Account Aggregator: Why the Future of Financial Intelligence is Consented, Intelligent, and Insightful

Digio, DigiLink Account Aggregator transforms consented financial data into real-time, actionable insights, enabling a complete 360° view of user finances.

Businesses have long lacked access to adequate, accurate, and reliable Financial Intelligence about their users. Previously, it was based on scanned bank statements, human-read and analysed by qualified individuals.

However, recent regulatory developments regarding third-party access to investor portfolio data signal a significant shift in the financial services landscape. For fintechs, wealth managers, and lending institutions, this development necessitates a shift away from legacy aggregation methods toward more standardized and regulated frameworks.

The industry is currently transitioning from informal data access methods to a formal Consented-Data model.

While interim solutions such as manual Consolidated Account Statement (CAS) uploads provide temporary continuity, the Account Aggregator (AA) framework is emerging as the sustainable infrastructure for secure financial data sharing.

However, acquiring raw financial data is merely the foundational step. Institutions require an infrastructure that not only aggregates data but also processes and interprets it accurately and consistently for actionable decision-making.

Digio addresses these requirements through a three-tiered architecture designed to convert raw data into a comprehensive 360-degree financial view, instantly and consistently

The Need for 360-Degree Financial Intelligence

Fragmented systems and data coverage gaps have historically challenged the financial sector. A holistic view of a user's financial profile is critical across multiple industries to drive engagement and evaluate risk effectively.

- NBFC/Lenders: Institutions require robust mechanisms to assess repayment risks pre-disbursement, balance checks before debit collections, and monitor loan accounts post-disbursement to identify NPAs early on.

- Wealth Management: Advisors must tailor investment offerings and advice to a client's comprehensive understanding of their assets and risk tolerance.

- Personal Finance: Applications must accurately track investments and returns to forecast spending and influence user behavior.

- Insurance: Underwriting processes benefit from indicators of payment history and the ability to customize products based on financial data.

DigiLink: A Structured Approach to Financial Intelligence

To support these use cases, Digio utilizes a three-tiered framework that moves from consented access to granular insights.

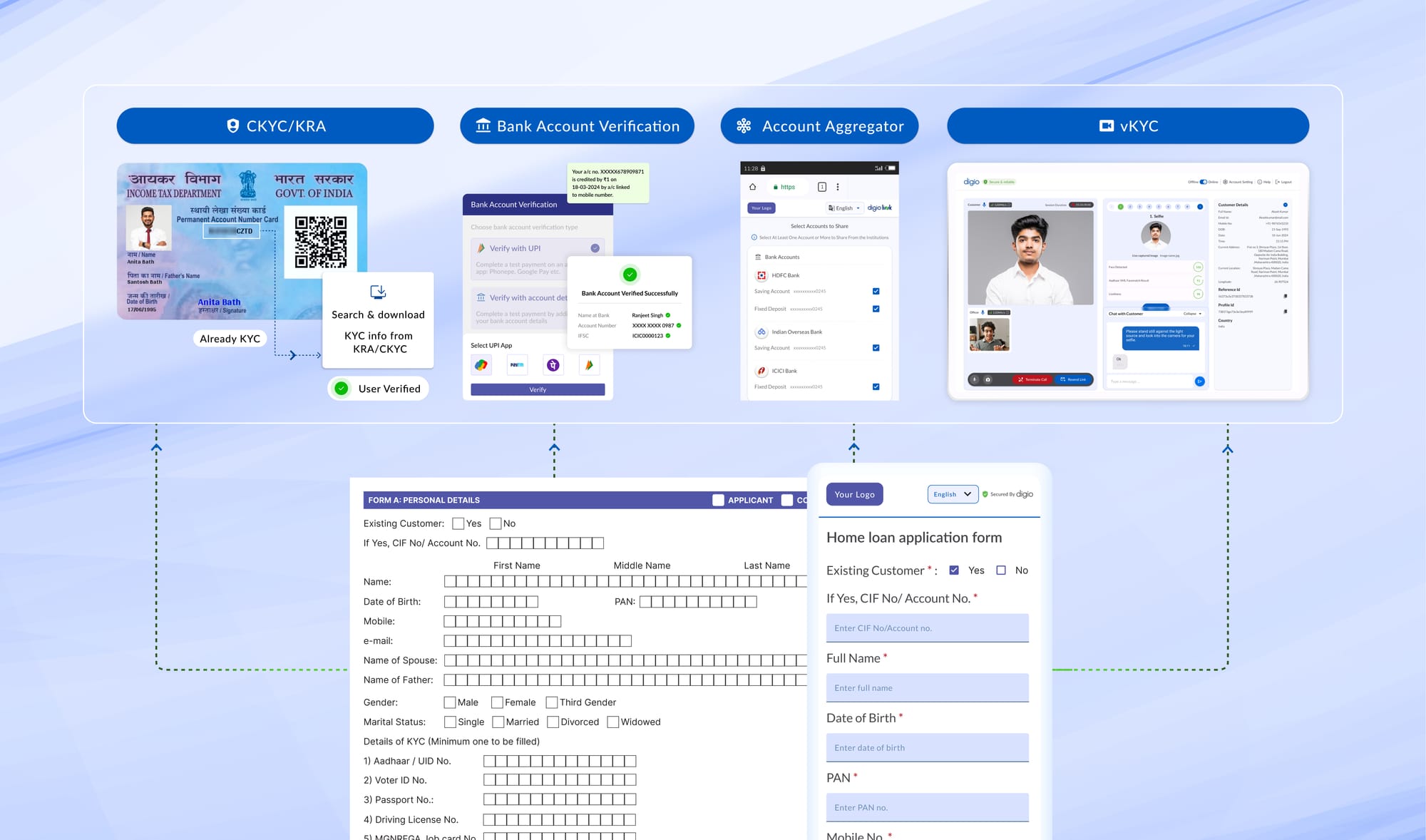

1. Consented: The Foundation

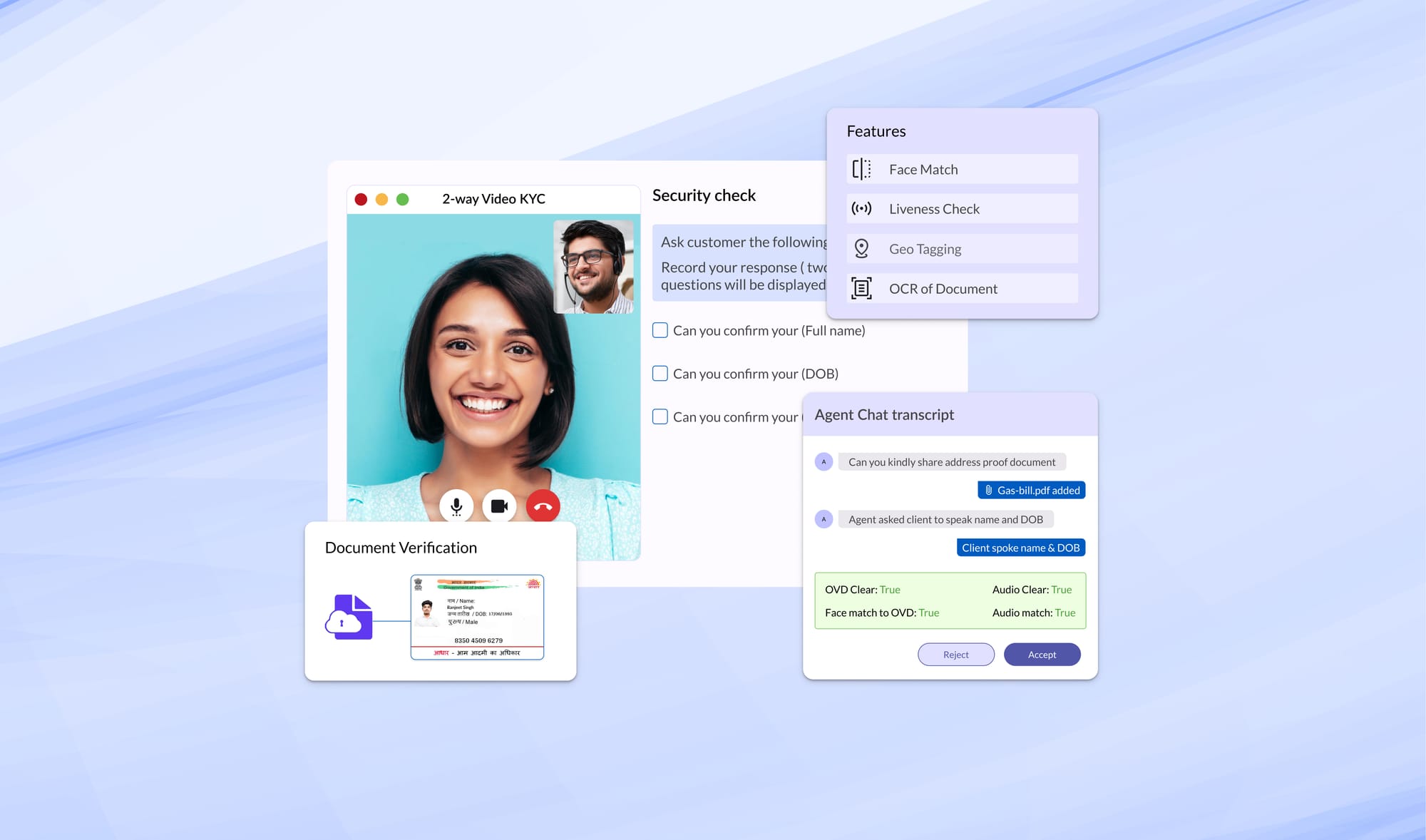

As an RBI-licensed Account Aggregator, DigiLink functions as a consent custodian. This layer facilitates the secure fetching of financial data from Financial Information Providers (FIPs) to Financial Information Users (FIUs) while ensuring:

- Security: The system is data-blind and encrypted, ensuring that the aggregator cannot see or store sensitive user data.

- Standardization: It replaces variable scraping methods with a standardized protocol for fetching data.

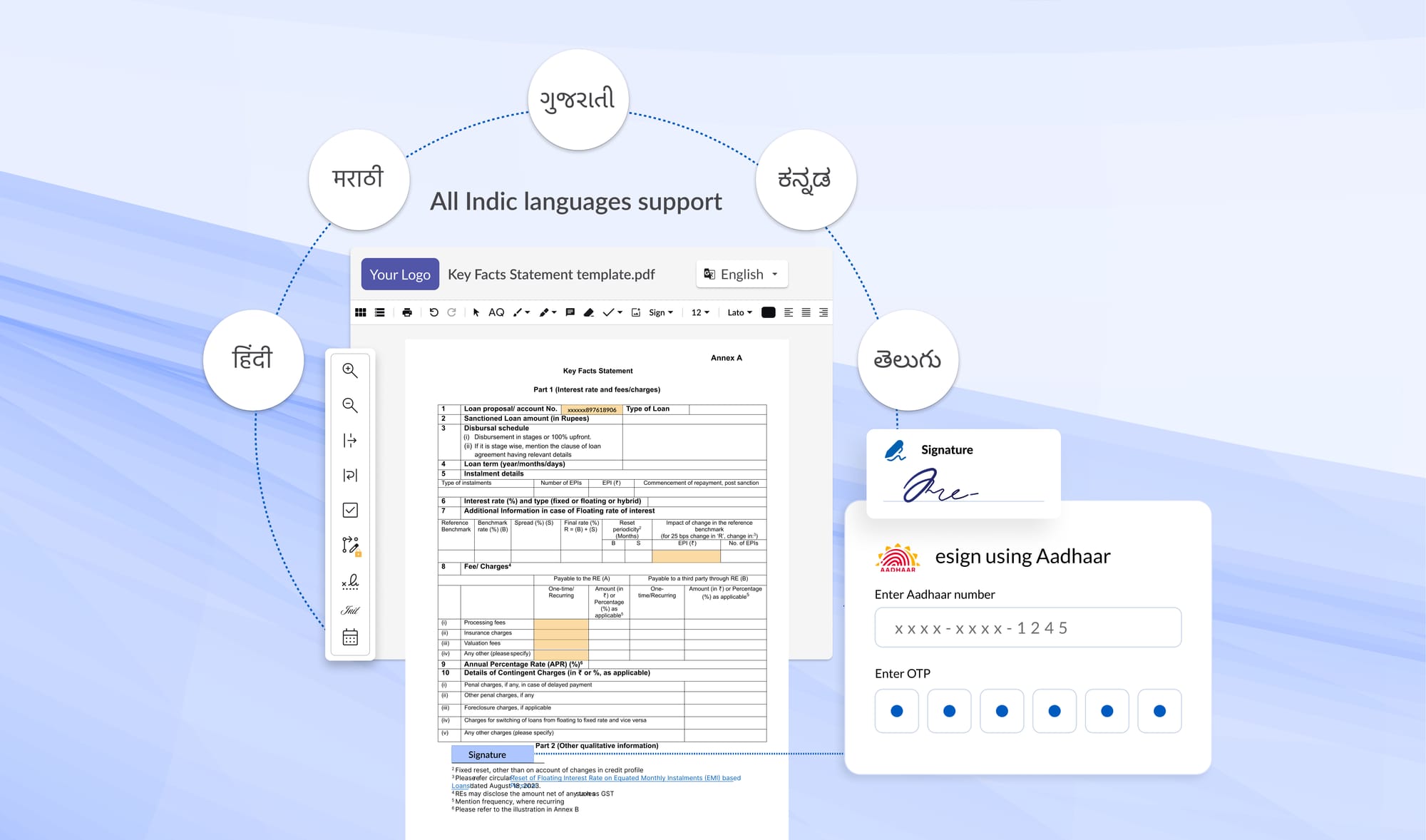

- User Control: The framework is permission-based, allowing users to authorize data sharing securely via strict authentication protocols.

- Statement Uploads: Digio’s AI/ML-based OCR engine enables users to scan and accurately extract data from uploaded statements, if and when selected by users.

2. Intelligent: The Processing Layer

The Intelligence layer, powered by the Statement Analyser, is designed to ingest and standardize disparate data sources.

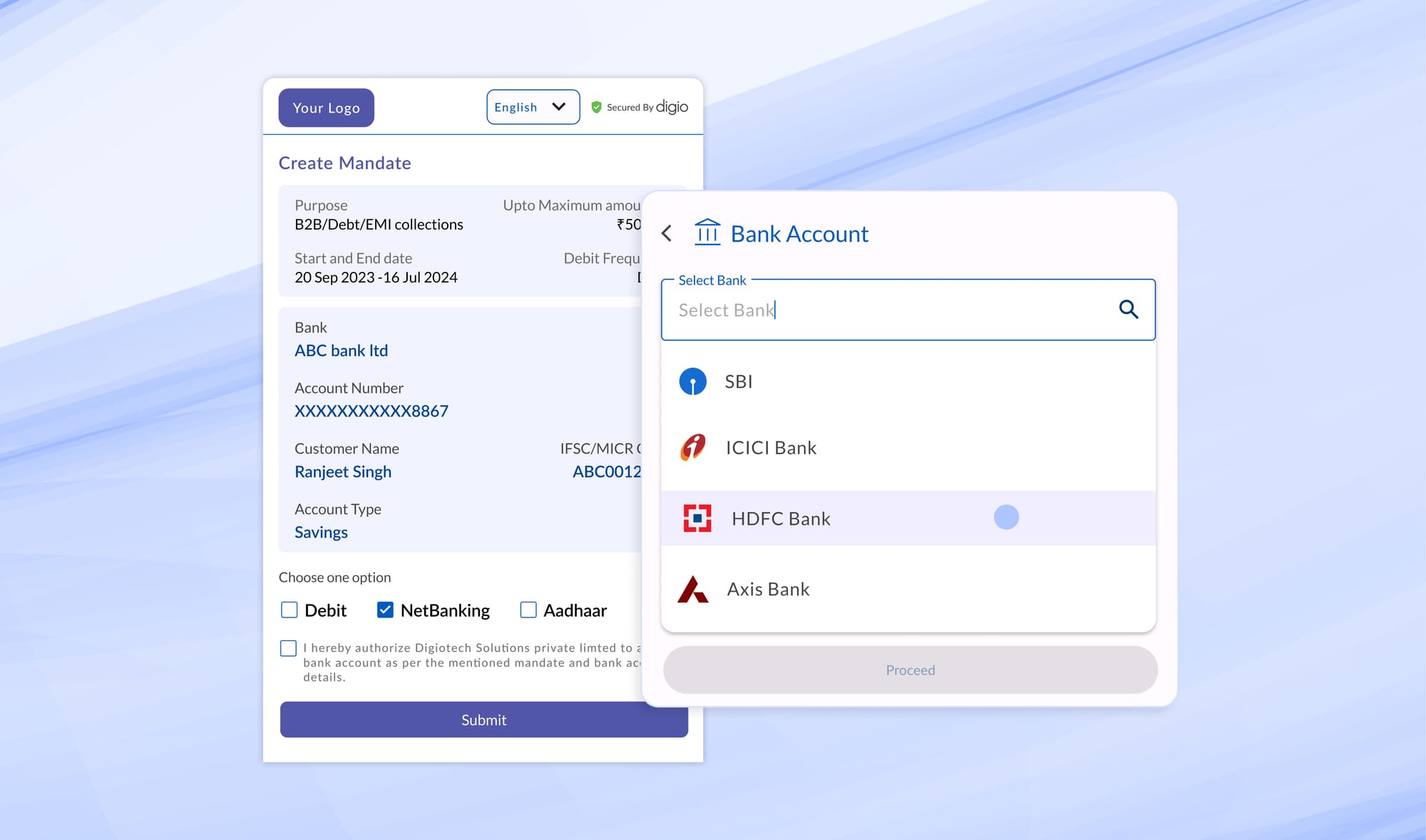

- Aggregation: It combines data from the Account Aggregator framework with user-uploaded PDF statements, ensuring comprehensive coverage even when FIPs are unconnected.

- Categorization: The engine standardizes raw transaction data, identifying income, expenses, savings, and investments regardless of the source bank or format.

- Predictive Analytics: Utilizing machine learning, the system detects patterns and trends, converting raw statements into strategic intelligence.

3. Insightful: The Decision Engine

The final layer, Insights, focuses on insights, visualization, and decision support.

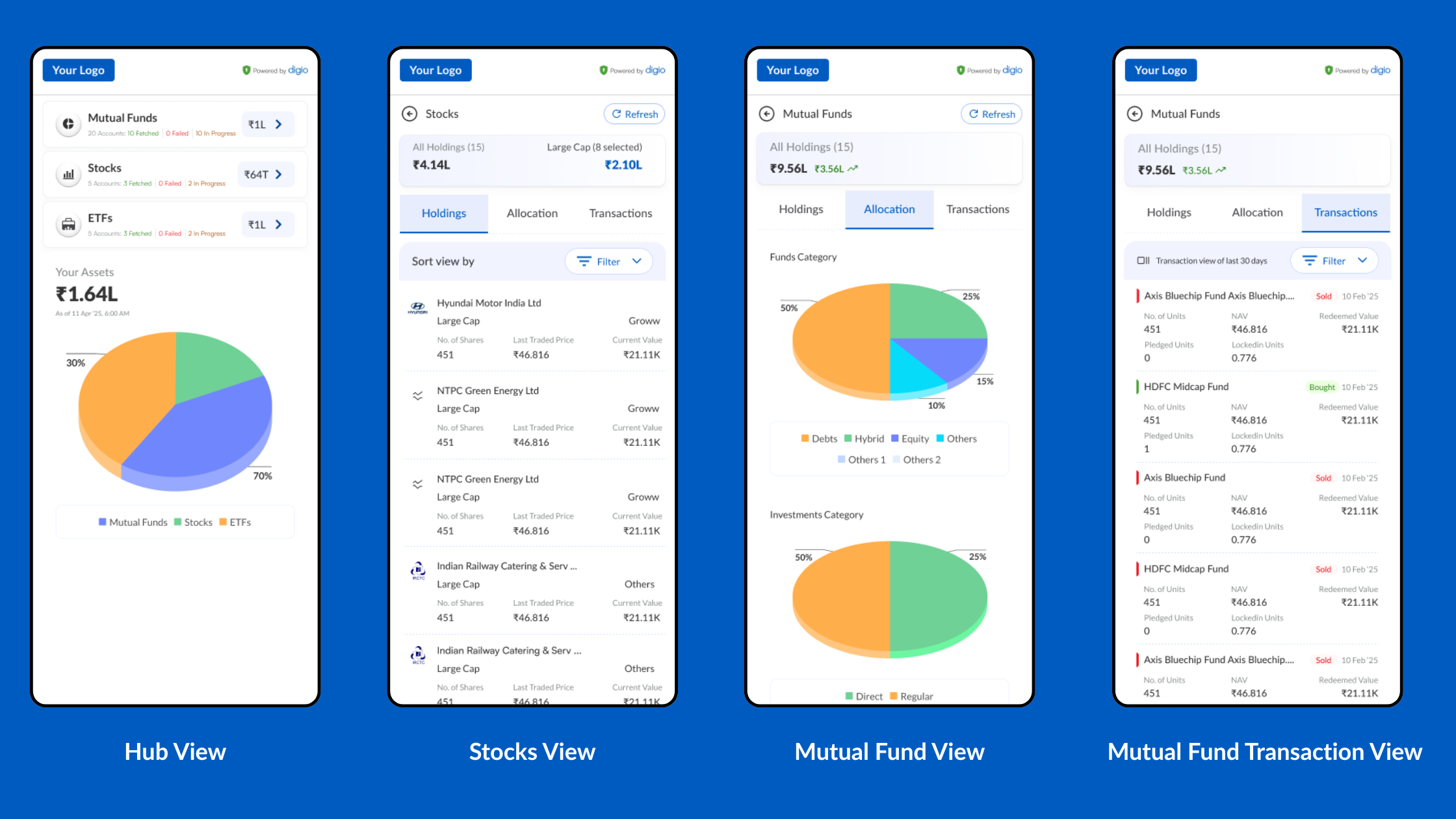

- Granular Analysis: The system provides detailed views of financial activity, including spend categorization and creditworthiness scoring.

- Visual Dashboards: Data is presented through plug-and-play widgets, which include charts and graphs to facilitate immediate understanding of a user’s portfolio distribution and financial health, and drives users’ prompt action

- Actionable Reporting: This layer supports critical business functions from risk profiling and underwriting to investment advisory by generating reports that identify red flags and behavioral patterns.

By adopting this structured approach, financial institutions can transition seamlessly to the new regulatory environment while enhancing their ability to derive meaningful insights from user data, with minimal technical effort and literally no time

Read more Blogs

Digitally transform business operations with Digio!

Try first. Subscribe later.

Boost your legal ops efficiency by 80%

Learn how Digio can enhance your business productivity

Get 1-on-1 business use case solutioning

Speak with our business consultants to get a solution walkthrough for your business requirement

Test the APIs

Let your development team test our API suite to understand configurability and product integration

Subscribe

Get the best in industry commercials for your business usecase