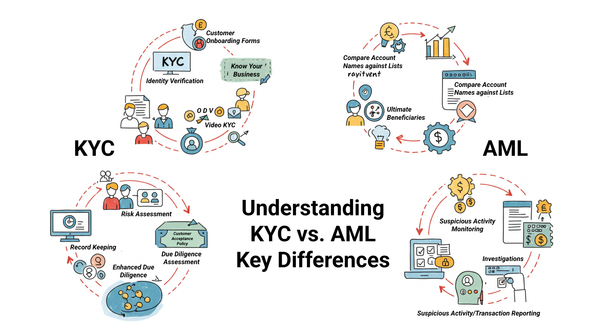

AML

What Is Money Laundering—and Why Do Companies Worry About It?

Money laundering is the process criminals use to make “dirty” money (proceeds of illegal activity) appear legitimate. Without checks, illicit cash can flow through everyday financial products—loans, investments, trading—funding terrorism, drug cartels, fraud, and corruption.