandating clear communication and informed consent, these guidelines aim to create a more trustworthy and accessible lending environment for all borrowers, especially those in the MSME sector.

Digio supports Regulated Entities in staying compliant with the RBI guidelines by providing a comprehensive digital solution for automating the KFS journeys.

Kindly reach out to us on BD@digio.in or Support@digio.in

Read more Blogs

Digitally transform business operations with Digio!

Try first. Subscribe later.

Boost your legal ops efficiency by 80%

Learn how Digio can enhance your business productivity

Get 1-on-1 business use case solutioning

Speak with our business consultants to get a solution walkthrough for your business requirement

Test the APIs

Let your development team test our API suite to understand configurability and product integration

Subscribe

Get the best in industry commercials for your business usecase